History Is Loud And Clear: This Is The Last Fed Hike

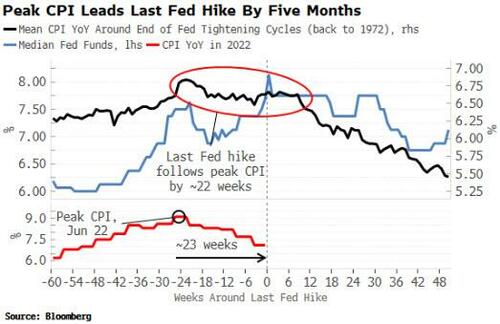

It’s not just Academy strategist Peter Tchir who bucks the prevailing consensus of at least two more rate hikes in 2023, and expects that today’s 50bps rate hike will be last one by the Fed: Bloomberg strategist Simon White is also in this contrarian camp, and here’s why – looking at historical data back to 1972, White finds that the last Fed hike takes place, in average terms, about 22 weeks after the peak in CPI. With the peak CPI in this cycle hitting in June, about 22/23 weeks ago, that would put the last Fed hike of the cycle at today’s meeting. After that, the first cut then happens – in median terms – about 16 weeks later, which in the current cycle would put us in early April 2023. In short, today the tightening cycle and, and the easing cycle begins in 4 months.

Here is White’s full forecast which, if correct, will be sufficient to spark the next bull market:

A Fed pivot could happen faster than even fairly dovish market expectations anticipate.

Tuesday’s softer-than-expected CPI report cemented the notion that peak Fed hawkishness is behind us, and makes a 50 bps hike today a very high likelihood.

The market is expecting the first full 25 bps cut from the Fed by November next year. But the historical record says it could come even sooner, surprising the market and (further) disappointing the Fed’s desire for higher-for-longer.

Looking back to 1972, the last Fed hike takes place, in average terms, about 22 weeks after the peak in CPI. Peak CPI in this cycle was in June, about 22/23 weeks ago, which would put the last Fed hike of the cycle at today’s meeting. The first cut then happens, in median terms, about 16 weeks later, which in the current cycle would put us in early April 2023.

Restricting the above analysis to the inflationary recessions of the 1970s and early 1980s does not much alter the length of time between peak CPI and last Fed hike.

There is no reason for history to repeat, of course, but this ties up nicely with the state of play. Traders in recent months have pushed the expected peak in Fed Funds ahead of the Dots, meaning for the first time that the market was amplifying rather than inhibiting desired Fed policy, and increasing the chance that peak Fed hawkishness has indeed elapsed.

Further, recession risk is rising and while one is not likely to be imminent, recessions often come on faster than expected. Jobs data still look fairly robust on the surface, but cracks are appearing, e.g. in unemployment claims, and there is a material risk that the data we are seeing today could be revised much lower.

Even though the Fed has talked tough on keeping policy restrictive for longer than normal, a rapid deterioration in the economic outlook could easily push policy makers to reverse course much quicker than most expect.

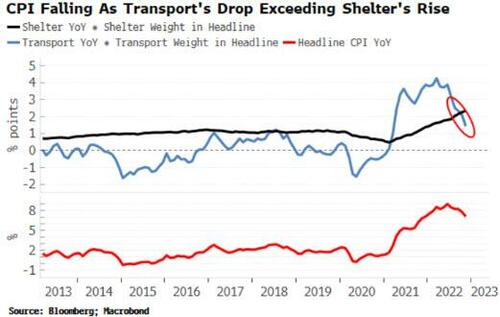

This is especially the case if inflation keeps falling at its current pace. This week’s report showed that the transport component (which was contributing the most to CPI) continues to fall at a rapid clip, overwhelming the steady rise in shelter, and keeping pressure on the headline number.

Tyler Durden

Wed, 12/14/2022 – 10:45

via ZeroHedge News https://ift.tt/CDVNMrQ Tyler Durden