Futures Green After Bouncing From Session Lows As Overnight Swings Turn Violent

US equity-index futures have swung wildly in the illiquid, overnight session, and after earlier dropping as much as 0.5% following the rapid move higher in US Treasurys and UK gilts, they have since erased all losses to trade near session highs, up 0.3% with Nasdaq futures also up 0.2%, as investors the surge in yields fizzled and as investors assessed disappointing earnings from Tesla against resilient reports from AT&T and IBM. Oil jumped, Chinese stocks spiked (but then fizzled) and both the offshore and onshore yuan rose after a Bloomberg report sparked market optimism that Chinese officials are mulling shortening the amount of time people coming into the country must spend in mandatory quarantine, an implicit tempering of the country’s much maligned coved zero policies. The US dollar slumped as sterling spiked as UK Prime Minister Liz Truss began meetings with a key Conservative party official, stoking speculation that a change in leadership may be afoot. US 10-year yield holds steady at about 4.12%.

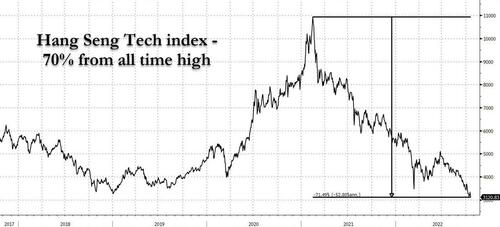

In other notable overnight developments, Hong Kong’s Hang Seng index tumbled to the lowest level since 2009 amid continued liquidations and outflows from China…

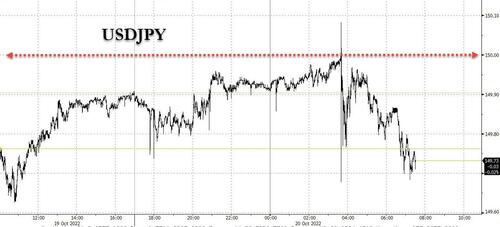

… while the yen finally weakened past the closely watched 150 per dollar level, marking a 32-year low and keeping investors on high alert for further intervention to support it. And sure enough, the BOJ promptly jumped in sparking a big move lower in the pair. The move followed a surge in US Treasury yields to multi-year highs that widened the gap with Japanese equivalents.

In premarket trading, bank stocks were mostly higher following their worst day in more than a month. In corporate news, the world’s biggest banks have already had to use about $30 billion of their own cash this year to fund loans for acquisitions and buyouts that they weren’t able to offload to investors. US-listed Chinese stocks bounced in premarket trading, a day after Wednesday’s selloff sent the Nasdaq Golden Dragon China Index down to its lowest closing level since July 2013. The KraneShares CSI China Internet Fund ETF rises 2.1% as of 7:20 a.m. in New York. Here are the other notable premarket movers:

- Tesla (TSLA US) falls 5.5% in premarket trading after the world’s most valuable automaker missed third-quarter revenue estimates as it struggled to get its cars to customers. Fellow EV firms lower in premarket trading include: Nikola (NKLA US) -2%, Faraday Future (FFIE US) -2%, Rivian (RIVN US) -1.8%, Canoo (GOEV US) -0.7%

- Alcoa (AA US) drops 9.3% in premarket trading after the aluminum giant reported worse-than-expected results for the third quarter, putting pressure on its global peers.

- International Business Machines (IBM US) shares rise 3.1% in premarket trading after the IT services company reported third-quarter revenue that beat expectations.

- Ally Financial (ALLY US) shares drop 2.5% in premarket trading as Morgan Stanley downgraded the car-finance company to equal-weight from overweight following Wednesday’s third-quarter results.

- Sunrun (RUN US) shares slump 4.1% in premarket trading after Wolfe downgrades the stock in a note to peer perform, citing headwinds from a rising interest-rate environment.

- Las Vegas Sands (LVS US) shares rise 1% in US premarket trading after posting better- than-expected 3Q adjusted property Ebitda. That was driven by a solid performance in Singapore while uncertainty remains around Macau.

