The Lowest VIX Since The Pandemic Started Is Something That Deserves Attention

By Peter Tchir of Academy Securities

It turns out the bulls had every right to be Dancing in the Street as stocks posted a very strong week (even the Russell 2000 and Regional Banks participated). Friday’s jobs data seemed to put the nail in the coffin on rate hike fears. The market has decided, rightfully so, that we are almost done with rate hikes and unless we get disastrous inflation data, any future hikes will be small enough not to act as a headwind.

Could the Fed jawbone their way to more hikes? Possibly, but does anyone really think we need to get to 6%? Maybe, maybe we could get talked into 5.5%, but markets should be able to withstand that, probably quite easily. So, the fear of further rate hikes has been nullified as a bearish argument. It should mean that inflation data, will have reduced impact on markets, unless we get some extreme readings pointing to a rebound in inflation (which has not been the case, nor is it likely to be).

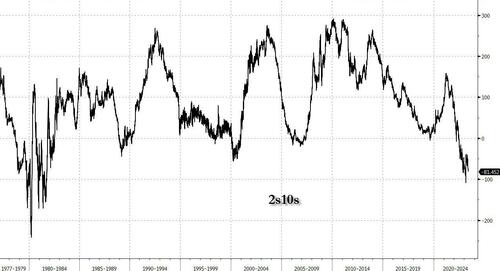

That only leaves “recession” fears as a potential stumbling block. As discussed on Friday, markets ran with the strong headline jobs numbers and chose to ignore the much weaker household data (it does play second fiddle to the establishment data, yet it is what is used to determine the unemployment rate). Oil surged on Friday, signaling reduced recession fears (or some optimism on global growth). The 2s vs 10s spread became more inverted, closing the week at -81 bps. It has only closed at a more inverted level on 12 days in the past several years (in March 2023 when hard landing was handily beating soft landing in most forecasts). It is interesting that no one is talking about inverted yield curves anymore (thankfully, as it often attracts far more attention than it deserves), but this reversal to so much inversion (it was “only” -41 bps a month ago) is at least somewhat interesting.

While markets traded as though positioning was very short, basic sentiment indicators, like AAII, CNN Fear and Greed, and simple RSI (Relative Strength Indicator) all point to neutral or even overbought conditions.

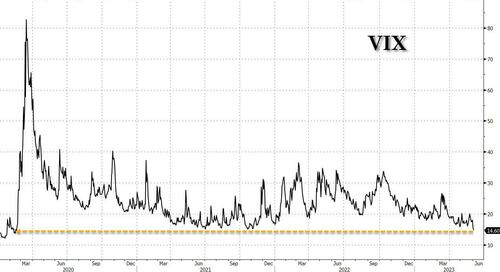

As a bear, who is worried about the economy, I’m the most nervous about being wrong as I’ve been at any time in the past two months. The S&P had increased a “whopping” 1.3% from April 3rd to May 31st (a number that seems to surprise many as it feels as if we’ve been in a bull market during that time) and explains why VIX is all the way back to 14.6 the lowest since February 14th 2020!

The lowest VIX since the pandemic started is also something that deserves attention, though it averaged 14.9 from February 2019 to February 2020, with a low of 11.5, so maybe, it is just finally normalizing after the traumatic experience of COVID and ZIRP.

We get a lot of economic data this week, which away from the jobs data (excluding the nasty little household survey) was not strong last week. But I fully expect to be in a good news is good and bad news is bad mentality as the Fed should play the smallest role in markets that it has done for a long time. Really refreshing to write that and hope it is correct.

Across the Globe

With the U.S. and China we see the following:

- Signs that possibly both sides, but certainly the U.S. want to make sure that the tension doesn’t derail the “necessary” trade and links between the two countries.

- Some efforts to offer olive branches, or at least fig leaves to reduce tension (the handshake at the defense forum in Singapore, for example) can create the hope that things can improve.

- What I struggle with most is how many conversations start with “well China needs us more than we need them, so it makes sense for them to want to normalize relationships”. Yet, that the “China needs us more..” is usually just an assertion, rather than a statement backed up by a litany of facts. Without a doubt, there was a time that China needed us as much or more than we needed them, but I continue to suspect that time has passed (the shift from Made In China to Made by China).

- This article on the China Jet caught my attention. I’m not in a rush to step into a Comac (Commercial Aircraft Corp of China Ltd. – not the most adventurous of names), but the maiden flight with passengers seems like a noteworthy milestone. This story fits with the view that China is in various stages of shifting from just making things for us, to trying to sell their own brands.

- The yuan has now become a topic of conversation with almost every one of our clients. Not just in terms of hedging it, but them seeing companies trying to use it to their advantage. While the dollar remains the reserve currency, we’ve seen a noticeable and serious increase in attention to they yuan as it develops into a currency used for trade.

Remain cautious on China/US Relations.

Japan continues to benefit from tensions in the Asia Pacific.

It has been a year or more in the making, but Japan does seem to be a beneficiary of what is going on across the globe. The Nikkei is up 21% this year. We see continued interest from companies in Japan. Our theory has been that:

- First tariffs and then COVID lockdowns had companies rethinking China as their manufacturing hub, with other countries in Southeast Asia gaining traction.

- Since Putin invaded Ukraine and we’ve seen the ability to effectively blockade Taiwan, people have been casting their eye towards Japan as their presence on the global stage, powerful (and growing) military offer a degree of “safety” that might not be achievable in other smaller economies in the region.

We continue to see interest in Japan and India growing. India remains the “inflation wildcard” in my “surprise” scenarios for inflation and rates.

The one thing I think we can say for certain regarding Russia and Ukraine, is the world is growing weary of the war. Add Indonesia to the list of countries tossing out “peace” proposals. No obvious peace in sight, (see May’s Around the World for latest comprehensive update on the war). Weirdly or sadly or both, I’m not sure a peace deal does much for global markets as we seem to have accepted the status quo, and it is clear (at least from this seat) that trading relationships have permanently changed in the globe and won’t go back to where they were before the invasion.

Tyler Durden

Sun, 06/04/2023 – 18:00

via ZeroHedge News https://ift.tt/uTrOkUt Tyler Durden