Landing At Terminal 5

As Deutsche Bank’s Jim Reid writes today, “there are many things I’ve got wrong in my career, and plenty I’ll get wrong again” but he certainly is taking a victory lap for having been so far ahead of the game on how far the Fed will need to go in this cycle to tame inflation.

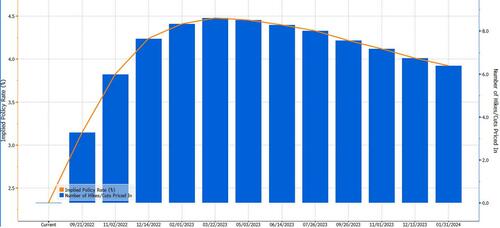

As Reid reminds clients, the house view from the bank’s chief US economist, Matt Luzzetti, has been ahead of the street all year, and in the April “What’s in the tails?” note (discussed here), David Folkerts-Landau, Peter Hooper and Reid set out a more aggressive view suggesting that the Fed Funds would likely need to get in the 5-6% range to tame inflation, which in the process would create a deep recession in 2023. While there was disbelief at the time from the majority, less than half a year later, we are getting closer and closer to the market pricing in such an outcome for peak Fed Funds (currently ~4.4%, which actually makes Ray Dalio’s recent prediction that stocks will drop 20% if the Fed hikes to 4.5%, when 4.4% is already priced in, confirm that he really doesn’t understand much about markets).

Anyway, this morning DB’s Luzzetti upgraded his terminal rate forecast to 4.9% based on a piece (available to pro subs) where they present two approaches for calibrating the appropriate terminal rate. Both approaches – comparing the nominal fed funds rate to inflation and a suite of common policy rules – suggest that a fed funds rate at or around 4.5% could be required by early next year… which is also fully priced in right now.

Meanwhile, accounting for risk management considerations, a rate approaching 5% is likely to be needed. As such, they now expect the Fed’s policy rate to peak at 4.9% in Q1 of next year.

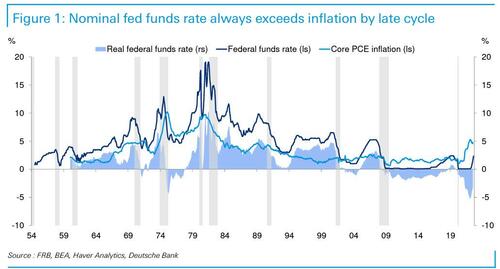

Whilst the modelling Matt’s team have laid out in the note is more sophisticated, in more simplistic terms, as today’s Chart of the Day from Jim Reid shows, nominal fed funds always exceeds inflation by late cycle and as core PCE forecasts get upgraded, this suggests a terminal rate that needs to get closer to 5% to be consistent with the historic pattern.

So despite the recent sharp rise in market pricing of the Fed, Reid concludes that this analysis points to further meaningful upside risk to terminal rate expectations across the street and in markets.

Tyler Durden

Fri, 09/16/2022 – 06:55

via ZeroHedge News https://ift.tt/jmyklR5 Tyler Durden