Gold Demand Hit 11-Year High In 2022

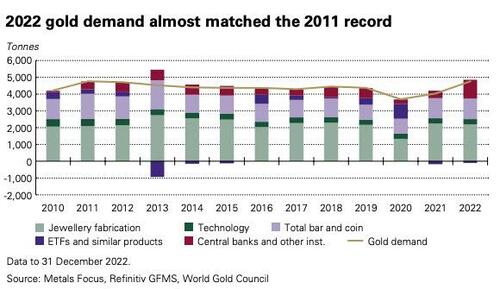

Gold demand grew by 18% to 4,741 tons in 2022, the highest demand in 11 years, according to data compiled by the World Gold Council.

Massive central bank purchases coupled with strong retail investor buying and slowing outflows from ETFs drove overall demand higher.

Gold demand last year was on par with 2011, “a time of exceptional investment demand,” according to the WGC.

Central banks bought 1,136 tons of gold last year. It was the second-highest level of net purchases on record dating back to 1950. It was the 13th straight year of net central bank gold purchases.

Central banks added 417 tons of gold to their reserves in Q4, bringing the total in H2 to 862 tons. This was due to a combination of reported buying by central banks in Turkey, India, Uzbekistan, and many other emerging markets, along with an estimate for significant unreported buying. Central banks that often fail to report purchases include China and Russia. Many analysts believe China is the mystery buyer stockpiling gold to minimize exposure to the dollar.

Meanwhile, the Chinese central bank officially waded back into the gold market after going silent in 2019. The People’s Bank of China reported 62-ton purchases in both November and December, raising its total gold reserves to over 2,000 tons for the first time.

According to the World Gold Council, there are two main drivers behind central bank gold buying — its performance during times of crisis and its role as a long-term store of value.

It’s hardly surprising then that in a year scarred by geopolitical uncertainty and rampant inflation, central banks opted to continue adding gold to their coffers and at an accelerated pace.”

Investment demand for gold was also strong in 2022, totaling 1,107 tons, a 10% increase year-on-year.

Gold bar and gold coin demand grew by 2%, building on strong demand in 2021. In total, global investors bought 1, 217 tons of gold bars and coins.

The second half of the year was particularly strong for bar and coin buying, charting two successive quarters of demand of around 340 tons for the first time since 2013.

According to the WGC, “The need for wealth protection in the global inflationary environment remained a primary motive for gold investment purchases.”

Investors in the West had a particularly strong appetite for gold and broke an annual record. Combined US and European purchases of gold bars and coins hit 427 tons. That exceeded the previous record of 416 tons set in 2011.

Institutional investors who primarily buy and sell paper were not as bullish on gold last year. Despite rampant price inflation, they bought into the narrative that the Federal Reserve was going to win the inflation fight. They sold gold every time the Fed hiked rates. As a result, gold ETFs charted outflows of 110 tons. That was an improvement over the 189-ton outflow in 2021.

The World Gold Council summed up the dueling narratives in the investment market.

As well as underlying support from geopolitics, gold investment was impacted by a combination of multidecade high inflation, especially in Western markets, and the resultant aggressive rate hikes by the Fed and other central banks. Bar and coin investors focused on the former and sought the safety of gold as a hedge against inflation. In contrast, gold ETF investors reduced their holdings, especially in the second half, focusing on gold’s rising opportunity cost as central banks across the globe imposed hefty rate hikes and the US dollar surged.”

Gold jewelry demand softened in 2022, falling 3% to 2,086 tons. Rising gold prices in the fourth quarter drug down demand.

Demand for gold in technology saw a sharp Q4 drop, driving a full-year decline of 7%. According to the WGC, “deteriorating global economic conditions hampered demand for consumer electronics.”

Gold used in the electronics sector fell 18% y-o-y to 58 tons during the final quarter of the year. According to the World Gold Council, it was the largest quarterly y-o-y fall in the sector since 2009 – a direct consequence of the unprecedented combination of challenges the industry is currently facing.

The gold supply was up modestly, rising 2% on the year, with mine production inching up 1% to a four-year high of 3,612 tons. Even with the rebound in mine output, it still hasn’t recovered to the 2018 record.

Now that the COVID-19 production disruptions and widespread China safety stoppages of 2021 have reversed, this lack of production growth gives further credence to claims that gold production is close to plateauing.”

Here’s how the World Gold Council summed up gold’s performance in 2022.

Gold’s diverse uses, in jewelry, technology and by central banks and investors, mean different sectors of the gold market rise to prominence at different points in the global economic cycle. This diversity of demand and self-balancing nature of the gold market underpin gold’s robust qualities as an investment asset.”

You can read the full World Gold Council 2022 Demand Trends Report HERE.

Tyler Durden

Wed, 02/01/2023 – 11:50

via ZeroHedge News https://ift.tt/N4FcxtU Tyler Durden