US stocks slipped on Wednesday after a two-day rally saw the S&P 500 reclaim $1.2 trillion in market capitalization amid support from technical levels and optimism about earnings. Higher bond yields and Tesla’s sobering report provided reminders of the tough macroeconomic backdrop as costs for companies remain high and the Federal Reserve pushes forward with interest rate hikes.

“We continue to see plenty of macroeconomic headwinds,” said Marija Veitmane, a senior strategist at State Street Global Markets. “As central banks tighten financial conditions, earnings will crack. So we are very much in the sell-the-rally camp.”

Investors continue to closely monitor events in the UK where Liz Truss’s chaotic premiership looked close to imploding as backbench Conservative lawmakers openly said she should resign and even Cabinet ministers discussed her future. The pound weakened and 10-year UK bond yields climbed, but were off their highs.

A generally strong start to the third-quarter earnings season has bolstered sentiment toward equities. But investors are having to balance signs of corporate resilience against fears about the impact of persistent inflation, hawkish moves by the Federal Reserve and other central banks and threats to the economy.

“I think the market now is looking at 2023 and baking some kind of mild downturn into the price,” Hugh Gimber, global market strategist at JPMorgan Asset Management, said on Bloomberg Television. “The key is that inflation number coming down, because if it does, 5% for the Fed looks to me roughly as the right figure and then the market can have a clearer picture.”

In Europe, the Stoxx 50 fell 0.5% with Spain’s IBEX flat but outperforming peers; the DAX lags, retreating 0.8%. Telecoms, financial services and retailers are the worst-performing sectors. Oil and gas shares are the only rising sector in Stoxx Europe 600 index on Thursday as crude extended gains amid a report that China debates easing some Covid restrictions, while European gas advanced after a five-day losing run. The Stoxx Energy sub-index advanced 1.3% as of 10:45 a.m. in London, while the broader equity benchmark declined 0.5%. Here are some of the biggest European movers today:

- Oil and gas shares are the only rising sector in Stoxx Europe 600 index on Thursday as crude extended gains amid a report that China is debating easing some Covid restrictions, while European gas advanced after a five-day losing run. BP gained 1.5%, Shell +1.4% and TotalEnergies +1.5%

- Saipem soars as much as 13% in Milan, the most intraday since July 14, after winning a $4.5 billion engineering and construction contract from Qatargas. Jefferies upgraded the stock to buy after the “material” award

- Yara shares gain as much as 7.2% after fertilizer maker’s 3Q adjusted Ebitda beat analyst estimates and was seen as very strong in an uncertain quarter. Declining gas prices are also pointing toward restarting fertilizer capacity in Europe as demand is rising

- Brunello Cucinelli shares soar as much as 11.5%, the most since March, after it delivered a significant beat in its 3Q results as well as a major uptick in FY guidance

- Nokia shares fall as much as 6.8% after a mixed set of results, with sales beating consensus estimates while profit and margin lagged. The bottom-line was dragged down by the network equipment maker’s Technologies segment, which continued to be hobbled by a delay in patent contract renewals

- Ericsson shares slide as much as 16%, the most since Oct. 2016, after reporting third-quarter operating profit and margin that missed analyst estimates. While the Swedish telecom equipment maker pledges to change pricing and cut costs, analysts still see margin pressure persisting into the next year

- Volvo shares fall as much as 5.9% in Stockholm trading, the most intraday since May 2, as analysts highlight that focus for 3Q results is on the weaker Truck division margin, which is driving a miss at Ebit level

- GB Group shares plummet as much as 20%, hitting the lowest since September 2017, after identity verification company published a first-half trading update. Davy said the revenue was below consensus expectations

Earlier in the session, Asian equities headed for a second day of declines, as the recent selloff in Hong Kong shares deepened amid investor concerns on China’s zero-Covid approach. The MSCI Asia Pacific Index dropped as much as 1.6%, as tech shares faced fresh losses after bond yields spiked overnight. The gauge pared some of its earlier losses after a report that Chinese authorities were considering a shorter quarantine for inbound travelers. Hong Kong led declines in the region, with its benchmark falling to the lowest since 2009 as Chief Executive John Lee’s maiden policy speech left investors disappointed. Traders remained concerned about consumer demand in China amid lockdowns and rising Covid cases, as well as the spillover into earnings for the region.

