Futures Fumble 1% Gain, Turn Sharply Lower As Yields, Dollar Soar

US stock futures erased overnight gains of over 1% as worries about the impact of scorching inflation and a looming recession took the shine off a strong start to the corporate earnings season. Contracts on the S&P 500 dropped 0.4% in an extremely illiquid session at 7:15 a.m. in New York after earlier rising as much as 1.1%. Nasdaq 100 futures were also down 0.4%, despite a boost from a better-than-expected report from Netflix which sent the stock soaring 13% in premarket trading.

Behind the sudden, violent slump is today’s renewed surge in interest rates which pushed the 10Y Yield to 4.10%, the highest level since October 2008, potentially driven by news that the BOE would launch gilt sales on Nov 1.

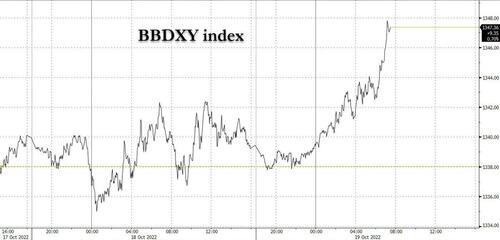

A surge in the dollar sparked by a plunge in sterling, which tumbled after soaring food prices drove UK inflation back into double digits in September, matching a 40-year high of 10.1% and intensifying pressure on the central bank and Liz Truss’s government to act. Gilts were broadly lower weighing on rates sensitive sectors like banks, property and construction and retail. The result is that UK equities dropped following four days of gains.

In premarket trading, Netflix soared as much as 14% in premarket trading, set for its biggest jump since January 2021, after the video streaming company handily beat estimates for paid subscribers, signaling the worst of the slowdown is likely over. Shares of other video-streaming companies are rising after Netflix’s quarterly results reassured investors that its business was back on track. Walt Disney +2.8%, Roku +3.7%, Warner Bros Discovery +1.7%, fuboTV +3.4%. Bank stocks are lower in thin premarket trading Wednesday, putting them on track to snap a two-day winning streak. In corporate news, Mitsubishi UFJ Financial Group is evaluating an acquisition of some loan portfolios from Credit Suisse to expand its business in the US. HSBC has been reprimanded by a UK watchdog for violating environmental advertising rules, after it sought to depict itself as a green bank in a set of posters. Here are other notable premarket movers:

- United Airlines shares jump 7.1% in US premarket trading Wednesday following earnings that beat estimates, with analysts saying results and outlook are impressive on strong demand, better costs. Here’s what they are saying:

- Lam Research leads fellow chip-tool makers higher in premarket trading after ASML said its fourth-quarter sales would likely be better than estimates, driven by strong demand for its advanced chip-making machines. Lam Research (LRCX US) +3.1%, Applied Materials (AMAT US) +1.7% and KLA (KLAC US) +2%

- Olaplex shares plummet 42% in premarket trading after the hair-care products company slashed full-year forecasts due to slowing sales and announced the departure of its COO Tiffany Walden.

- Evercore ISI cuts Best Buy, Lowe’s, Advance Auto and Petco Health & Wellness to in-line from outperform in note on Wednesday. All the stocks drop in premarket trading. Best Buy (BBY US) falls 1.6%, Lowe’s (LOW US) -1.1%, Advance Auto (AAP US) -1.1%, Petco (WOOF US) -3.2%

- Keep an eye on Polaris as the stock was cut to neutral from buy at Citi as the broker flags retail environment being “substantially worse than previously anticipated” after it made checks with the company’s off-road vehicle dealers.

- Intuitive Surgical shares jumped 7.4% in postmarket trading on Tuesday after the company posted revenues and adjusted earnings per share for the third quarter that were higher than consensus analyst estimates.

Upbeat company results, cheaper valuations and UK policy reversals have helped buoy risk appetite in recent sessions. At the same time, investors are having to keep track of weakness in the global economy and the impact of persistent inflation on decisions by policymakers at the Federal Reserve and other central banks.

Indeed, US stocks have had a roller-coaster October so far as investors swing between fears about a hawkish Federal Reserve and optimism over early third-quarter reports that have showed signs of resilience to higher prices. While a Bank of America survey showed full capitulation among stock investors, strategists have warned that the uncertain macroeconomic outlook could fuel further declines, according to Bloomberg.

