US NatGas Slumps To Six-Month Low As Supply Fears Ease

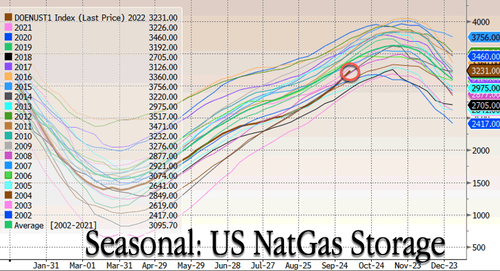

US natural gas prices slid to a six-month low Thursday morning as traders speculated US stockpiles could climb even higher, easing concerns about tight supplies ahead of the heating season.

NatGas for November delivery slid over 2% to $5.35 per million British thermal units on Nymex around 0935 ET.

“Futures have now erased most of the rally that followed the Russian invasion of Ukraine,” Bloomberg said.

The Energy Information Administration is expected to publish a weekly report this morning that shows another large inventory build. Warmer weather in the US has also been a factor in depressing demand.

“Survey averages for the morning EIA storage report suggest a build of +102-105 Bcf, larger than the 5-year average of +73 Bcf. Temperatures were near to warmer than normal over most of the US, besides slightly cool across the Great Lakes and Ohio Valley. We expect a build of +105 Bcf, and if close, will improve deficits from -221 to near -190 Bcf,” NatGasWeather noted on its website.

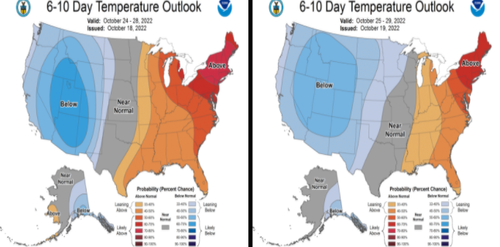

Warmer weather is forecasted in the National Weather Service’s 6-10 day outlook for the eastern half of the US, keeping demand for the fuel low.

However, stockpiles are still below the 20-year average, and the Freeport terminal is expected to restart soon after a June fire.

Energy research firm Criterion Research explained more about the dynamics at play for NatGas markets heading into the cold season:

The market has begun to shift its gaze towards the winter season as the Lower 48 got its first quick douse of cold weather this week – and the early temperature look into November has thus far shown temps slightly above normal for the continental US. Concurrently, debates are ongoing about when/if Freeport LNG is going to restart on time. That question remains unanswered, but the terminal does have three LNG vessels slated for arrival by the end of October and a fourth scheduled in November. The other factor in play is production, how strong will it be once November hits and when will Appalachian production start to ramp up with its normal 4Q push.

1/ The PHMSA has stated that Freeport LNG will require full reg. approvals before their planned November restart can take place. It is being said that the regulator won’t clear a partial restart until all of Freeport’s proposed changes are received and accepted #natgas #ongt #lng

— Criterion Research (@PipelineFlows) October 20, 2022

Any blast of cold weather for an extended period could reverse the downtrend in US NatGas prices. Plus, watch export data of Freeport shipments, as they should start to increase shortly.

Tyler Durden

Thu, 10/20/2022 – 10:15

via ZeroHedge News https://ift.tt/vAbh4lG Tyler Durden