“History suggests it is hard for stocks to rally in the face of EPS cuts,” said Stephen Innes, managing partner at SPI Asset Management in a note. “While stock prices should trough before EPS estimates bottom, there is still a lot of wood to chop.” Benchmarks in Taiwan, South Korea and Australia also fell, with the latter extending declines after government data showed that Australian hiring almost stalled in September. Japan’s gauges slid even as the yen weakened past the closely-watched 150 per dollar. Indexes in Indonesia and Malaysia defied the broader gloom to gain more than 1%.

The Hang Seng Tech index has now tumbled more than 70% from its Jan 2021 high.

China’s possible cut in quarantine period for inbound travelers is a small step in the right direction but a lot more is needed to lift investor sentiment dented by the country’s Covid Zero policy. US futures pared losses after the Bloomberg report on the news. The offshore yuan briefly gained as much as 0.5% to 7.2353 against the dollar. According to Amir Anvarzadeh, a strategist at Asymmetric Advisors: “A cut to quarantine rules for inbound travelers will not be enough for the Chinese market to rebound”

Japanese stocks slid as investors refocused on the impact of higher US interest rates and a looming global recession after a two-day rally. The Topix fell 0.5% to close at 1,895.41, while the Nikkei declined 0.9% to 27,006.96. Hoya Corp. contributed the most to the Topix decline, decreasing 3.5%. Out of 2,166 stocks in the index, 596 rose and 1,454 fell, while 116 were unchanged.

Australian stocks declined with global growth fears in focus; the S&P/ASX 200 index fell 1% to 6,730.70, in step with most markets in Asia and on Wall Street amid worries of a global slowdown. Miners contributed the most to the gauge’s retreat as investors weighed quarterly production reports. They also assessed jobs data that suggest the RBA will continue to slow the pace of interest rate increases. In New Zealand, the S&P/NZX 50 index fell 0.8% to 10,832.03.

Key Indian stock gauges gained for a fifth straight day, their longest run of advances in two months, before a key festival next week and as robust corporate earnings boost investor sentiment. The S&P BSE Sensex gained 0.2% to 59,202.90 in Mumbai, while the NSE Nifty 50 Index advanced 0.3%. The indexes overcame decline of as much as 0.5% as weekly derivative contracts expired Thursday. The key benchmarks have risen more than 2% this week and were trading near their highest level since Sept. 21. Twelve of 19 sector sub-gauges compiled by BSE Ltd. advanced, led by oil & gas companies while consumer durables were the worst performers. For the week, information technology stocks are the best performers, helped by stronger-than-expected earnings. Out of 11 Nifty 50 companies, which have so far reported earnings, eight have either met or exceeded average estimates, while three have trailed. Asian Paints’ quarterly results trailed estimates, dragged by weaker revenue growth and rising costs, while Bajaj Finance’s numbers matched consensus

In rates, 10-year TSY yields trade near session lows at around 4.12%, richer by 1bp on the day after earlier rising 5bps to 4.17% while German 10-year yield rises 5.5bps to 2.43%. Treasuries pared losses in the early US session, rising with gilts which stretch to fresh session highs and outperform on the day as Bank of England Deputy Governor Ben Broadbent says UK rates may not rise as much as markets foresee. Gilts outperformed by 4bp while bunds lag Treasuries by 2bp; belly outperformance tightens 2s5s30s fly by 4bp on the day. Dollar issuance slate empty so far and expected to be light; Wednesday saw three borrowers price $6.5b. Three-month dollar Libor +4.70bp at 4.32457%

In FX, the Bloomberg Dollar Spot Index hovered as the greenback traded mixed against its Group-of-10 peers, though most pairs consolidated recent moves. Treasury yields rose by as much as 2bps, led by the short end.