“While it looks like capitulation, we probably have not seen a bottom yet,” said Randeep Somel, a portfolio manager at M&G Investments. “Companies’ earnings are not reflecting wider macro economic expectations yet, and that isn’t likely to dissipate until around early next year once we got through what is likely to be a rough winter,” he said on Bloomberg TV.

Quantitative strategists at Citigroup Inc. said US stocks were pricing in the highest odds of a recession than any other asset class, but still could be poised for more losses. “US equities have priced the most (but not enough) recession risk, and earnings estimates have further to adjust,” strategists including Alex Saunders wrote in a note dated Oct. 18 (he must be ignoring commodities, which are pricing in a global depression).

“US equities have priced the most (but not enough) recession risk, and earnings estimates have further to adjust,” strategists including Alex Saunders wrote in a note. “US bonds have priced the least risk, but it will take some time before bonds react to recession risks given the hawkish Fed.”

European stocks struggled to eke out a fifth day of gains as most sectors decline; real estate, retail and utilities drop, while tech and insurance outperform. Euro Stoxx 50 rises 0.2%, paring earlier gains; Stoxx 600 is down 0.2%. IBEX lags, dropping 1%. Utilities stocks fell, led by German names, after Handelsblatt reported that the German Economy Ministry is planning to cap electricity prices along the lines of the proposals made to cap gas prices. The sector is among the worst-performing groups on the broader gauge, down 1.1%, with Encavis, RWE and BKW all down at least 4.5%. In Germany’s plan, utilities will have to offer relief for consumers on a base contingent designed to encourage energy saving, according to the report

Earlier in the session, Asia stocks fell, with shares in Hong Kong dropping the most in the region as the maiden policy speech by the territory’s leader failed to ease concerns about China’s earnings outlook and rising mainland Covid cases. The MSCI Asia Pacific lost as much as 0.8%, erasing an earlier gain, as shares of technology companies such as Alibaba, Tencent and TSMC weighed. A selloff in consumer stocks dragged down Hong Kong and China gauges as a plan unveiled by Chief Executive John Lee to woo back foreign talent and ease housing woes failed to offset concerns about earnings and Covid. Benchmarks in Japan and Australia rose in tandem with gains in Wall Street. Read: HK Developers Drop as Stamp Duty Rule Disappoints: Street Wrap Most Asia fund managers in a survey by Bank of America expect weaker corporate profits in the region during the next 12 months, with net 72% of the view that consensus estimates for earnings per share growth are too high. It’s been almost a year since Bitcoin hit a record. Where do you see it going from here? Fill out our survey. “Global growth expectations are shrouded in pessimism but improving on the margin for China,” the survey report said. “However, investors are wary that the continued pursuit of a zero-Covid strategy could pour cold water on their fledgling hope for a China recovery.” China’s intermittent lockdowns continue to weigh on sentiment, with the ongoing party congress in China offering little hope to investors and traders assessing the impact on corporate profits in the latest results season. The MSCI Asia gauge is trading near April 2020 levels after dropping more than 28% this year

Japanese stocks extended their advance to second day, driven by gains in information companies and machinery makers. The Topix rose 0.2% to 1,905.06 as of 3 p.m. close in Tokyo, while the Nikkei 225 advanced 0.4% to 27,257.38. SoftBank Group contributed the most to the Topix’s gain, increasing 3.7%. Out of 2,166 stocks in the index, 1,376 rose and 674 fell, while 116 were unchanged.

Australian stocks edged higher, with the S&P/ASX 200 index rising 0.3% to close at 6,800.10 as investors digested quarterly output reports from commodity producers. All sectors gained except for energy and technology. Banks and industrials contributed the most to the gauge’s advance. In New Zealand, the S&P/NZX 50 index rose 0.6% to 10,916.65.

Indian stocks indexes rose for the fourth straight session before giving away the majority of gains, dragged by the rupee’s slide against the dollar. The S&P BSE Sensex rose 0.3% to 59,107.19 in Mumbai, while the NSE Nifty 50 Index advanced 0.1%. The gauges rose as much as 0.7% before paring the advance in the last hour of trading. For the week, they are up about 2% each. The Indian rupee tumbled to a record, declining to 82.98 against the greenback in late trading, as the central bank was seen moving away from supplying dollars. The looming expiry of weekly derivative contracts also weighed on local shares. Ten of the 19 sector sub-gauges compiled by BSE Ltd. advanced today, led by energy companies, while utilities and power firms were the worst performers. “Domestic institutions have been strong buyers in the market over the last week, as 2QFY23 results have come in line or stronger than expected,” S Hariharan, head of institutional equity at Emkay Global Financial, said.

