Stellar 30Y Auction Bucks Treasury Puke Fest

In today’s shitshow of a post-CPI market session, the last thing traders needed to worry about was whether the 30Y TSY auction would be a failure. Luckily, it wasn’t, and moments ago the Treasury sold $18bn in 30Y paper (in a 29-Y 11-Month reopening of cusip TJ7), in a far stronger auction than yesterday’s lousy 3 and 10Y sales.

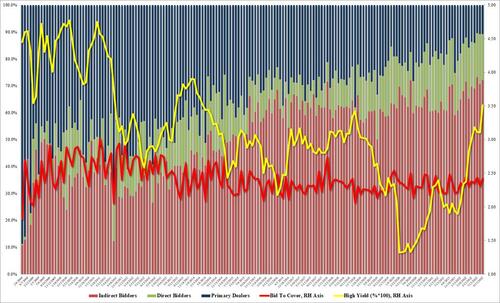

The high yield of 3.511%, was – as expected – the highest since April 2014, surpassing the previous Fed tightening top of 3.418% from November 2018. More importantly, the yield stopped through the 3.530% When Issued by 1.9bps, the biggest strop through since March as traders are buying at least one of today’s dips.

The bid to Cover of 2.419 was slightly above last month’s 2.310, and was generally in line with the six-auction average of 2.37%. In other words, not great, not terrible.

The internals were similarly ok, with Indirects taking down 72.09%, above last month’s 70.65% and above the six-auction average of 69.9%, and with Directs awarded 17.1%, just below the recent average of 17.3%, that meant Dealers were left holding on to 10.85%, virtually unchanged from the past two auctions (10.46% in July, 10.84% in August).

Overall, this was a far better auction than yesterday’s lousy, tailing 10Y, and certainly far better than what today’s 30Y could have been if we had a sudden buyers strike now that the Fed is fully intent on hiking until something breaks. For now, however, nothing is breaking and the auction was strong enough to send yields sharply lower both at the 30Y and across the entire curve… which of course isn’t saying all that much after today’s massive selloff across all asset classes post the CPI.

Tyler Durden

Tue, 09/13/2022 – 13:17

via ZeroHedge News https://ift.tt/Jrkae8O Tyler Durden