- The euro erased a modest loss to near $0.98. Bunds fell for a third session as traders continued to digest Wednesday’s unexpected German Finance Agency decision to increase its own securities holdings for repo purposes, with schatz swap spreads narrowing for a sixth day, the longest streak since December

- UK bonds pared an earlier loss and traders cut bets on BOE tightening after Deputy Governor Ben Broadbent said it’s not clear that UK interest rates need to rise as much as the market expects. The pound fell below $1.12 as Liz Truss’s premiership looks close to imploding after she fired one minister over a security breach and two others were heard resigning amid the fallout from a chaotic parliamentary vote before agreeing to stay in their posts

- The yen fluctuated in a tight range, and briefly rose above 150 per dollar. Japanese Finance Minister Shunichi Suzuki said excessive and sudden moves in the foreign exchange market triggered by speculation can’t be tolerated. Japan’s benchmark yield climbed above the central bank’s policy ceiling and monetary authorities announced unscheduled bond purchases to rein it back in. Demand for long gamma in dollar-yen gains traction as spot breaches the psychologically-key 150 level

- Australia’s dollar slid as much as 0.7% amid a weak jobs print, before reversing following a report that Chinese officials were debating whether to shorten quarantine for inbound travelers. Bonds fell. Australia’s employment rose by just 923 people in September, below the forecast of 25,000, government data showed

In commodities, WTI and Brent December contracts are firmer intraday with the former around USD 86/bbl (84.49-86.27 range) whilst the latter resides around USD 93.50/bbl (91.95-93.92 range). The crude complex is buoyed by the pullback in the Dollar after receiving a boost from source reports that China is considering easing its COVID rules for travellers. Spot gold sees some support from the DXY remaining under 113.00, although remains well off recent highs, with the yellow metal still around the USD 1,630/oz mark (vs yesterday’s 1,654.50/oz high). LME metals are mixed but 3M copper receives a boost from the Buck alongside the aforementioned China source reports, but the red metal remains under USD 7,500/t.

Overall, Bitcoin is contained and essentially unchanged on the session around USD 19.1k with specific updates relatively limited and participants focused on broader market action.

To the day ahead now, and data releases from the US include the weekly initial jobless claims and existing home sales for September, whilst in Germany there’s the PPI reading for September. Central bank speakers include the Fed’s Harker, Jefferson, Cook and Bowman, the ECB’s de Cos and BoE Deputy Governor Broadbent. Earnings releases include Danaher, Philip Morris International, Union Pacific, AT&T and Blackstone. Finally, EU leaders will gather for a summit in Brussels.

Market Snapshot

- S&P 500 futures down 0.5% to 3,690.25

- MXAP down 0.8% to 136.26

- MXAPJ down 0.9% to 440.36

- Nikkei down 0.9% to 27,006.96

- Topix down 0.5% to 1,895.41

- Hang Seng Index down 1.4% to 16,280.22

- Shanghai Composite down 0.3% to 3,035.05

- Sensex down 0.3% to 58,948.91

- Australia S&P/ASX 200 down 1.0% to 6,730.73

- Kospi down 0.9% to 2,218.09

- STOXX Europe 600 down 0.5% to 395.57

- German 10Y yield up 3% to 2.45%

- Euro little changed at $0.9777

- Brent Futures up 0.9% to $93.26/bbl

- Gold spot little changed at $1,630.01

- U.S. Dollar Index down -0.1% at 112.86

Top Overnight News from Bloomberg

- Giorgia Meloni, the right-wing leader poised to form a new Italian government, said she’d give up on the fledgling coalition if her allies can’t commit to supporting Ukraine along with Italy’s European Union and NATO partners

- France’s Economy & Finance minister Bruno Le Maire targets inflation of 4% by the end of 2023, AFP reports, stressing these are “objectives, not forecasts”

- Turkey’s central bank is poised to take another step toward cutting interest rates into single digits this year, a gamble masterminded by President Recep Tayyip Erdogan to power economic growth ahead of elections next June

- German Chancellor Olaf Scholz warned that a proposal to introduce a European Union-wide cap on gas prices could backfire as the region seeks to offset a drastic supply cut from Russia.