In FX, the Bloomberg dollar spot index spiked 0.3% as the greenback rose against all of its Group-of-10 peers apart from the New Zealand dollar; the yen tumbled to a fresh 32 year low of 149.70 against the dollar while the pound slumped below $1.13. The euro slumped to almost $0.98. The shift in the euro’s volatility term structure shows that traders are following central banks into being more data dependent than before. Australian and New Zealand dollars trim intraday gains alongside similar moves in US futures.

In Japan, authorities continued their jawboning of the yen, with Finance Minister Shunichi Suzuki saying he is increasing the frequency of monitoring foreign-exchange markets. The currency hovered above 149 per dollar. The 10-year government bond yield rose above the 0.25% upper limit of the central bank’s target range, a breach that’s likely to prompt the Bank of Japan to step up bond purchases to limit the advance.

“The outlook for the UK is very, very difficult and certainly when focusing on our asset allocation it’s predominantly in the US where we have much higher conviction and certainty of outcome,” Grace Peters, JPMorgan Private Bank’s head of investment strategy, said on Bloomberg Television.

In rates, Treasuries were cheaper across the curve with losses led by belly, cheapening 2s5s30s spread by 3bp into early US session. US yields cheaper by nearly 7bp across belly of the curve, flattening 5s30s spread by almost 3bp following three successive steepening sessions; 10-year around 4.09%, cheaper by ~8bp on the day. US coupon issuance resumes with $12b 20-year bond reopening; WI yield near 4.34% is above all auction stops since the May 2020 reintroduction of the tenor and ~52bp cheaper than September auction, which stopped through by 1.3bp

Front-end bund yields rose by 12bps as the curve bear- flattened after Germany’s Finance Agency said it will increase the amount of securities it can lend to traders in the repo market by €54b, a move strategists say will help ease a collateral squeeze that has plagued the debt market in recent months. Bunds underperform gilts and USTs. German 10-year yield is up 7 bps to 2.35%, while gilts 10-year yield is up 3bps to below 4% and Treasuries 10-year yield climbs ~5bps to above 4%. Most UK bonds fell, while the pound dropped as much as 0.6% after data showed UK CPI rose 10.1% last month from 9.9% in August, exceeding economists expectations of 10% and adding to pressure on policy makers to lift the key rate significantly next month. The bank of England also confirmed that it will start selling down its portfolio of gilts.

In commodities, oil rose amid concerns that the European Union’s latest sanctions on Russian fuel could exacerbate the market tightness that the US is trying to alleviate with additional sales. The Biden administration will announce Wednesday a plan to release 15 million barrels from US emergency oil reserves in an effort to ease high gasoline prices. WTI and Brent Dec futures are firmer intraday after yesterday’s decline, which saw Brent dip under USD 90/bbl but settle at the figure.

LME metals are mostly softer amid the firmer Dollar and risk aversion, with 3M copper extending its losses under USD 7,500/t. US President Biden will lay out plans on Wednesday to continue using the SPR to gain more stability in gas prices and will reiterate that gasoline company profits are too high and should be returned to consumers, according to a senior administration official. Furthermore, the Biden administration agreed to make future oil purchases to refill reserves at prices at or below USD 67.00-72.00/bbl, while President Biden will announce 15mln additional barrels for delivery from SPR in December, extending the initial timeline and completing the 180mln commitment. Spot gold trades lower intraday and back under the USD 1,650/oz mark as the Dollar picks up in pace.

Japan plans to further loosen crypto rules as soon as December “by making it easier to list virtual coins, potentially boosting the country’s allure for Binance and rival exchanges”, according to Bloomberg.

Looking to the day ahead now, data releases include the UK and Canadian CPI readings for September, along with US housing starts and building permits for September. From central banks, the Fed will release their Beige book, and we’ll also hear from the Fed’s Kashkari, Evans and Bullard, the ECB’s Centeno and Visco, and the BoE’s Cunliffe and Mann. Finally, earnings releases include Tesla, Procter & Gamble and Abbott Laboratories.

