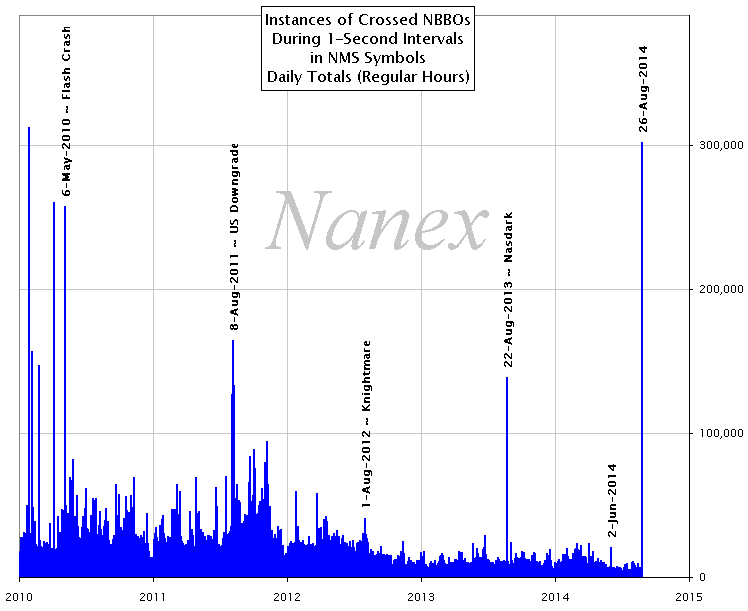

For 39 minutes today, as we noted earlier, the US stock "market" broke. As Nanex details, a total of 1,384 symbols were affected as 100s of stocks trade with crossed NBBOs, practically eliminating any chance for retail traders to transact. Options market were frantic, volatility swung around like a Ukrainian border-patrol agent, and yet the US equity indices limped ever higher. For those who fear 'the big one', for those who understand market liquidity, for those who got a glimpse of what happens when large crowds meet small doors in the high-yield credit market, today's "broken" market was a cold hard lesson that few 'moms and pops' would have noticed… but from the perspective of 'ability to trade' – today's market was worse than the Nasdaq Blackout and the Flash Crash… Hedge accordingly.

The Retail Lockout of 2014

Hundreds of symbols with crossed NBBOs

1. Count of symbols with a crossed NBBO each second. Event started at 11:58:25 and ended at 12:37:27. Over symbols were affected during several seconds of time. A total of 1,384 symbols were affected.

2. Final impact at the end of the day: higher count of instances of symbols with a crossed NBBO each second than Nasdaq blackout or Flash Crash!

3. BITA – trades color coded by reporting exchange and NBBO (red indicates where it was crossed).

4. Showing Retail trades – note how these trades only occur when the NBBO is not locked (dark gray). In other words, a crossed NBBO shuts down retail order matching.

5. Retail selling – gets the worst prices when the NBBO returns to normal.

6. Retail buying.

* * *

But apart from that… and the year's lowest trading volume… stocks are at all-time highs so that must be good right… until someone decides to sell that is… to lock in that 'wealth effect'… now we leave it to the game theorists to decide, is first mover advantage net positive now so close to the end of QE?

via Zero Hedge http://ift.tt/1qssXCv Tyler Durden