A more detailed look at global markets courtesy of Newquawk

Asia-Pacific stocks were pressured following the weak handover from Wall Street owing to the higher yield environment and as global inflationary headwinds offset the recent earnings momentum. ASX 200 was led lower by the underperformance in tech and following disappointing jobs data, although the energy sector bucked the trend after gains in oil prices and strong quarterly output updates from Woodside Energy and Santos. Nikkei 225 briefly fell beneath 27,000 with participants on intervention watch, while stronger-than-expected Exports and Imports failed to spur risk appetite as the data also contributed to a record trade deficit for the fiscal first half. Hang Seng and Shanghai Comp. declined from the open with the former on course for its lowest close since 2009 amid heavy losses in tech and with the mainland also downbeat after the lack of surprises from the PBoC which maintained its benchmark lending rates unchanged as widely expected, although news of China mulling shortening its quarantine eventually lifted the Shanghai Comp into the green.

Top Asian News

- PBoC 1-Year Loan Prime Rate (Oct) 3.65% vs. Exp. 3.65% (Prev. 3.65%); 5-Year Loan Prime Rate (Oct) 4.30% vs. Exp. 4.30% (Prev. 4.30%)

- China reportedly held emergency talks with chip firms after US curbs, according to Bloomberg.

- China is reportedly mulling cutting inbound quarantine to 7 days from 10 days which will be presented to the top leaders, according to Bloomberg.

- Indonesian 7-Day Reverse Repo (Oct) 4.75% vs. Exp. 4.75% (Prev. 3.75%); will intervene in FX to prevent imported inflation.

- Japanese Finance Minister Suzuki provides no comment on FX levels; cannot tolerate speculative moves; will take action against any speculative, excessive and sudden moves, via Reuters. Japanese currency diplomat Kanda says excessive and disorderly FX moves have a negative impact on the economy, will not comment on whether Japan is intervening now or has intervened today

European cash bourses trade mixed with the breadth of the market narrow (Euro Stoxx 50 -0.2%; Stoxx 600 -0.4%). Sectors in Europe are mostly negative with no overarching theme – Energy and Banks outperform amid price action in underlying crude and yields respectively. Meanwhile, Telecom names sit at the bottom of the pile as Ericsson (-14%) and Nokia (-5.3%) slide following red flags on margins. US equity futures are softer across the board but to varying degrees, with the NQ (-0.9%) lagging the ES (-0.5%) and RTY (-0.4%), with Tesla carrying a larger weight in the NDX (circa. 4.0%) than the SPX (circa. 1.8%). Tesla Inc (TSLA) – Q3 2022 (USD): Adj. EPS 1.05 (exp. 1.00), Revenue 21.45bln (exp. 21.96bln). Q3 FCF USD 3.30bln (exp. 2.89bln). Q3 Automotive gross margin +27.9% (exp. +28.4%). Tesla sees initial phase of semi deliveries begin in December 2022. Tesla still sees 50% avg. annual growth in vehicle deliveries. Raw material cost inflation impacted quarterly profitability along with ramp inefficiencies from Gigafactory Berlin-Brandenburg, Gigafactory Texas, 4680 cell production. Battery supply constraints will be main limiting factor. CEO Musk said looking forward to a record-breaking Q4 and the Co. is gaining rapid traction in 4680 cell production. -5.0% in the pre-market

Top European News

- BoE’s Broadbent says the MPC is likely to respond relatively promptly to news about fiscal policy. Remains to be seen if rates need to rise as much as currently priced in by markets, via BoE. The justification for tighter policy is clear. If government support mitigates the effect of import costs, there is more at the margin for monetary policy to do. If Bank Rate really were to reach 5.25%, the cumulative impact on GDP of the entire hiking cycle would be just under 5% – of which only around one quarter has already come through

- UK Tory 1922 Committee officers are expected to meet on Thursday to discuss the leadership crisis in the Tory party, according to The Telegraph’s Editor. However, recent reporting indicates the Committee will not be meeting today.

- UK PM Truss’s office noted that the Tory party’s chief whip and deputy chief whip remain in their posts.

