Another Big Reversal FOMC Day: Markets Call Hawkish Fed’s Bluff

The day started off with a drop in import and export price inflation. But that was just a side-show as stocks limped higher into the main event.

Then The Fed and Powell’s presser smashed the vase of fantasy on the ground of reality with a hawkish statement and projections and an even more hawkish Powell.

-

POWELL: LABOR MARKET REMAINS EXTREMELY TIGHT

-

POWELL: A RESTRICTIVE POLICY STANCE LIKELY NEEDED FOR SOME TIME

-

POWELL: NEED SUBSTANTIALLY MORE EVIDENCE OF LOWER INFLATION

-

POWELL: FED STILL HAS SOME WAYS TO GO ON RATE HIKES

-

POWELL: STANCE ISN’T YET RESTRICTIVE ENOUGH EVEN W/ TODAY’S MOVE

-

POWELL: NO RATE CUTS UNTIL CONFIDENT INFLATION MOVING TOWARD 2%

-

POWELL: WILL HAVE TO HOLD RESTRICTIVE RATES FOR SUSTAINED TIME

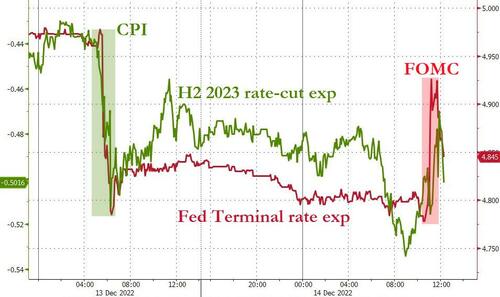

All of which sent rate-hike expectations surging, but they gave back some of that hawkishness as Powell spoke…

Source: Bloomberg

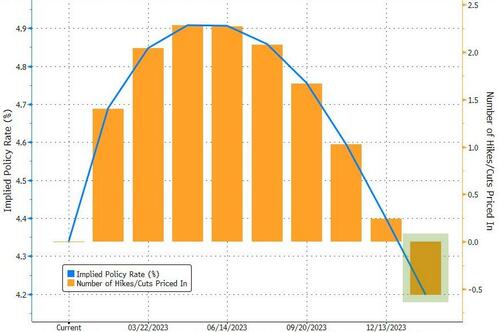

The market is now pricing in rates being lower than current rates by Jan 2024…

Source: Bloomberg

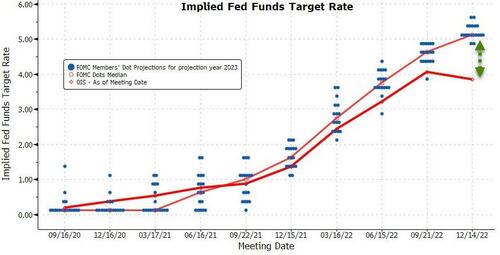

The market is not buying what The Fed is selling…

Source: Bloomberg

The markets did their usual thing – jerking one way on the statement, then swinging all the way during the press conference which was as usual full of contradictions…

The market has reversed entire initial kneejerk reaction on past 5 FOMCs during the Powell presser. Will today be 6 out of 6

— zerohedge (@zerohedge) December 14, 2022

…but markets grabbed on the remote possibility of The Fed adjusting its inflation target: Bloomberg’s David Wilcox explained:

“At the presser, Powell slaps down any notion of rethinking the 2% inflation target any time in the foreseeable future. Implicitly, he leaves open the possibility of revisiting the target down the road — perhaps at the next ‘framework review’ due to be concluded in about 2025, or perhaps the one after that. In other words, not until WAY down the road.”

Neil Dutta at Renaissance Macro agreed:

Powell even saying that there could be a “longer-run project” in looking at the inflation target is “dovish”

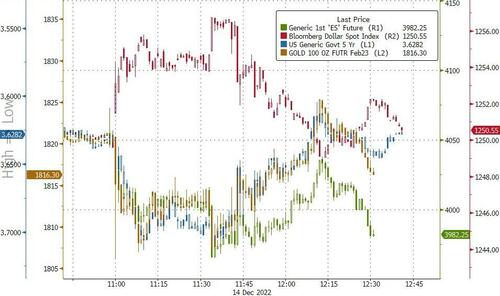

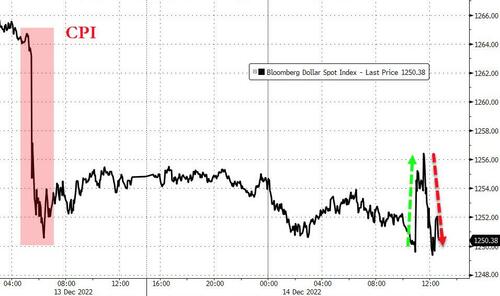

And that, along with Powell saying that we are ‘getting close to sufficiently restrictive rates level” seemed to reverse everything. The Dollar spiked as everything else dumped initially; then Powell started speaking and the dollar dropped and everything else rebounded…

Simply put – the market is calling The Fed’s hawkish bluff.

Stocks ended lower after dumping and pumping. Nasdaq underperformed (swinging from +1% to -1.5%) but the moves by the close were not by any means significant…

The S&P started the day back above the 200DMA, but fell back below it on the FOMC…

Treasury yields mostly ended the day lower in yields, despite spiking initially on the FOMC statement. The short-end notably underperformed however (2Y +2bps, rest of curve down 1-2bps)…

Source: Bloomberg

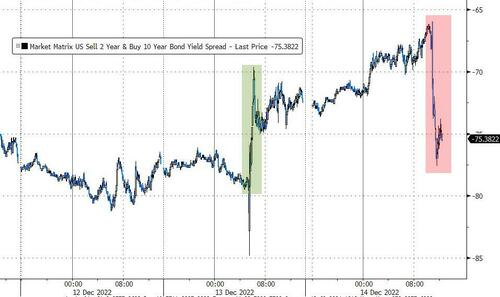

Which flattened the yield curve significantly…

Source: Bloomberg

The odds of a 50bps hike in Feb popped and dropped (now at just 25%), while the odds of a March 25bps hike rose to 60%. There’s a 76% chance that The Fed will not hike in May…

Source: Bloomberg

The dollar initially rebounded on the FOMC statement then reversed on Powell’s comments…

Source: Bloomberg

Bitcoin ramped back above $18,000 ahead of The Fed then was slapped back below it…

Source: Bloomberg

A huge crude build knocked oil prices (briefly), but the machines wanted it higher and so WTI topped $77 (one week highs)…

Gold initially tumbled on the FOMC statement then bounced back…

Finally, and perhaps most notably today, Powell was asked about the decoupling between financial conditions and the tightening of policy rates…

Source: Bloomberg

His response was and umm-ahh but he finally admitted that it is important that financial conditions reflect policy restraint.

“The Fed’s actually pretty hawkish here,” Former Federal Reserve Bank of New York President Bill Dudley says. He also draws attention to that (diplomatically phrased) comment from Powell at the start about the need for financial conditions to reflect Fed tightening action.

“If markets ease financial conditions, the implicit notion there was that just means we’re going to have to do more to make financial conditions tight.”

So what do you think that means for credit spreads, stock prices, and bond yields?

Tyler Durden

Wed, 12/14/2022 – 16:00

via ZeroHedge News https://ift.tt/MuAL4oE Tyler Durden