IMF Raises Global GDP Outlook, Warns “Not Out Of The Woods” As Inflation Proves Sticky

Confirming once again that economic sentiment always follows markets, earlier today the International Monetary Fund published its latest semi-annual World Economic Outlook report in which it put an end to its recent gloom (in keeping with the meltup in global stock markets), and raised its outlook for the world economy in 2023, estimating that risks have eased in recent months after the US averted a default and authorities have postponed a banking crisis.

“The recent resolution of the US debt ceiling standoff and, earlier this year, strong action by authorities to contain turbulence in US and Swiss banking, reduced the immediate risks of financial sector turmoil,” the IMF said. “This moderated adverse risks to the outlook.”

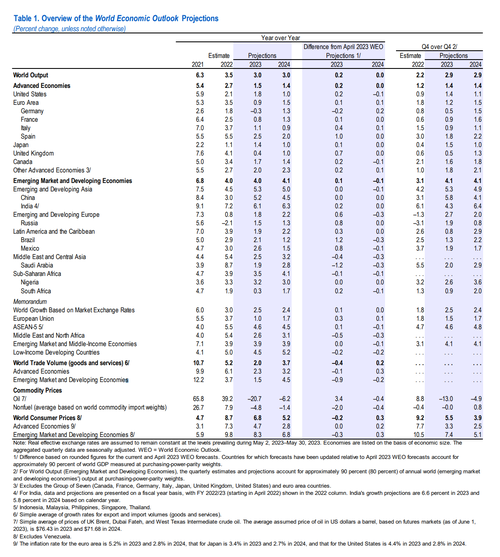

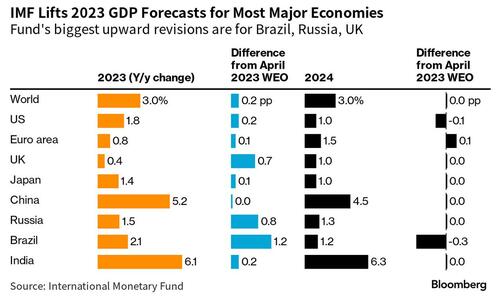

Global GDP will grow 3% in 2023, the IMF said in its world Outlook report released Tuesday. While that’s still a slowdown from 3.5% growth last year, it’s faster than its 2.8% projection in Apri; for 2024 the IMF sees the global economy stagnating, indicating the risk of a global recession has faded at least according to the IMF, which however is always wrong, so if anything the IMF’s “cautious optimism” is cause of worry.

Drilling down into the report we find:

- IMF expects the US to grow 1.8% this year, a 0.2% increase from April, before slowing to 1% in 2024.

- China is seen growing 5.2% this year, unchanged from its prior projection. However, it warned that the nation’s recovery following the post-pandemic reopening at the beginning of this year is slowing, in part due to softness in the real estate industry that’s hurting investment, as well as weak foreign demand and rising youth unemployment.

- Curiously, Saudi Arabia is expected to suffer the biggest growth slowdown, as GDP growth tumbles from 8.7% in 2022 to just 1.9%, a 1.2% cut from the last forecast, reflecting a drop in the price of oil and oil-output cuts announced in April and June

- UK GDP forecast was boosted by 0.7% to a 0.4% expansion, on better-than-expected consumption, falling energy prices, lower post-Brexit concerns and a resilient financial sector

- Russia GDP also increased by 0.8% point to 1.5% growth, reflecting a strong first half of the year among retail trade, construction and industrial production, driven by fiscal stimulus

- Brazil GDP was upgraded 1.2% points to a 2.1% expansion after a surge in agricultural output early in the year, which also helped lift activity in services

- Germany is the only country projected to be in recession in 2023 when its GDP contracts 0.3%, compared with a prior forecast for a 0.1% drop, on weak manufacturing output and an economic contraction in the first quarter

Yet despite the modestly more optimistic global view, the IMF warned that prospects for growth look weak compared with the 3.8% average during the two decades prior to the Covid-19 pandemic and that “the balance of risks to global growth remains tilted to the downside.”

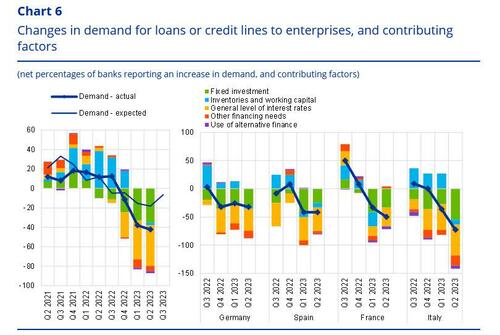

According to the DC-based fund, higher interest rates, which are helping to tame inflation, will weigh on activity, something we already saw in the record drop in European loan demand.

Additional shocks like an intensifying of the war in Ukraine and “climate disasters” could spur even more central-bank tightening. Indicatively, compared to the IMF, Bloomberg Economics’ outlook is more subdued: its base case is for global GDP growth of 2.8% in 2023, dipping to 2.7% in 2024 – down from 3.3% in 2022 and below the pre-pandemic trend of 3.4%.

The IMF also cited continued risks to financial stability driven by i) higher rates, ii) a slower-than-expected recovery in China, iii) debt distress in emerging economies and iv) threats to trade from geoeconomic fragmentation, which has accelerated due to the Ukraine war and the growing cold war between Washington and Beijing.

Even as tighter monetary policy takes a bit out of growth, the priority in most economies remains achieving sustained disinflation, the IMF said, adding that central banks should stay focused on restoring price stability and strengthening financial supervision and risk monitoring. That’s expected to play out this week, when both the Fed and ECB are set to raise interest rates further.

As a result, the IMF sees inflation slowing to 6.8% this year, compared with a 7% forecast in April, and down from 8.7% in 2022. At the same time, the fund also raised its projection for cost-of-living increases in 2024 by 0.3% point to 5.2%, saying that it expects core prices, which exclude food and energy, to cool more gradually than before.

Advanced economies are driving the slowdown in global growth from last year’s 3.5%, the IMF noted, particularly as weaker manufacturing offsets services. Meanwhile, activity in developing and emerging economies is seen stable this year and next, it said.

In an interview with the Financial Times, IMF chief economist Pierre-Olivier Gourinchas said the economic outlook had improved since the multilateral lender last published its projections in April amid a bout of banking sector stress.

“Things are moving in the right direction,” he said, adding there was now less danger of global growth slipping to 2% or below, since the most acute financial risks had abated (again: the IMF – like the Fed – is always wrong in its forecasts so this should be reason for great concern).

Besides inflation, the IMF cautioned that debt distress across developing economies remains a top concern despite emerging countries on the whole remaining “resilient” to financial market volatility

Another fear is that, despite sharp falls in headline rates, strong labor markets and potent consumer demand will make inflation hard to fully root out. That will mean central banks will have to keep tightening their monetary policy screws.

Gourinchas anticipated little reprieve from rate-setters even as the era of “outsized hikes” comes to a close. “We are nearing the peak of the hiking cycle, but we’re not quite there yet,” he said. “We’re going to see central banks holding where they are until they are confident enough that the economy is on the right track.”

If central banks keep interest rates higher for longer than investors currently expect, “you might have at some point the market realising that [its expectations of borrowing costs are] a bit misaligned”, Gourinchas said.

At the moment markets expect central banks such as the Fed to begin cutting rates around the turn of this year. If those bets prove incorrect, “that would lead to some repricing and then you could get a chain of events that creates some volatility”.

Tyler Durden

Tue, 07/25/2023 – 12:10

via ZeroHedge News https://ift.tt/EBZinAo Tyler Durden