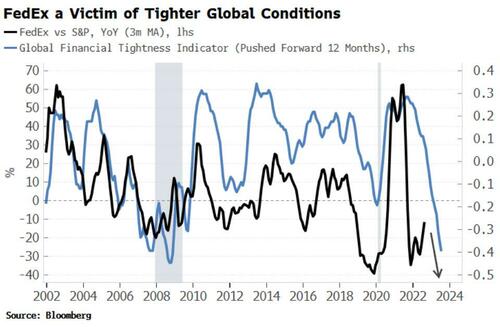

FedEx’s Troubles A Stark Symptom Of Tight Global Liquidity

By Simon White, Bloomberg Markets Live commentator and reporter

FedEx’s announcement it would be withdrawing its earnings forecast is but another indication the US and global economies are slowing.

The delivery company is a bellwether for the economic outlook, and is highly sensitive to global monetary conditions. Such conditions have yet to improve while central banks around the world remain squarely focused on eradicating elevated inflation, pointing to more underperformance ahead for FedEx.

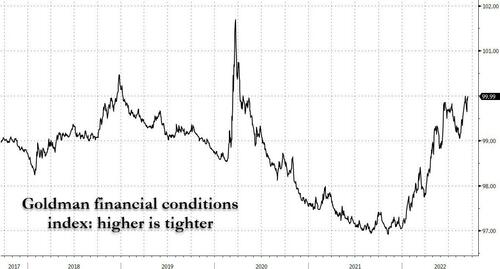

Higher interest rates are feeding through into higher borrowing rates across the board, while banks are tightening their lending standards and credit spreads are widening. Mortgage rates are rising fast too, which is putting the squeeze on consumption, with Thursday’s retail sales report for August overall coming in much weaker than expected.

There is more to come.

Revenues, about the only fundamental support currently contributing positively to S&P returns, will be stressed in such an environment, leaving equities on flimsier ground, and prone to higher volatility, especially while gamma is negative.

Tyler Durden

Fri, 09/16/2022 – 12:05

via ZeroHedge News https://ift.tt/gTG1Mvb Tyler Durden