Putin Kills Goldilocks: Stocks Slammed As Russia Wrecks Dove’s Dreams

Today’s price action was bought to you by the word “Goldilocks” and the number ‘Zero‘.

Goldilocks was the word thrown around by all asunder with regard to the labor market data today – most especially a drop in wage growth – which prompted a dovish response from markets (who apparently are unable to remember what Jay Powell said just last week).

Just to steal the jam out of goldilocks’ donut, we do note that hours worked continued to tumble – not a good sign – sending up recession-risk flares left and right…

Source: Bloomberg

And the number Zero is the amount of Russian gas that Putin will allow to flow to Europe through Nord Stream 1 after ‘coincidentally’ finding an oil leak and keeping the crucial pipeline closed (just after G-7 agreed on the completely unworkable Russian oil-price cap scheme)

That all sent rate-hike odds tumbling, with the odds of a 75bps hike this month dropping from 75% to 55%…

Source: Bloomberg

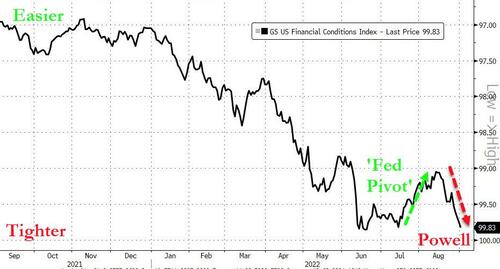

Powell will be pleased though as financial conditions have tightened significantly back to the tightest of the cycle after the Fed Pivot easing…

Source: Bloomberg

On the day, everything was awesome after the jobs data… until the European close (low liquidity) when stocks tanked as Gazprom ‘coincidentally’ found an oil leak and said it would keep the gas pipeline closed for longer. Nasdaq went from Secretariat to the glue factory in a few brief minutes…

This leaves the Nasdaq down around 8% since Powell’s J-Hole jawbone…

The Nasdaq Composite is down 6 days in a row – something it hasn’t done since early August 2019.

The S&P rallied perfectly up to its 50DMA and then reversed… Putin’s timing was perfect.

All S&P Sectors ended the week in the red with Tech and Materials the worst performers. Energy stocks were the most volatile…

Source: Bloomberg

Treasuries were very mixed on the week after yields puked on the jobs data, leaving the 2Y yield unchanged but the long-end up 15bps…

Source: Bloomberg

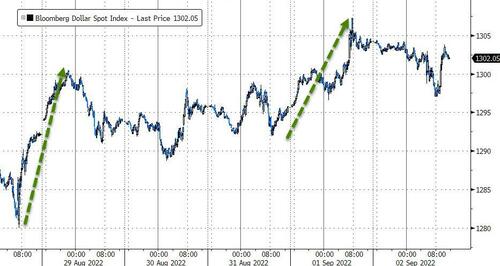

The dollar extended its post-Powell gains…

Source: Bloomberg

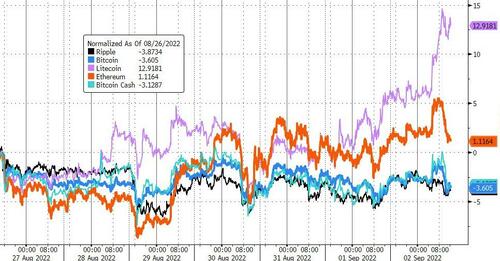

Litecoin managed some gains on the week but the rest of crypto was dumped with Bitcoin underperforming Ethereum…

Source: Bloomberg

Bitcoin has now hovered around $20,000 for 10 days…

Source: Bloomberg

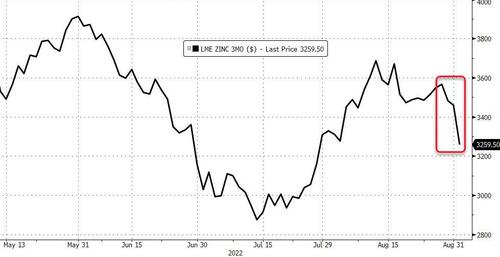

Zinc headed for its biggest weekly loss in over a decade on concern Chinese demand will be hamstrung by new virus restrictions.

Source: Bloomberg

Oil tanked this week again with WTI back below $90…

Gold rallied on the day extending yesterday’s gains after bouncing off $1700…

And here is what that buys in Germany now…

What 1 ounce of gold looks like in Germany pic.twitter.com/anc6UeHuFP

— zerohedge (@zerohedge) September 2, 2022

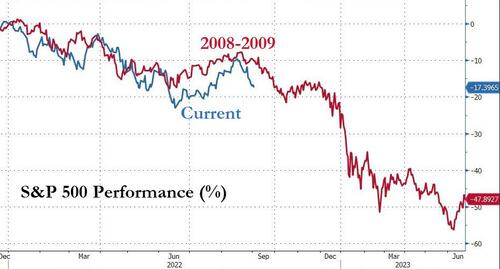

Finally, if you thought it was bad now, just wait…

Source: Bloomberg

On that happy thought, have a great long-weekend.

Tyler Durden

Fri, 09/02/2022 – 16:00

via ZeroHedge News https://ift.tt/wNmu64F Tyler Durden