Market Snapshot

- S&P 500 futures down 0.2% to 3,726.50

- STOXX Europe 600 down 0.4% to 398.38

- MXAP down 0.8% to 137.80

- MXAPJ down 1.1% to 445.81

- Nikkei up 0.4% to 27,257.38

- Topix up 0.2% to 1,905.06

- Hang Seng Index down 2.4% to 16,511.28

- Shanghai Composite down 1.2% to 3,044.38

- Sensex up 0.2% to 59,077.34

- Australia S&P/ASX 200 up 0.3% to 6,800.06

- Kospi down 0.6% to 2,237.44

- German 10Y yield up 3% to 2.354

- Euro down 0.3% to $0.9826

- Brent Futures up 0.6% to 90.59

- Gold spot down 0.7% to $1,640.03

- U.S. Dollar Index up 0.25% to 112.42

Top Overnight News from Bloomberg

- Embattled UK Prime Minister Liz Truss faces a brewing parliamentary rebellion if she is forced to abandon a key Conservative manifesto commitment on pensions as part of a frantic austerity drive

- Record-low demand for German bonds at a government auction suggests investors are getting picky as countries ready a wall of sales and speculation mounts that the ECB will start reducing the bonds it’s amassed on its balance sheet over the years

- Bank of Japan Board Member Seiji Adachi reinforced the central bank’s message that it won’t adjust policy in response to the rapid weakening of the yen, pushing back against persistent market speculation

- The value of US Treasuries owned by Japanese investors slid by almost 3% in August to the lowest level in three years as a slump in global debt markets hammered down prices

- A number of hedge funds are starting to come around to the idea that it may be time to buy the beaten-up pound and gilts. Others say investors should remain cautious. Great Hill Capital in New York sees opportunities to go long sterling after the currency’s recent wild ride. Blue Edge Advisors Pte sees positives in longer- maturity gilts as global growth slows

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mixed following the choppy performance stateside where the major indices wobbled on news that Apple cut iPhone 14 Plus production less than two weeks after its debut, but then recovered heading into the close and with futures underpinned after-hours after strong earnings and subscriber additions from Netflix. ASX 200 gained with outperformance in defensive sectors although the upside was contained by a lacklustre mood in miners after BHP’s quarterly output update which included higher iron output but also a severe drop in coal production. Nikkei 225 was led higher by notable strength in blue-chip names including SoftBank and Fast Retailing and with firm gains also in utilities and power stocks, while the latest commentary from BoJ board member Adachi echoed the central bank’s dovish message as he warned against a shift towards tightening and pushed back on responding to short-term FX moves with monetary policy. Hang Seng and Shanghai Comp. remained pressured amid COVID concerns and data uncertainty, while Hong Kong Chief Executive John Lee’s first annual Policy Address failed to inspire a turnaround despite the announcement of measures to support property, tech start-ups and attract foreign talent.

Top Asian News

- Hong Kong Chief Executive John Lee said in his first annual Policy Address that national sovereignty and security are top priorities, while he also noted Hong Kong faces a “new chapter” of development and warned Hong Kong faces risks from global turmoil and Covid. Lee added that they will allow overseas talent to refund extra stamp duty on home purchases and will introduce a bill this year to exempt the stamp duty payable for transactions conducted by dual-counter market makers. Lee also stated the HKEX will revise main board listing rules next year to facilitate fundraising of advanced tech enterprises that have yet to meet the profit and trading record requirements, according to Reuters.

- BoJ’s Adachi said monetary policy does not directly control FX and there are times FX moves rapidly short-term, while he added that responding to short-term FX moves with monetary policy would heighten uncertainty over BoJ’s guidance which is not good for the economy. Adachi also stated that inflation is starting to increase but he is not convinced yet that the BoJ’s target will be achieved in a stable and sustained manner. Furthermore, he said they must be cautious about shifting toward monetary tightening as downside risks to the economy are increasing and a shift to monetary tightening would weaken demand and heighten the risk Japan will revert to deflation, while the best approach now is to maintain easy monetary policy.

