Microsoft Jumps After Cloud Revenues Beat Expectations

With all eyes on super-tech bellwether Microsoft, and specifically on how the company’s Azure cloud division would do, not to mention what the company would say about its outlook, this is what the company reported moments ago:

- Revenue $52.747 billion, missing estimates $52.93 billion; yet in constant currency terms, revenue grew 7%, beating the estimate of +6.59%

- Adjusted EPS $2.32, beating estimates 2.30

Here, a mixed picture at best, and some more details

- Productivity and Business Processes revenue $17.00 billion, beating the estimate $16.81 billion

- Office Commercial products and cloud services revenue increased 7% (up 14% in constant currency) driven by Office 365 Commercial revenue growth of 11% (up 18% in constant currency)

- Office Consumer products and cloud services revenue decreased 2% (up 3% in constant currency) and Microsoft 365 Consumer subscribers grew to 63.2 million

- LinkedIn revenue increased 10% (up 14% in constant currency)

- Dynamics products and cloud services revenue increased 13% (up 20% in constant currency) driven by Dynamics 365 revenue growth of 21% (up 29% in constant currency)

- More Personal Computing revenue $14.24 billion, missing estimate $14.74 billion, and down 19% Y/Y (down 16% in constant currency), which is to be expected following the PC buying spree during the covid lockdowns.

- Windows OEM revenue decreased 39%

- Windows Commercial products and cloud services revenue decreased 3% (up 3% in constant currency)

- Xbox content and services revenue decreased 12% (down 8% in constant currency)

- Search and news advertising revenue excluding traffic acquisition costs increased 10% (up 15% in constant currency)

- Devices revenue decreased 39% (down 34% in constant currency)

- Operating income $20.40 billion, missing estimate $21 billion

- Capital expenditure $6.27 billion, missing estimate $6.63 billion

But while the above were largely in line, what everyone was looking for was what MSFT reported about Cloud and here there was some good news, to wit: Intelligent Cloud revenue came in at $21.51 billion, which increased 18% (up 24% in constant currency), and beat estimates of $21.43 billion. Server products and cloud services revenue increased 20% (up 26% in constant currency) driven by Azure and other cloud services revenue growth of 31%, up 38% in constant currency, and beating estimates of 35% .

A snapshot of growth rates by various operating divisions shows just how extensive the impact of the strong dollar was across the board.

Commenting on the quarter, CEO Satya Nadella, said that “The next major wave of computing is being born, as the Microsoft Cloud turns the world’s most advanced AI models into a new computing platform. We are committed to helping our customers use our platforms and tools to do more with less today and innovate for the future in the new era of AI.”

“We are focused on operational excellence as we continue to invest to drive growth. Microsoft Cloud revenue was $27.1 billion, up 22% (up 29% in constant currency) year-over-year as our commercial offerings continue to drive value for our customers,” said Amy Hood, executive vice president and chief financial officer of Microsoft.

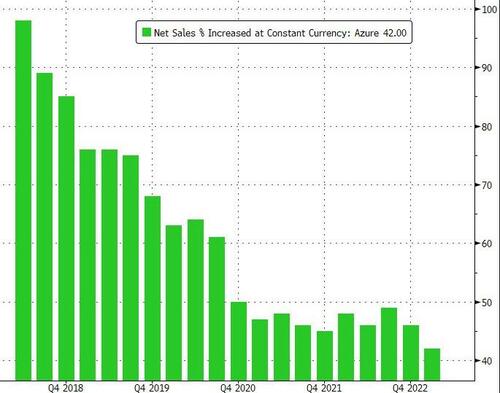

And while the growth within Azure was the slowest observed yet in MSFT history…

… it may have been just enough to ease market fears of the bottom falling out.

In kneejerk reaction, MSFT stock jumped more than 4% after hours…

… kicking off the closely-watched big-tech earnings season on an upbeat note. Peers such as AMZN were also up some 3% after hours.

That said, keep an eye out for forecasts and more during the firm’s conference call, due at 5:30pm NY time: a word out of place could promptly burst any bullish sentiment from the cloud beat.

Tyler Durden

Tue, 01/24/2023 – 16:18

via ZeroHedge News https://ift.tt/ZQzYbCF Tyler Durden