Nomura Is First Bank To Call For 100bps Rate Hike Next Week

In the aftermath of today’s shocking CPI print, and with the Fed smack in the middle of the blackout period ahead of next week’s FOMC decision, traders – both carbon-based and algorithmic – have been furiously refreshing the WSJ’s Nick Timiraos page eagerly waiting for a clue from Powell’s favorite mouthpiece whether or not the Fed will hike 100bps (market odds of a full 1% increase are now over 20%) or will keep next week’s hike at 75bps.

Timiraos having to release a top ten books of the year article cause Powell’s left him on read pic.twitter.com/gRzZIufK36

— Newsquawk (@Newsquawk) September 13, 2022

As a reminder, it was a similar situation back in June that a Timiraos article – coming again in the middle of the blackout period after a red hot inflation print – that cemented what would be the first of many 75bps hikes, and coming just weeks after Powell had erroneously assured Congress that there would be no 75bps rate hike (not surprisingly a few weeks later, the Fed finally gave up on forward guidance, admitting it has absolutely no idea what is happening in a few days, let alone years).

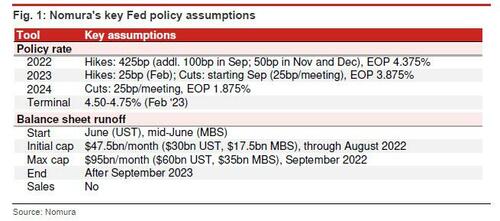

And while we wait, Nomura decided to fill the information vacuum with its own forecast, and after correctly being the first to predict in June that the Fed will hike 75bps (even if it was wrong with its 100bps rate hike call in July), and also being the first bank to call for a 2022 US recession, it forecast moments ago that the Fed will infact hike 100bps next week, above the bank’s prior 75bps forecast, due to “materializing upside inflation risks”; looking ahead, the Japanese bank now expects a 50bps rate hike in November, and also in December, 25bp higher than its previous forecast. And with the bank’s February 2023 expectation of a 25bp hike unchanged, Nomura’s terminal rate forecast now stands at 4.50-4.75%, 50bp higher.

Some more details from the full note (available to pro subs):

- We believe upside inflation risks are materializing: The August CPI report – with broad-based strength across both monthly core goods and core services inflation – suggests a series of upside inflation risks may be materializing. For some time, we have highlighted an emergence of a wage-price spiral and increasingly unanchored inflation expectations as factors that could keep inflation persistently elevated for longer, requiring a more forceful response from the Fed. With the latest data, we believe those risks are starting to materialize via higher measured inflation across a broad range of goods and services.

- We expect a 100bp September hike and a 50bp higher 4.50-4.75% terminal rate: We continue to believe markets underappreciate just how entrenched US inflation has become and the magnitude of response that will likely be required from the Fed to dislodge it. While the Fed did not raise rates by 100bp at the July meeting, contrary to our expectations, we think recent data will encourage policymakers to revisit whether they should increase the pace of rate hikes, considering the Fed’s commitment to data dependence…. As a result, we believe these materializing upside inflation risks will push the Fed towards raising rates by 100bp at the September FOMC meeting, above our previous forecast of 75bp. Beyond September, we continue to expect a 50bp hike in November, but now expect another 50bp hike in December, 25bp higher than our previous forecast. With our February 2023 expectation of 25bp unchanged, our terminal rate forecast now stands at 4.50-4.75%, 50bp higher than our previous forecast.

- We believe it is increasingly clear that a more aggressive path of interest rate hikes will be needed to combat increasingly entrenched inflation stemming from an overheating labor market, unsustainably strong wage growth and higher inflation expectations

- Recent developments reinforce our views around entrenched inflation and a likely impending recession. The August CPI report reinforces our view that inflation is increasingly entrenched and that a recession will ultimately be required to weaken the labor market and restore price stability. Despite a historically rapid hawkish pivot in 2022 and a series of much-larger than-usual rate hikes, the inflation outlook has shown few signs of sustained improvement… As a result, we continue to expect the Fed to tighten financial conditions further, resulting in notable headwinds to growth, pushing the economy into recession later this year and lifting the unemployment rate to almost 6% in 2024.

More in the full note (available to pro subs), which the Fed is probably reading right now and deciding whether to give Timiraos the green light to leak it. And while we wait, the odds of a full 1% rate hike in Sept are rising fast, boosted by the Nomura take, and at last check were almost 30%.

Tyler Durden

Tue, 09/13/2022 – 12:41

via ZeroHedge News https://ift.tt/on21MxR Tyler Durden