- Coal Miner Left With Retiring Plants in Indonesia Green Push

- Taiwan Central Bank Sees Severe Economic Challenges Next Year

- Billionaire Ambani Splurges $163 Million on Priciest Dubai Villa

- Singapore’s COE Category B Bidding Rises to S$110,000

Equities in Europe trade mostly lower after initially opening modestly firmer across the board. Sectors overall are now mostly lower (vs a mixed open) with no overarching theme, with Tech, Banks, Media, and Insurance towards the top of the bunch whilst Real Estate, Utilities, Retail, and Basic Resources sit as the laggards. US equity futures are off best levels with the RTY lagging peers and the NQ slightly more cushioned following Netflix earnings. Click here and here for the Daily European Equity and Additional Opening News, which includes earnings from ASML & Nestle among others. Netflix Inc (NFLX) – Q3 2022 (USD): EPS 3.10 (exp. 2.13), Revenue 7.93bln (exp. 7.84bln). Q3 Net subscriber additions 2.41mln (exp. 1.07mln). Sees Q4 EPS USD 0.36 (exp. 1.20). Sees Q4 revenue USD 7.78bln (exp. 7.98bln). Sees Q4 streaming paid net change +4.5mln (exp. +3.9mln). Won’t provide paid membership forecasts from Q4. (PR Newswire) Shares rose 14.3% after-market, +13.8% in the pre-market

Top European News

- Daily Mail’s Hodges understands UK PM Truss has been informed by Graham Brady the traditional threshold of letters for a leadership challenge has been breached. But he is insisting on a threshold of half the parliamentary party before acting.

- UK Tory rebels were reported to have asked opposition Labour Party MPs to help them oust UK PM Truss as Tory backbenchers grow increasingly frustrated with the PMs leadership, according to The Telegraph.

- Pensions could increase in line with earnings instead of inflation next year after UK PM Truss went back on her commitment to the pension triple lock, according to The Telegraph.

- UK Chancellor Hunt met with Chairman of the 1922 Committee Brady on Tuesday afternoon which prompted further questions about the future of UK PM Truss, according to Sky News.

- UK Chancellor is lining up taxes on energy companies and banks to fill a GBP 40bln UK fiscal hole, according to FT.

- Germany is planning an electricity price cap along the lines of a gas cap, according to Handelsblatt; German Economy Ministry Draft: cabinet should discuss power and gas price breaks on November 18th, via Reuters.

FX

- Franc flounders as Dollar rebounds alongside bear-steepening in US Treasuries, USD/CHF probes parity as DXY tops 112.500.

- Sterling deflated irrespective of firmer than forecast UK inflation data on broader economic, fiscal and political concerns; Cable tests support around 1.1250 from a 1.1350+ peak.

- Euro fades against Greenback and edges closer to 0.9800, Yen slips further through 149.00 in the ongoing absence of actual Japanese intervention and the Loonie treads cautiously between 1.3700-1.3800 parameters into Canadian CPI.

- Antipodes fare better vs their US peer post-NZ inflation and pre-Aussie jobs as NZD/USD hovers near 0.5700 and AUD/USD just above 0.6300.

- Japanese PM Kishida says no comment on FX; need to take appropriate action against excess FX volatility. Japan’s Finance Minister Suzuki says there is no change to the thinking on FX, in frequent communication with the MOF.

Fixed Income

- Gilts dented post-CPI which topped 10%, though clawed back losses to mid-97.00; before further pressure on political updates and ahead of a later DMO outing.

- Bunds and USTs under pressure in sympathy, with Bunds tacking the laggard mantel in wake the German FinMin increasing the size of outstanding bonds; yield above 2.30%

- Stateside, USTs are moving in tandem with peers though magnitudes a touch more contained ahead of 20yr supply and Fed speak; curve mixed, overall.

- German Finance Ministry says increased the size of 18 outstanding bonds by EUR 3bln each (total of EUR 54bln), via Reuters; increase will provide flexibility to cover financing needs during the energy crisis.

Commodities

- WTI and Brent Dec futures are firmer intraday after yesterday’s decline, which saw Brent dip under USD 90/bbl but settle at the figure.

- Spot gold trades lower intraday and back under the USD 1,650/oz mark as the Dollar picks up in pace.

- LME metals are mostly softer amid the firmer Dollar and risk aversion, with 3M copper extending its losses under USD 7,500/t.

- US Private Energy Inventory (bbls): Crude -1.3mln (exp. +1.4mln), Gasoline -2.2mln (exp. -1.1mln), Distillates -1.1mln (exp. -2.2mln), Cushing +0.9mln.