- ITV’s Peston, citing a member of UK Cabinet, that it is clear there is a will among ministers to attempt to keep PM Truss in office until October 31st (when the budget will be announced). A view that contrasts the recent update from ITV’s Brand, citing a 1922 member, that the “odds are against” PM Truss surviving the day as PM

FX

- Pound precarious as pressure continues to build against UK PM Truss and BoE’s Broadbent infers that market expectations on rates may be too hawkish, Cable pivots 1.1200

- Yen slips under 150.00 mark vs Dollar as yields continue to rally, but rebounds amidst further Japanese verbal, if not actual intervention

- Franc remains on the backfoot due to as a funding currency, but Euro gleans traction from data and EGB/UST spread convergence, USD/CHF straddles 1.0050 and EUR/USD bounces ahead of 0.9750 to reclaim 10 and 21 DMAs

- Aussie labours after payrolls miss consensus by some distance and before recovery in tandem with Yuan on reports that China may relax some Covid rules for inbound travellers, AUD/USD eyes 0.6300 from sub-0.6250 and USD/CNH off peaks near 7.2800

- Riksbank’s Ingves, to Swedish parliament, says easing mortgage repayment rules would be inappropriate.

- RBI is continuing spot USD sales and receiving December forwards, according to traders cited by Reuters.

Fixed Income

- Debt remains depressed though notably off worst levels after dovish remarks from BoE’s Broadbent lifted Gilts to the mid-98.00 region.

- In turn, both USTs and Bunds have climbed off lows of 109.19+ and 134.86 respectively, though still post downside of circa. 3 and 50 ticks respectively.

- The complex looks to US data and Fed speak while BTPs await updates out of Italy as potential PM Meloni is set to begin constructing her cabinet, with particular focus on the Berlusconi’s Foreign Minister nominee.

Commodities

- WTI and Brent December contracts are firmer intraday with the former around USD 86/bbl (84.49-86.27 range) whilst the latter resides around USD 93.50/bbl (91.95-93.92 range).

- The crude complex is buoyed by the pullback in the Dollar after receiving a boost from source reports that China is considering easing its COVID rules for travellers.

- Spot gold sees some support from the DXY remaining under 113.00, although remains well off recent highs, with the yellow metal still around the USD 1,630/oz mark (vs yesterday’s 1,654.50/oz high).

- LME metals are mixed but 3M copper receives a boost from the Buck alongside the aforementioned China source reports, but the red metal remains under USD 7,500/t.

- MMG’s (1208 HK) Las Bambas copper mine in Peru reportedly halted copper transportation due to protests.

- German Energy Regulator says potential gas emergency is now end of February at the earliest, rather than end of November which was part of the scenario analysis in the August forecast, via Reuters.

Geopolitical

- Russia’s Deputy UN envoy said Russia would reassess cooperation with the UN Secretariat if the UN chief sends experts to Ukraine to inspect downed drones and is not optimistic about the renewal of the Ukraine grain Black Sea export deal, according to Reuters.

- US State Department said the US, UK and France raised the issue of Iran’s transfer of drones to Russia at a meeting of the UN Security Council on Wednesday, according to Reuters.

- US Treasury senior official travelled to Turkey this week and discussed sanctions and export controls imposed on Russia, according to Reuters.

- US and South Korea are conducting military drills at their fastest pace in years to show their readiness as tensions rise on the divided Korean Peninsula, according to Nikkei Asia Review.

- EU states have agreed on new sanctions against Iran regarding the supply of drones to Russia, according to the Czech EU presidency; to freeze assets of three individuals and one entity responsible for the drone sale.

US Event Calendar

- 08:30: Oct. Initial Jobless Claims, est. 232,000, prior 228,000

- 08:30: Oct. Continuing Claims, est. 1.38m, prior 1.37m

- 08:30: Oct. Philadelphia Fed Business Outl, est. -5.0, prior -9.9

- 10:00: Sept. Existing Home Sales MoM, est. -2.1%, prior -0.4%

- 10:00: Sept. Home Resales with Condos, est. 4.7m, prior 4.8m

- 10:00: Sept. Leading Index, est. -0.3%, prior -0.3%

Central Bank Speakers

- 12:00: Fed’s Harker Discusses the Economic Outlook

- 13:30: Fed’s Jefferson Makes Opening Remarks at Careers Event

- 13:45: Fed’s Cook Speaks on Panel at Careers Event

- 14:05: Fed’s Bowman Has Opening Remarks at Community Development…

DB’s Jim Reid concludes the overnight wrap

It’s half-term and unfortunately I can’t completely escape my responsibilities. Tomorrow I’m off to Center Parcs for the first time for a few days. It’s fair to say I’m the least excited of the five of us going. All tips on how to survive the experience welcome. I’ll be broadcasting the EMR live from there on Monday morning whilst on holiday as my co-authors are both off with Tim getting married. So many congratulations to him. Since I started the EMR nearly 16 years ago I think 9 of my co-authors have got married while working on it, 10 including me. It’s a publication that breeds stability and wholesome values. All are still going strong as far as I’m aware!

