WTI Rallies After Big Crude, Product Draws

Oil prices are extremely noisy this morning with OPEC+ headlines dominating price action (after prices surged 9% in the past two days in anticipation of this move by the cartel).

“Near term OPEC has put a floor in crude,” but the 2 million barrel cut was largely priced in already on Tuesday, said Rebecca Babin, a senior energy trader at CIBC Private Wealth Management.

We also note that Hurricane Ian’s impact may already be affecting some of this week’s inventory, production, and implied demand after API reported unexpectedly large crude and product draws.

API

-

Crude -1.77mm

-

Cushing +925k

-

Gasoline -3.47mm

-

Distillates -4.05mm – biggest draw since Mar 2022

DOE

-

Crude -1.356mm (-1.00mm exp)

-

Cushing +273k

-

Gasoline -4.728mm – lowest overall inventory since 2014

-

Distillates -3.443mm

The official DOE data confirmed API with large crude and product draws seen last week…

Source: Bloomberg

Gasoline stocks fell to their lowest since 2014…

Source: Bloomberg

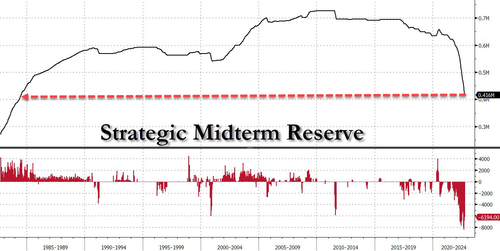

6.194mm barrels were drained from the Strategic Midterm Reserve…

Source: Bloomberg

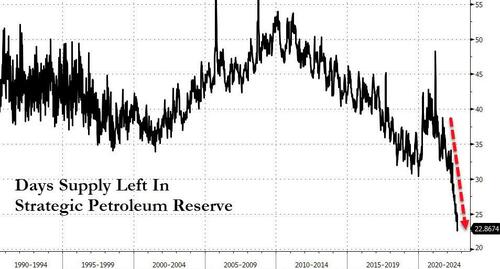

As a reminder, the SPR is now at a record low 22 days of supply…

Source: Bloomberg

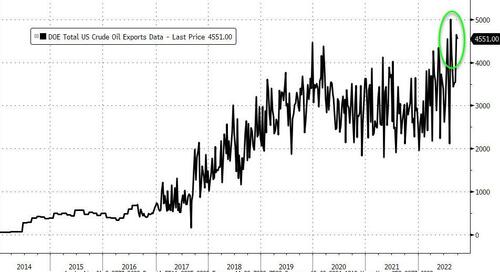

Something else to note on US crude exports, it’s the second time ever that we’ve registered above 4m b/d on a 4-week average.

Source: Bloomberg

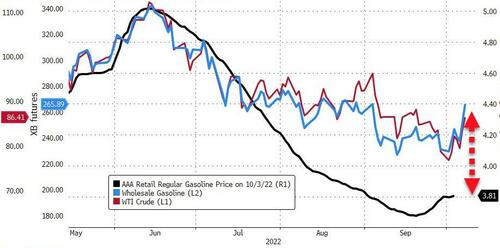

So US gas prices are about to soar so Europe can have some fuel?

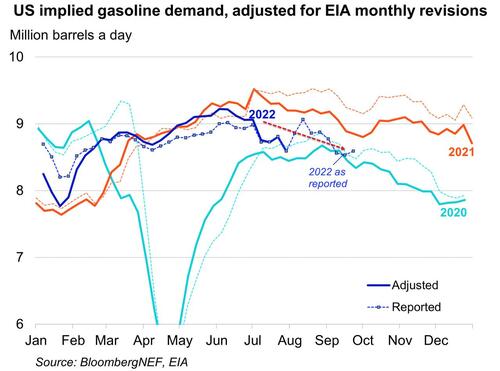

Gasoline demand destruction continues to show up…

Source: Bloomberg

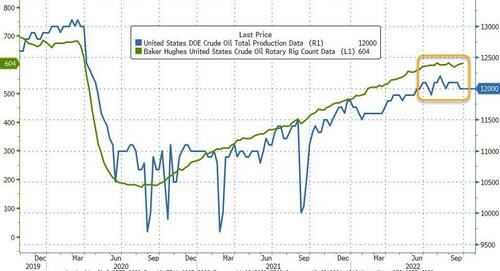

US Crude production was flat on the previous week

Source: Bloomberg

WTI was hovering around $86.50 ahead of the official data print and rallied above $87 after the big draws…

“I see some some persistence upside certainly from a supply perspective. Two million barrels a day is a substantial cut,” said Harry Altham, energy analyst for StoneX Group.

“But of course, that doesn’t detract from the longer-term implications of demand destruction” from slowing global economies, he added.

Finally, we note that all of this likely implies pump prices will continue rising into the MidTerms and Biden’s “tools” are running out to ‘fix’ that…

Source: Bloomberg

Who will he blame now?

Tyler Durden

Wed, 10/05/2022 – 10:37

via ZeroHedge News https://ift.tt/IzTQYJX Tyler Durden