- US President Biden will lay out plans on Wednesday to continue using the SPR to gain more stability in gas prices and will reiterate that gasoline company profits are too high and should be returned to consumers, according to a senior administration official. Furthermore, the Biden administration agreed to make future oil purchases to refill reserves at prices at or below USD 67.00-72.00/bbl, while President Biden will announce 15mln additional barrels for delivery from SPR in December, extending the initial timeline and completing the 180mln commitment.

Geopolitics

- Russia says it is preparing to evacuate civilians from Kherson which comes as Ukrainian troops push closer to the city as part of a successful counter-offensive, according to AFP News Agency

- Europe is planning to sanction a number of Iranian individuals and entities regarding arms sales to Russia, according to Politico citing diplomats/officials; adding, a list of sanctions has been prepared, aim is to be in agreement before Thursday/Friday

- US, Britain and France plan to raise Iran’s arms transfers to Russia during closed-door UN security council meeting Wednesday, according to Reuters citing diplomats.

- North Korea said it fired artillery shells on Tuesday to send a warning against South Korea’s military drills and it called on its ‘enemies’ to immediately stop causing military tensions, according to KCNA.

US Event Calendar

- 07:00: Oct. MBA Mortgage Applications -4.5%, prior -2.0%

- 08:30: Sept. Building Permits, est. 1.53m, prior 1.52m, revised 1.54m

- Building Permits MoM, est. -0.8%, prior -10.0%, revised -8.5%

- 08:30: Sept. Housing Starts, est. 1.46m, prior 1.58m

- Housing Starts MoM, est. -7.2%, prior 12.2%

- 14:00: U.S. Federal Reserve Releases Beige Book

DB’s Jim Reid concludes the overnight wrap

Our wayward but lovely dog Brontë doesn’t get so much of a mention these days but I have to say that she was taken to the Vet yesterday and although she got a clean bill of health the report back from my wife shocked me. She’s 8 in a couple of months and the Vet said we will soon have to move her to geriatric food portions. When my wife told me it actually made me quite upset. Firstly because it seems like only yesterday she was a puppy (maybe because she still acts like one), and secondly in dog years she’s not much older than me. If anyone tries to put me on geriatric food portions soon they’ll be trouble!

There’s been a bit of feast and famine in markets over the last 24 hours, with both equities and bond yields seeing sizeable intra-day swings without obvious catalysts. The S&P 500 fell from an intraday high of +2.31% just after the open to close “only” close +1.15% higher but was then buoyed after the bell by Netflix who reported that subscriber growth topped estimates, leading to $3.10 EPS versus $2.12 expectations. Their equity jumped in after-hours trading, ultimately settling around +14% higher, reversing the -1.73% decline in normal trading. This has helped S&P 500 and the Nasdaq 100 futures be +0.79% and +1.19% higher this morning as we go to print.

Prior to this, equities generally had a positive day yesterday in spite of the volatility, with the S&P 500 posting a broad-based advance that saw more than 89% of the index move higher on the day, whilst Europe’s STOXX 600 (+0.34%) advanced for a 4th day running. Megacap tech stocks had lagged behind ahead of the Netflix report, with the FANG+ index just (+0.24%) after dipping into the red late in the New York afternoon. Netflix itself was one of the biggest decliners in the S&P and the biggest decliner in the FANG+ at -1.73% before their earnings. The after-hours Netflix news followed a number of other releases, including Goldman Sachs (+2.33%) where trading revenue of $6.2bn beat estimates, alongside Johnson & Johnson (-0.35%) who cut their sales forecast for the year. Today’s highlights include Tesla who’ll be reporting after the close.

In fixed income the ranges were large even if closing levels weren’t much different. 10yr Treasury yields saw an intraday surge of more than +10bps around the time of the US open, before closing essentially unchanged. In Asia, US 10yr yields are +1.5bps higher, trading just above 4%. Meanwhile in Europe, yields on 10yr bunds (+1.4bps), OATs (+0.8bps) and BTPs (+3.2bps) moved slightly higher but bunds traded it a 13.5bps range.