The honeymoon rally of the last few days petered out yesterday, with Treasury yields hitting multi-year highs as investors turned their focus back to central banks and how fast they’ll hike rates. All the big central banks are deciding policy over the next couple of weeks, so it’s not surprising that’s happening, but sentiment wasn’t helped either by further inflation surprises from the UK and Canada for September, which echoed what we’d already seen from the US last week. and added to the sense that the hiking cycle will be extended. After the close, we then heard from Tesla who missed revenue estimates, sending their shares -7% lower in after hours trading. Supply chain issues continued to beleaguer the company, particularly around batteries. Nevertheless, they still forecast strong growth and Elon Musk said a meaningful share buyback was likely. For whatever it’s worth on the macro side, Musk also believes commodity prices will continue to fall. Meanwhile, in overnight trading, futures tied to the S&P 500 (-0.3%) and NASDAQ 100 (-0.6%) are pointing to further losses. However these losses have halved as I type, possibly on breaking news on Bloomberg that China is considering cutting quarantine for arrivals from abroad from 10 to 7 days. I’d imagine there are hopes the zero covid policy is loosening a bit.

Back to bonds and treasury yields rose to new highs for this cycle across the yield curve, with the 10yr yield up +12.7bps at 4.13%. This morning in Asia, they are another +1.25bps higher trading at a fresh 14-yr high of just under 4.15% as I type. This comes as investors move to expect an increasingly aggressive tightening cycle from the Fed over the months ahead, with the rate priced in for the December meeting up a further +3.2bps to 4.51%. It’s gone just above the previous high for this cycle of 4.52% overnight. Furthermore, the peak rate for this hiking cycle priced in for May went up by +8.6bps to 4.97%. This morning in Asia it’s gone above 5% for the first time in this cycle.

We heard from a few Fed officials yesterday, including Presidents Bullard, Evans, and Kashkari. President Bullard noted the Fed could yet still bring forward tightening into 2022. If policy got tight enough, he noted that 2023’s inflation profile could look better. A point often cited by those expecting a rapid improvement in inflation is the composition of certain rent measures the Fed follows presents a lagged reading, and therefore inflation is not currently as bad as they expect. Bullard directly addressed that point in his remarks and that unsurprisingly, the Fed is aware of such methodological shortcomings and takes them into account when evaluating the stance of policy. President Kashkari spoke along similar lines, noting the Fed still needed tighter policy but could wind up pausing tightening come next year. Evans struck the same tone, expressing hope that the September dot plot would prove the optimal amount of tightening, so a much slower pace of tightening next year. Regardless of the above, we still have more than 75bps priced for November at 78.1bps.

As we await their next decision in just under a couple of weeks from now, there was further evidence yesterday that the Fed’s hikes were filtering their way through to the real economy, with data from the mortgage Bankers Association showing the contract rate on a 30yr fixed mortgage hit 6.94% in the week ending October 14. That’s the highest it’s been since 2002, and came as their gauge of applications to purchase or refinance a home fell a further -4.5% to its lowest level since 1997, which echoes the decline in other housing indicators we’ve seen recently. US housing starts for September were also down more than expected, hitting an annualised rate of 1.439m (vs. 1.461m expected), with the previous month’s number also revised down by -9k. On the other hand, building permits rose to an annualised rate of 1.564m (vs. 1.530m expected).

For equities it was also a rough session, with the S&P 500 coming down -0.67% after having gained +3.82% over the two days at the start of the week. Netflix (+13.09%) was the top performer in the index following its earnings release the previous day, but otherwise it was a broad-based decline that saw over 76% of the index move lower. The Nasdaq underperformed, falling -0.85%, and that was before Tesla’s earnings miss after the close. The major indices lost ground in Europe too, with the Stoxx 600 (-0.53%) bringing an end to its run of 4 consecutive gains.

