Record Demand For Blockbuster 10Y Auction Sends Yields Tumbling

After yesterday’s horrific 3Y auction printed with some of the ugliest metrics in history, including the biggest tail in at least 7 years, many were incredulous: how is it possible that the mood in the bond market could reverse so fast after a barrage of stellar coupon auctions in January. Some speculated that this was purely due to the auction taking place in the slipstream of Powell’s speech which sent yields sharply higher and confused investors in the primary market. As it turns out they were right, because moments ago the Treasury sold $35 billion in 10Y paper as part of refunding week, which was a mirror image of yesterday’s catastrophic auction and had some of the strongest metrics in history.

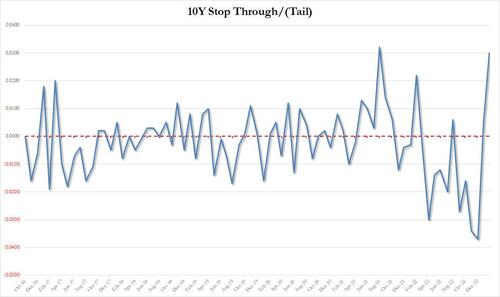

Starting at the top, the high yield printed at 3.613%, which stopped through the When Issued 3.643% by 3bps, which was the second biggest stop through in at least 7 years, and a wild reversal from the record tail hit just two months ago when everyone was selling bonds with the bathwater in December.

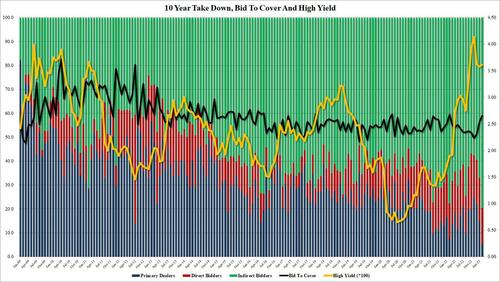

While the bid to cover was also a big improvement, coming in at 2.66, up from 2.53 in January and the highest since Feb 22, it was the internals there were truly off the charts: after a series of already elevated Indirect awards in the past years, January’s Inidrect takedown soared from 67.0% to 79.5%, which was the highest on record!

And with Directs taking a slightly lower than average 15.2%, vs the six-auction avg of 18.6% and below last month’s 17.9%, Dealers were left with a paltry 5.4%, the lowest Dealer award on record!

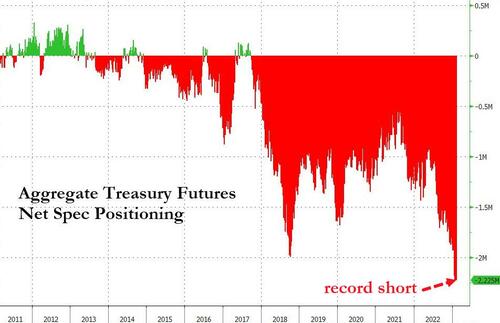

Needless to say, this was a stupendous, blowout auction, and amid nerves that we could get a repeat of yesterday’s horrific 3Y, yields promptly tumbled to session lows across much of the curve with the 10Y plunging as low as 3.63% in kneejerk response, down almost 5bps on the day. Which means that it’s another painful day for speculators, because as a reminder, net spec positioning is currently the shorted it has ever been!

Tyler Durden

Wed, 02/08/2023 – 13:26

via ZeroHedge News https://ift.tt/nZWrqel Tyler Durden