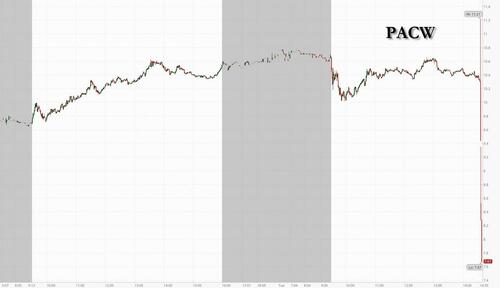

PacWest Plunges On WSJ Report It Will Be Bought By Far Smaller Peer Banc of California

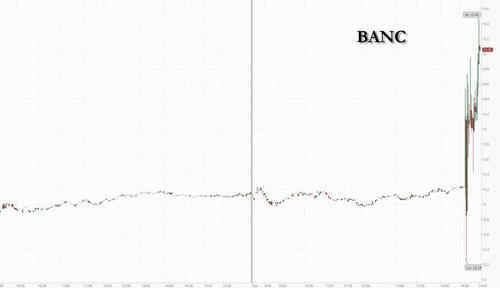

Troubled regional bank PacWest Bancorp saw its stock move wildly moments ago, first spiking then tumbling, after the WSJ reported that the far smaller Banc of California (market cap of $770MM vs PACW’s $1.2BN) was in advanced talks to buy PacWest Bancorp PAC, in what appears to be the first aggressive post-crisis bank “take-under” as the lenders seek “to further shore themselves up following a regional-banking crisis earlier this year.”

Citing “people familiar”, the Journal notes that a deal could be announced as soon as today, when both banks are scheduled to report results, assuming there isn’t a last-minute snag.

PacWest has been at the center of recent fears about the regional-banking system since the failure of three California lenders this spring, with the Beverly Hills, Calif., bank beset by deposit outflows and a sinking stock price. Shares of Banc of California dropped significantly too, but they jumped following the WSJ report.

Both banks have come through the recent turmoil in relatively good health and both stocks have rebounded somewhat. PacWest has sold assets to shore up its balance sheet, while Banc of California remained profitable in the first quarter.

According to the report, Centerbridge and Warburg Pincus plan to contribute equity “to help fund the deal” and will serve as the only external source of funding for the acquisition.

Tyler Durden

Tue, 07/25/2023 – 14:53

via ZeroHedge News https://ift.tt/0OcRDEI Tyler Durden