FOMC Hikes By 50bps, Hawkishly Signals Rates Will Go Higher-For-Longer

Tl;dr: Fed hiked rates by 50bps as expected but signaled, through its projections, that it will hike rates higher than the market expects and hold those rates higher for longer. Furthermore, the projections for economic growth, employment, and inflation all suggest The Fed expects a recession.

* * *

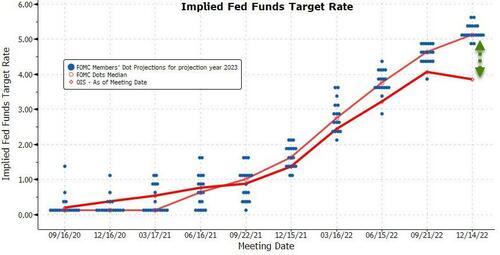

Since the November 2nd (dovish) FOMC statement and (hawkish) press conference chaos, gold and bonds have dramatically outperformed, stock have rallied as the dollar and crypto tumbled…

Source: Bloomberg

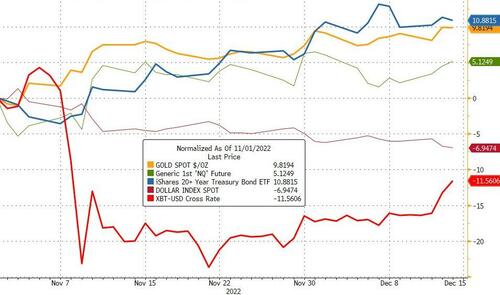

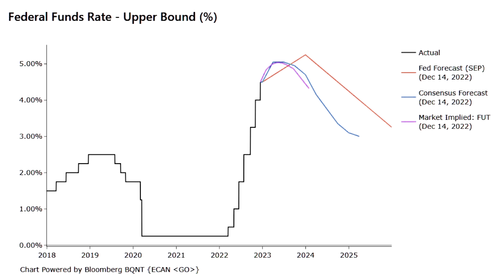

Most notably, despite Powell’s extremely hawkish press conference (which sent rate-hike expectations higher), the overall expectations of the trajectory of Fed rate has dived dovishly since the last FOMC. Note the terminal rate has dived from 5.20% to below 4.80%…

Source: Bloomberg

This has completely decoupled the market from The Fed’s dot-plot expectations for the rate-trajectory from here (with the market considerably more dovish)…

Source: Bloomberg

Note we will get a new dotplot today.

The market is pricing in around 6 rate-cuts from mid-2023 to end-2024…

Source: Bloomberg

Finally, and perhaps most importantly for Powell, we note that financial conditions have eased dramatically since the last FOMC, now at their ‘easiest’ since June (225bps of rate-hikes ago!)…

Source: Bloomberg

The market has fully priced-in a 50bps hike today but since the CPI print, February and March expectations have dovishly dropped (27% odds of 50bps in Feb and 48% of 25bps hike in March)…

Source: Bloomberg

So, the primary points of uncertainty are:

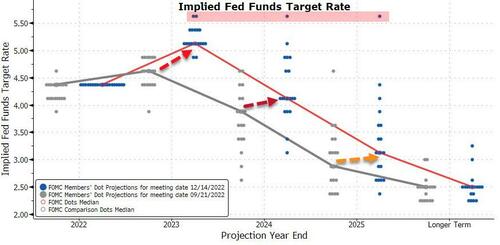

(i) how high DOTS move, 25bps – 50bps. Bond markets are pricing a ~4.8% terminal rate effectively achieved at the March 2023 FOMC meeting

(ii) the degree of hawkishness of Powell’s press conference. Investors are wondering if Powell delivers Jackson Hole (SPX -3.4%) or more like Brookings/Nov 30 (SPX +3.1%). It may be the case that Powell focuses on the length of time Fed Funds will remain elevated rather than pace or level.

So what did the FOMC say?

The Fed hiked rates by 50bps as expected, adding that “ongoing” rate-hikes are likely anticipated.

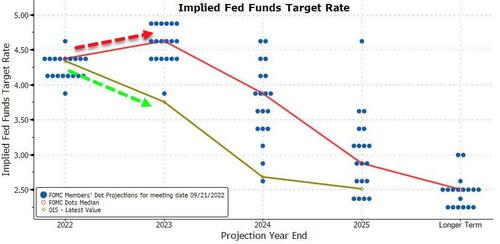

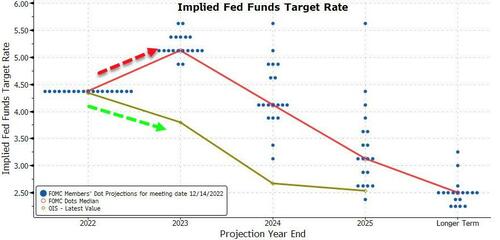

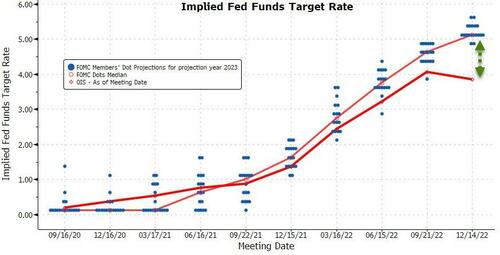

And even more hawkishly, The Fed’s new dotplot signals a median forecast of 5.1% in 2023 (more hawkish than expected), dropping to 4.1% in 2024. Additionally note that one Fed member expects 5.50-5.75% in 2025!

Which is even more hawkishly decoupled from the market’s dovish expectations…

While we had a unanimous vote today, there’s clearly a whole lot of division over expectations for policy in 2023.

With 7 of the 19 forecasters seeing a policy rate of above 5.25% next year, that’s a sizable minority.

The 2023 Median ‘Dot’ continues to hawkishly rise, decoupling from the market…

Fed projections see weaker economy in 2023; higher unemployment rates, more inflation and 50bps higher Fed funds rate.

Somebody is going to have to fold here…

As Bloomberg’s Chris Anstey notes, looking at the median forecasts for economic growth and the jobless rate, Fed policymakers are basically predicting a recession.

A 0.5% gain for GDP in the fourth quarter of next year compared with the current quarter could easily incorporate two or three quarters of contraction.

And the jobless rate rising by almost 1 percentage point — that’s an outlook that is pretty consistent with a recession.

So Powell may say they’re still hoping for a softish landing. But basically the Fed is projecting a recession.

Now all eyes and ears are on Powell to see if he flips the script once again.

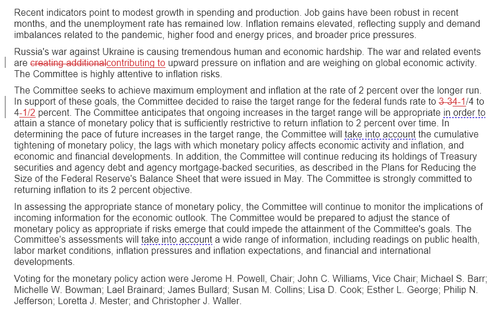

Read the full Redline of the statement below (virtually unchanged):

Tyler Durden

Wed, 12/14/2022 – 14:04

via ZeroHedge News https://ift.tt/9KU5maC Tyler Durden