UMich Inflation Expectations Slide In Sept, But…

While the University of Michigan’s Consumer Sentiment survey has traditionally contained dozens of key data points, ever since Jay Powell mentioned it specifically, the surveyed viewe of inflation expectations has been where all the algo’s eyes are drawn first.

Short-term expectations have tumbled since Powell highlighted it and were expected to drop further today (from 4.8% to 4.6%) and that is exactly what happened (with medium-term 5-10Y inflation exp falling from 2.9% to 2.8%)…

Source: Bloomberg

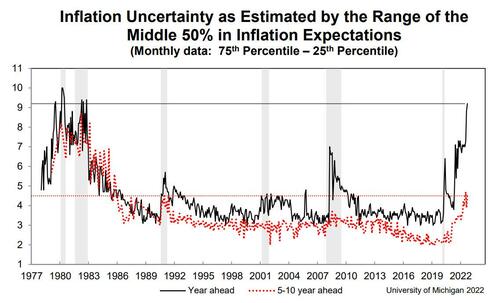

However, as UMich notes, it is unclear if these improvements will persist, as consumers continued to exhibit substantial uncertainty over the future trajectory of prices. Uncertainty over short-run inflation reached levels last seen in 1982, and uncertainty over long run inflation rose from 3.9 to 4.5 this month, well above the 3.4 level seen last September.

Away from that, preliminary data for September’s headline sentiment index was expected to continue its modest rebound from last month and it did but rose less than expected (from 58.2 to 59.5, below 60.0 expectations). Th8s was due to a notable miss in current conditions (which still inched higher MoM) while ‘hope’ beat expectations…

Source: Bloomberg

As UMich notes, the one-year economic outlook continued lifting from the extremely low readings earlier in the summer, but these gains were largely offset by modest declines in the long run outlook. Personal finance components of the index as well as buying conditions for durables remained at similar, relatively low levels from last month.

After the marked improvement in sentiment in August, consumers showed signs of uncertainty over the trajectory of the economy.

Tyler Durden

Fri, 09/16/2022 – 10:07

via ZeroHedge News https://ift.tt/ujUfCkV Tyler Durden