One thing possibly helping risk was the fact that global energy prices moved decisively lower yesterday, which also saw inflation breakevens decline across the big economies. Brent crude (-1.74%) fell back beneath $90/bbl intraday for the first time in a couple of weeks before closing at $90.03, which followed a Bloomberg report that there’d be another 10-15m barrels of oil released from the Strategic Petroleum Reserve. Even more strikingly, European natural gas futures (-12.37%) fell to a 4-month low of €113 per megawatt-hour, which comes as the long-range forecasts have suggested that we won’t be seeing the worst-case scenario of a cold winter in Europe, which in turn will reduce demand for heating. That’s a big boost to Europe on multiple levels, as lower prices mean that any measures to subsidise gas prices wouldn’t be as expensive as feared, whilst lower demand would reduce the risk of energy rationing or blackouts.

In terms of data, this is a big week for US housing and we got another glimpse yesterday of the continuing impact of rate hikes as mortgage rates have hit their highest level in over two decades. The US National Association of Home Builders’ market index fell to 38 in October (vs. 43 expected). That’s its lowest level in a decade with the exception of the pandemic months of April and May 2020, and continues its run of having fallen in every single month this year.

Here in the UK, the political situation remained incredibly volatile following the mini-budget U-turn, with constant press briefings about when Prime Minister Truss might be removed from office. The opinion polling remains dire for the government, with a YouGov poll yesterday showing that Truss had a net favourability rating of -70, which for reference is well beneath the -53 score for Prime Minister Johnson at the time of his resignation in early July. Strikingly, even if you just looked at those who voted Conservative at the last election, her net favourability was still at -51, with ratings that are deeply negative among every category of voters. We should hear from Truss in the House of Commons later for Prime Minister’s Question Time, so one that plenty of observers will be watching.

When it came to markets, the biggest story was an explicit pushback from the Bank of England on the FT’s report that the BoE were set to postpone the start of QT on October 31. We’d mentioned the report in yesterday’s edition, which saw equity futures move higher when it came out, but a BoE spokesperson said in the European morning that it was “inaccurate”. Gilt yields moved higher immediately afterwards, but by the close they’d moved lower, with the 10yr gilt yield down -2.2bps on the day. After Europe went home the BoE announced that QT/Gilt sales will commence from November 1st. So the earlier FT story proved to be inaccurate.

In the meantime however, sterling returned to being the worst-performing G10 currency again, closing down -0.33% against the US Dollar. This morning, sterling (+0.11%) is rebounding a little, trading at $1.1331 as I type. Keep an eye out for the latest UK CPI print shortly after we go to press as well, which is the last one ahead of the BoE’s next meeting a fortnight tomorrow. Our UK economist sees that returning to double-digits with a +10.0% reading, and he doesn’t expect it to fall out of double-digits until March 2023.

Asian equity markets are a little more mixed overnight. As I type, the Nikkei (+0.73%) and the Kospi (+0.18%) are trading in positive territory while the Hang Seng (-1.08%) is trading lower in early trade. Mainland Chinese stocks are also down with the CSI (-0.86%) and the Shanghai Composite (-0.51%) both in the red amid a lack of positive surprises from the 20th party congress.

Early this morning, the Bank of Japan (BOJ) Governor Haruhiko Kuroda in his speech to the parliamentary committee stated that the recent depreciation in the Japanese yen was sharp and one-sided and doesn’t bode well for the nation’s economy as it makes difficult for businesses to plan ahead.

In terms of yesterday’s other data, US industrial production came in on the upside with a +0.4% advance in September (vs. +0.1% expected), whilst the previous month’s contraction was also revised to a shallower -0.1% (vs. -0.2% previously). Separately in Germany, the ZEW survey’s current situation reading fell more than expected to -72.2 in October (vs. -68.5 expected), which is its lowest level since August 2020. However, the expectations component unexpectedly rose to -59.2 (vs. -66.5 expected), ending a run of 3 consecutive monthly declines.

To the day ahead now, and data releases include the UK and Canadian CPI readings for September, along with US housing starts and building permits for September. From central banks, the Fed will release their Beige book, and we’ll also hear from the Fed’s Kashkari, Evans and Bullard, the ECB’s Centeno and Visco, and the BoE’s Cunliffe and Mann. Finally, earnings releases include Tesla, Procter & Gamble and Abbott Laboratories.

Tyler Durden

Wed, 10/19/2022 – 08:08

via ZeroHedge News https://ift.tt/GYLo9Nl Tyler Durden