Nuclear Power May Become Crucial In Decarbonization Efforts

Authored by Tsvetana Paraskova via OilPrice.com,

-

Nuclear power generation could help the world decarbonize energy amid growing global demand for electricity.

-

Despite growing government support for nuclear energy in several countries, the economics of nuclear energy at its current state of development and innovation just doesn’t add up.

-

WoodMac: the biggest economic hurdle to the widescale adoption of SMRs is cost.

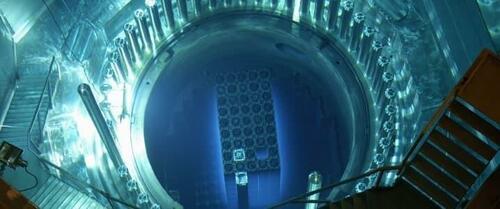

Nuclear power generation could help the world decarbonize energy amid growing global demand for electricity with the ‘electrify everything’ push, including in transportation.

The energy crisis of the past year and a half has led to increased support for nuclear power in many countries, including the U.S., the UK, and even Japan.

But negative perceptions are still entrenched, and nuclear costs are still much higher than the cost of providing wind and solar power. What wind and solar don’t currently have is stable baseload capacity to ensure a constant supply of electricity regardless of the weather. Nuclear power can do that, and its low lifecycle emissions can generate additional low-emission electricity to complement wind and solar energy.

Electricity Demand Set To Surge

Currently, electricity meets some 20% of the total global energy demand, but “Over the next 30 years, almost everything that can be electrified will,” Wood Mackenzie said in a recent report.

By 2050, the share of electricity in the world’s energy mix could more than double to 50%, and the need for power generation could be 1.7 times higher than current levels, according to WoodMac’s base case.

Under the same base case, nuclear power capacity is set to increase by 280 gigawatts (GW) by 2050.

Despite growing government support for nuclear energy in several countries, the economics of nuclear energy at its current state of development and innovation just doesn’t add up. Conventional nuclear power reactors and stations require billions of upfront investment and often face project cost overruns, while the next-generation reactors and small modular reactors are not cost-competitive now, either.

The Cost Challenge To Nuclear Renaissance

“The biggest economic hurdle to the uptake of the latest nuclear and small modular reactors (SMRs) is cost,” WoodMac said in its report.

If nuclear is set to play a role in the energy transition and decarbonization, lower costs—alongside greater social acceptance—will be key, the consultancy said.

Conventional nuclear power generated with pressurized water reactors (PWR) currently has a levelized cost of electricity (LCOE) at least four times that of wind and solar, per WoodMac’s estimates.

“The nuclear industry will have to address the cost challenge with urgency if it is to participate in the huge growth opportunity that low-carbon power presents. At current levels, the cost gap is just too great for nuclear to grow rapidly,” said David Brown, Director, Energy Transition Service at Wood Mackenzie, and lead author of the report.

The current costs of small modular reactors (SMRs), which analysts and governments believe could be the future of nuclear power, is even higher than the current generation of PWRs and much higher than wind, solar, natural gas, and coal power generation.

The promise of SMRs is that it’s a shorter-cycle approach and could avoid some of the manufacturing and commissioning pitfalls that giant PWR projects have encountered, WoodMac notes.

“SMRs are designed to be modular, factory-assembled and scalable. They are expected to be quicker to market, with a target construction time of three to five years compared with the ‘nameplate’ 10 years needed to build a large PWR,” Brown says.

Small Modular Reactors

The key to at-scale adoption of SMRs will be how fast costs could fall and potentially make this type of nuclear energy generation cost-competitive with other forms of energy, especially renewables.

Many companies are already working on SMRs and governments in the U.S., UK, and France, for example, bet on this type of technology and support its research and development.

Westinghouse is already seeking pre-application Regulatory Engagement Plan with the U.S. Nuclear Regulatory Commission (NRC) for its small modular reactor (SMR) called AP300 and using the technology of its flagship AP1000 reactor. The advanced passive safety system automatically achieves safe shutdown without operator action and eliminates the need for backup power and cooling supply, Westinghouse says, adding that “this also directly translates into a simplified design, lower CAPEX and smaller footprint.”

Design certification is anticipated by 2027, followed by site-specific licensing and construction on the first unit toward the end of the decade.

SMRs could also be used in industries to cut emissions that are hard to abate. For example, new research from NuScale Power showed this week the capabilities of NuScale SMRs for reducing emissions in industrial sectors.

UK’s Rolls-Royce plc said earlier this year it had progressed to Step 2 of the Generic Design Assessment (GDA) for its SMR, following the successful completion of the first step in the assessment by the UK’s independent nuclear regulators. The milestone puts Rolls-Royce SMR ahead of other designs in securing consent for an SMR to operate in the UK. Rolls-Royce says its ‘factory-built’ SMR power plant can generate 470 MW of low-carbon electricity – enough to power a million homes for at least 60 years.

With technological advances, SMRs may have the chance to see lower costs in the future, but cost is not the only hurdle where nuclear energy is concerned.

Greater public support, expansion and diversification of the uranium supply chain, and strong offtake agreements for nuclear power would also be vital for this type of low-emission energy source to play a more important role in the energy transition.

“Expanding public support for nuclear will be critical to expanding investment; voters will need to embrace the value proposition of nuclear for it to have a social licence to operate,” WoodMac’s Brown said.

“This is not as unrealistic as it sounds: today’s nuclear industry grew out of the energy security concerns and high commodity prices of the 1970s ? similar market dynamics to those we face today.”

Tyler Durden

Mon, 06/05/2023 – 11:20

via ZeroHedge News https://ift.tt/ErOJZNa Tyler Durden