Microsoft And Giga-Tech Earnings Preview

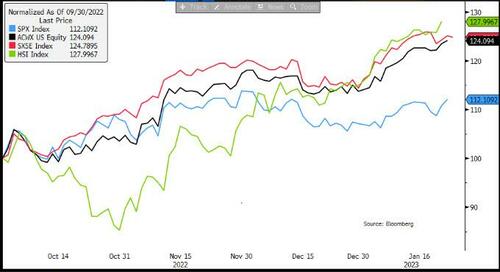

With MSFT earnings due after the close, and the balance of the FANG+ complex next week, markets have been in a holding pattern until we get some insight into just what the world’s largest companies are seeing; not only that, but according to JPM with many asking whether the US can reverse its underperformance relative to the rest of world…

… the answer – at least in the short-term – lies with Tech earnings, which are expected to experience their largest decline since 2016, according to Bloomberg. That said, over the longer-term, JPM notes add that “if we do experience a Fed pivot this year, then would anticipate a strong, positive buying impulse for Tech.”

Turning to MSFT and the GAMMA stocks specifically, here is what JPMorgan traders Ron Adler and Jack Atherton have to say ahead of today’s closely watched report which will set the benchmark for the rest of the giga-cap techs.

- While the squeeze in smaller market cap companies received a lot of attention, the newfound leadership from the stalwarts in tech has not been fully appreciated. GOOGL, META, AMZN, NFLX, NVDA, AMD, NOW, CRM, and ORCL (to name a few) have all outperformed YTD solidly, with NFLX kicking off earnings season on a solid note Thursday.

Here is Microsoft, which which today will be important especially in the context of cloud spending and how that trend is progressing, and which made waves this week with its $10BN investment in Open AI, coupled with the recent news it was laying off some 10,000 workers:

- MSFT (1/24 amc): Amidst structural and cyclical question marks over the public Cloud in recent months, sentiment has been dented here. Like GOOGL, LOs remain on board here in general. Investors expect management to reiterate the FY23 guide (10%+ cc revenue growth, OPM margins-100bps y/y), but my buy-side survey on average has investors a touch below the FQ2 Azure growth guide (+36% cc vs. guide +37%, FQ1 +42%). Expectations for the FQ3 guide align with consensus (+35% cc). Stock is unchanged YTD; Implied move 3%

And the rest:

- META (2/1 amc): It remains HF’s top mega-cap idea for 2023, confirmed by Doug’s buy-side survey last week. Buyside is looking for Q4 revenue -4% reported (guide -3-11%) and Q1 guide – 3% (i.e. top-end range slightly positive y/y). Investors are also hoping for another trim to the FY23 expense guide to ~$95b midpoint (currently $97b). After the last quarter, the call will be essential, and Zuckerberg needs to restore confidence with investors. While this has become a well-loved HF name, several recently questioned the upside story past $150, with the stock having run so far so fast. Stock +13% YTD; Implied move 10%.

- GOOGL (2/2 amc): It is still fairly well owned by LOs but remains a reasonably crowded HF short. Buyside is looking Q4 total revenue growth of +6% FXHN, with Search reported flat y/y, YouTube -3%, Cloud ~32% (Q3 +38%). The consensus at 24.5% OPM and the recent buy-side survey pointed to expectations of ~23%. Q3 buyback was $15.4b & investors are looking for something similar for Q4. GOOGL has a track record of making a splash with Q4 earnings (the last 4yrs have brought either more significant disclosures or a stock split announcement) – bulls would love to hear some commitment to cost cuts but ultimately, most see that as unlikely. Stock +3% YTD; Implied move 6%.

- AMZN (unknown): Like MSFT, since Q3 earnings, debates over the resilience and visibility of AWS have weighed on sentiment. Buyside is looking for Q3 revenue of $147B, EBIT $3B (guide $140- 148b, $0-4b); Q4 guidance of $127b, EBIT ~$4B (both high-end). The AWS forward-looking commentary will be more critical than Q4 but buy-side is looking for +21% (Q3 +27%). Investors are also looking for quantification of the benefits of recent cost-cutting measures. Following the recent splash ChatGPT has made, AWS’ AI capabilities relative Azure/GCP are increasingly coming up in conversations. Stock +14% YTD; Implied move 8%.

And here are comments from Goldman’s TMT traders:

- MSFT: Microsoft reports today post the close. Azure growth in focus. Specialist (Callahan) thoughts: “We have as 7 on 1-10 positioning scale. Faster/tactical money skews shorted into this print, counterbalanced by fact stock is still pervasively owned by variety of mkt participants (bulls focused on 2H’CY23 EPS inflection on opex savings + easier comps). Bogeys: some debate on the FY Revenue guide – do they back off DD y/y cc revs growth for FY23 or not, but feels like all that really matters is Azure growth – for the Dec qtr, investor expectations appear to be in the ~35-36% y/y cc range (vs guide ~37% y/y cc vs +42% y/y cc last qtr) and for the March qtr guidance, investor expectations have been marching lower with feedback largely in the +30-33% y/y cc range (obviously, the higher the better).”

- TXN: Texas Instruments reports today post close. Specialist (Callahan) thoughts: “Short interest still sits near all-time highs (21mn shares), but anecdotally, feels like negativity has thawed a bit. Per usual, people expecting a solid beat on 4Q – something around high-end of guide (~$4.8bn in revs or a ~4% beat) with more upside on EPS … for F1Q, we think people braced for at least a ~MSDs Revs q/q decline at midpt (vs cons down -4%), though, with China uncertainty, that band of expectations is pretty wide here … other moving parts: FCF / Capex trade off, CHIPS Act, China trends, orders/linearity.”

More in the full reports available to pro subs.

Tyler Durden

Tue, 01/24/2023 – 14:50

via ZeroHedge News https://ift.tt/QnMP21u Tyler Durden