Key Events This Week: Quiet Ahead Of Next Week’s Storm

The week after payrolls is almost always a bit quiet for data and this week DB’s Jim Reid reminds us that we have the added kicker of a Fed that has started their media blackout period ahead of next week’s FOMC which will be preceded by a key CPI print on Tuesday 13th, one day before the Fed decision.

At the moment markets price in around 22% chance of a hike next week and maybe CPI might be the main thing that shifts those odds towards a hike if the report is strong, according to Reid. If the Fed wants to communicate to the market one way or another ahead of next week then well placed media stories might surface (so far Timiraos has been hinting at a pause/skip).

However before CPI that does seem unlikely as nothing will be 100% decided until then. We are are back to having a fair bit of uncertainly over the near-term Fed outlook though. After spending most of the 4-day shortened week last week rallying around 25bps from the highest point post-SVB, 2yr US notes sold off +16bps on Friday after a strong headline payroll number that seemed to mask some notable weakness under the surface in the report. The headline increased +339k (+195k expected) with +94k of revisions over the last two months. However hours worked ticked down a tenth to 34.3hrs, which marks the lower end of the pre-covid range, and unemployment ticked up three-tenths to 3.7% via the household survey that showed employment falling by 310k with a 440k increase in unemployment. The household part of the report can be more volatile so caution is required. Adding to the confusing nature of the report, average hourly earnings came in at 4.3% YoY (vs 4.4% expected), still too high for comfort for the Fed but ticking lower.

Next up on the agenda, and as we detailed in “Liquidity To Collapse $1 Trillion In “3 Or 4 Months”, Pushing Economy Into The Abyss“, with the debt ceiling deal signed into law over the weekend, watch for a dramatic rebuild in the US TGA (Treasury General Account) over the next few weeks and months. This starts this week with T-bill issuance that DB’s Steven Zeng suggests could in net terms hit $400bn in June and cumulatively $800bn by the end of August and $1.3tn by year-end. If you’re on the bearish side this deluge could drain liquidity in financial markets but if you’re more sanguine you would say it will just reshuffle money away from money market funds and equivalents (so far no money has left MMFs which are at all time highs).

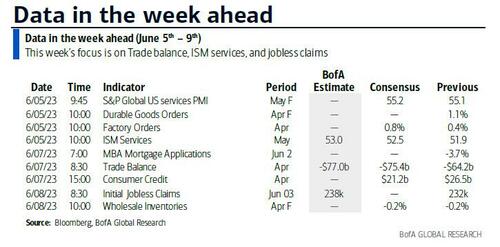

In data terms, the quiet week ahead will be headlined by today’s global services PMIs and the US ISM and factory orders prints, both of which disappointed (see here and here). Other highlights will be US factory orders (today) and US trade and consumer credit (Wednesday).

Over in Europe, key data releases for Germany include the trade balance today, factory orders tomorrow and industrial production on Wednesday. Elsewhere in the region, notable releases include the trade balance for France on Wednesday, retail sales for the Eurozone tomorrow and industrial production for Italy on Friday. In Asia, Japanese wages tomorrow and China CPI on Friday will be the highlights.

In terms of central banks, the RBA meet tomorrow with markets pricing in around a 30% chance of a hike with a full hike cumulatively priced in by the August meeting after recent hot inflation numbers. DB economists have now moved to price in a 25bps hike tomorrow, August and September now. The Bank of Canada meet the following day with markets pricing a one-in-three chance of a hike with economists closer to 50/50.

Courtesy of DB, here is a day-by-day calendar of events

Monday June 5

- Data: US May ISM services, April factory orders, China May Caixin services PMI, UK May official reserves changes, new car registrations, European wide May services PMI, Germany April trade balance, Eurozone April PPI

Tuesday June 6

- Data: UK May construction PMI, Japan April labor cash earnings, household spending, Germany May construction PMI, April factory orders, Eurozone April retail sales, Canada April building permits

- Central Banks: ECB Consumer Expectations Survey

Wednesday June 7

- Data: US April trade balance, consumer credit, China May trade balance, foreign reserves, Japan April leading index, coincident index, Italy April retail sales, Germany April industrial production, France April trade balance, current account balance, Canada Q1 labor productivity, April international merchandise trade

- Central Banks: BoC rate decision, ECB’s Guindos and Panetta speak

Thursday June 8

- Data: US Q1 household change in net worth, April wholesale trade sales, initial jobless claims, UK May RICS house price balance, Japan May Economy Watchers survey, bank lending, April trade balance, current account balance, France Q2 total payrolls

Friday June 9

- Data: China May CPI, PPI, Japan May M2, M3, Italy April industrial production, Canada Q1 capacity utilization rate, May jobs report

Finally, looking at just the US, Goldman writes that the key economic data release this week is the ISM services report on Monday. Fed officials are not expected to comment this week given the blackout period leading up to the FOMC meeting June 13-14.

Monday, June 5

- 09:45 AM S&P Global US services PMI, May final (consensus 55.1, last 55.1)

- 10:00 AM Factory orders, April (GS +1.0%, consensus +0.8%, last +0.4%); Durable goods orders, April final (last +1.1%); Durable goods orders ex-transportation, April final (last -0.2%); Core capital goods orders, April final (last +1.4%); Core capital goods shipments, April final (last +0.5%)

- 10:00 AM ISM services index, May (GS 53.0, consensus 52.6, last 51.9): We estimate that the ISM services index rebounded by 1.1pt to 53.0 in May. Our forecast reflects the rebound in our GSAI, favorable seasonality, and a modest improvement in other business surveys on net (services tracker +0.1pt to 50.2). The lack of negative news on the banking sector in recent weeks also argues for sequential improvement.

- 01:30 PM Cleveland Fed President Loretta Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will deliver welcome remarks at an event for the Council for Economic Education hosted by the Cleveland Fed. Mester is not expected to comment on monetary policy given the blackout period.

Tuesday, June 6

- No major data releases scheduled.

Wednesday, June 7

- 08:30 AM Trade balance, April (GS -$74.0bn, consensus -$75.4bn, last -$64.2bn): We estimate that the trade deficit widened by $9.8bn to $74.0bn in April.

Thursday, June 8

- 08:30 AM Initial jobless claims, week ended June 3 (GS 225k, consensus n.a., last 232k); Continuing jobless claims, week ended May 27 (consensus N.A., last 1,438k); We estimate initial jobless claims declined to 225k in the week ended June 3.

- 10:00 AM Wholesale inventories, April final (consensus -0.2%, last -0.2%)

Friday, June 9

- No major data releases scheduled.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 06/05/2023 – 11:10

via ZeroHedge News https://ift.tt/RUvtWYJ Tyler Durden