Back in Europe, sovereign bonds also lost ground across much of the continent as we approach the ECB’s decision next week. Yields on 10yr bunds were up +9.0bps to a post-2011 high of 2.37%, which followed comments by Slovenian central bank governor Vasle that the ECB should hike by 75bps at the next two meetings in October and December.

Here in the UK, gilts outperformed other European sovereign bonds for a third day running, with markets remaining calm as they looked forward to the government’s fiscal announcement on October 31. That outperformance was particularly noticeable among long-dated gilts, with yields on 30yr gilts down -31.9bps after the BoE’s announcement the previous evening that their Q4 gilt sales as part of quantitative tightening would only involve short- and medium-maturity gilts, rather than long-dated ones. To be fair though, gilts rallied right across the curve, and that came in spite of the latest UK inflation data for September, which showed CPI rising to +10.1% (vs. +10.0% expected), so back up to its level in July. In addition, core inflation continued to accelerate, hitting a 30-year high of +6.5% in September (vs. +6.4% expected).

Whilst UK markets were more subdued yesterday, there was fresh turmoil on the political front as Home Secretary Suella Braverman left the government after what was reported as a security breach. In Braverman’s resignation letter, the strong implication was that Truss herself should go, saying that “The business of government relies upon people accepting responsibility for their mistakes. Pretending we haven’t made mistakes, carrying on as if everyone can’t see that we have made them, and hoping that things will magically come right is not serious politics.” A chaotic parliamentary vote late in the session won’t make life any easier for PM Truss in the short-term.

Back on inflation, there wasn’t much respite elsewhere, as Canadian inflation similarly surprised on the upside with a +6.9% reading in September (vs. +6.7% expected). That prompted investors to ratchet up their expectations of future rate hikes from the Bank of Canada, with another 75bp move at their meeting next week now fully priced in. That said, there was some marginally better news from the Euro Area on inflation, as the final CPI release for September was revised down a tenth to +9.9%, having come in at +10.0% on the earlier flash reading. But although that revision takes it out of double-digit territory, it’s worth noting that’s still the fastest inflation since the single currency’s formation.

Asian equity markets are tumbling this morning with the Hang Seng (-2.36%) leading losses, after briefly sliding -3.0% in early trade, its lowest intraday level since 2009 due to a selloff in Chinese listed tech shares. Elsewhere the KOSPI (-1.47%) and the Nikkei (-1.11%) are also deep in the red. Mainland China’s Shanghai Composite (-0.39%) and the CSI (-0.80%) are also falling.

Early morning data showed that exports in Japan advanced +28.9% y/y (v/s +26.6% expected), increasing for the 19th consecutive month in September and compared to the prior month’s +22.0% rise. This was on the back of strong demand for autos and mineral fuels. At the same time, imports surged +45.9% y/y (v/s +44.9% expected) and against a +49.9% gain in the previous month.

Staying on Japan, yields on 10yr JGBs again briefly moved beyond the BoJ’s upper limit of 0.25%, prompting the central bank to announce unscheduled bond buying for the first time this month to bring it back within its target range.

Adding to the challenge for policy makers, the Japanese yen continues to press towards the 150 level, as it reached yet another fresh 32-yr low of 149.96 against the US dollar, thus increasing the possibility for further government intervention to support the battered currency.

Separately, the People’s Bank of China (PBOC) left its benchmark lending rates unchanged for a second month, keeping the 1-yr loan prime rate at 3.65% and the 5-yr rate at 4.3%.

To the day ahead now, and data releases from the US include the weekly initial jobless claims and existing home sales for September, whilst in Germany there’s the PPI reading for September. Central bank speakers include the Fed’s Harker, Jefferson, Cook and Bowman, the ECB’s de Cos and BoE Deputy Governor Broadbent. Earnings releases include Danaher, Philip Morris International, Union Pacific, AT&T and Blackstone. Finally, EU leaders will gather for a summit in Brussels.

Tyler Durden

Thu, 10/20/2022 – 07:49

via ZeroHedge News https://ift.tt/E2v9NxR Tyler Durden