Market Goes Haywire With Dozens Of NYSE Trading Halts At The Open After “Technical Glitch”

Update (9:52am ET). According to the NYSE, as of 9:48am, all systems are back to normal, although that is an understatement in a market where nobody knows what the correct opening price is! We are still waiting for the NYSE to give a detailed explanation of what caused this latest “broken markets” episode.

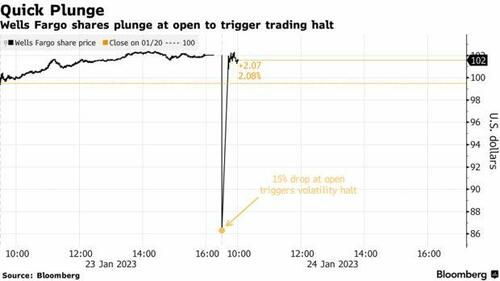

While it is still unclear what was the “technical glitch” that sent the world’s biggest companies into a multi-trillion market cap rollercoaster, Bloomberg reports that “a wave of sell orders targeting financial services stocks swept across American equity exchanges at the open of trading Tuesday, sending companies including Wells Fargo & Co. and Morgan Stanley to brief but sharp plunges from which they mostly quickly recovered.”

After closing Monday at $45.03, Wells Fargo fell as low as $38.10 before bouncing back, while Morgan Stanley plunged to $84.93 after ending at $97.13 on Monday.

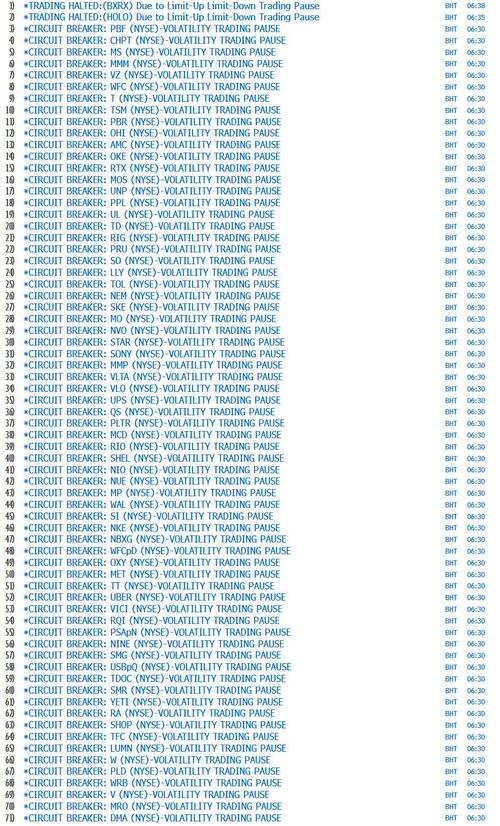

That may be accurate, it’s not comprehensive as virtually every NYSE-listed stock was slammed at the open, only to rebound powerfully before tumbling once more. Indeed, as noted below, other impacted stocks included the likes of Walmart, McDonald’s and Exxon. These stocks saw drops of at least 12% before they were halted. Their moves have now rebounded to less than 1% in either direction.

Tuesday’s transactions occurred in New York Stock Exchange-listed securities and took place on virtually every trading platform, including ones overseen by CBOE Global Markets and private venues reporting to the Finra trade reporting facility.

* * *

It has been a while since we had a market-wide break.

Something snapped at exactly 9:30:00 am ET this morning when stocks opened for trading, only… they didn’t, as instead hundreds of NYSE-listed stocks were immediately halted for trading after breaching circuit breaker limits…

… which among others saw giga-caps such as Exxon, Morgan Stanley, Verizon, AT&T, Nike, and Wells Fargo tumbling as much as 11%…

… while McDonalds traded down to $236.42 before rebounding to $268.32 – a $55 billion swing in market cap in seconds – before being almost immediately halted.

While it is unclear what the “technical glitch”, as CNBC called it, in question was many stocks had abnormally large moves when stocks opened for trading, which triggered the resulting volatility halts.

It took several minutes for the circuit breakers to be lifted and for trading to return to something resembling normalcy although nobody knows if these prices are accurate or still affected by whatever glitch halted trading.

Tyler Durden

Tue, 01/24/2023 – 09:50

via ZeroHedge News https://ift.tt/VeFvl7T Tyler Durden