Big-Tech Bounces, Banks Bust, Bonds Breakdown As Rate-Hike Odds Rise Ahead Of Fed

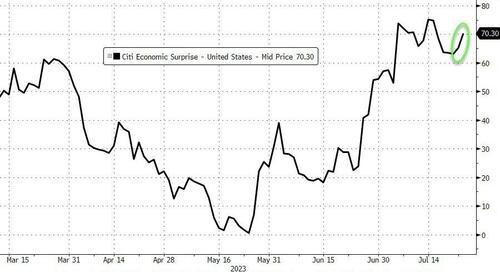

Consumer Confidence jumped to post-COVID highs, the labor market appears to getting ‘easier’ once again (Jobs data in conf board survey), home prices are rising at a rapid clip once again, and regional Fed surveys all ticked up…

Source: Bloomberg

Does that sound like the economy The Fed wants to see after 500bs of hiking? Financial Conditions are at the same level of ‘easiness’ as they were when The Fed did its first 50bps hike in May of 2022…

Source: Bloomberg

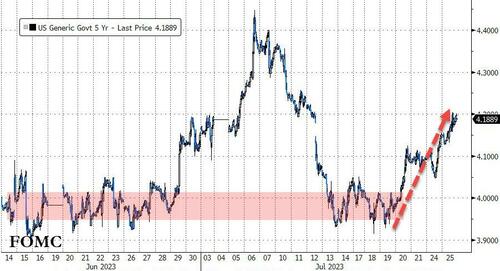

The last two weeks have seen a notably hawkish bias to short-term rate markets with a 25bps hike locked and loaded for tomorrow but now a 50% chance of another rate-hike by year-end.

Source: Bloomberg

But Nasdaq doesn’t care about such formalities as more hawkish expectations, soaring 1% on the day. Late-day weakness dragged Small Caps into the red and The Dow clung to green…

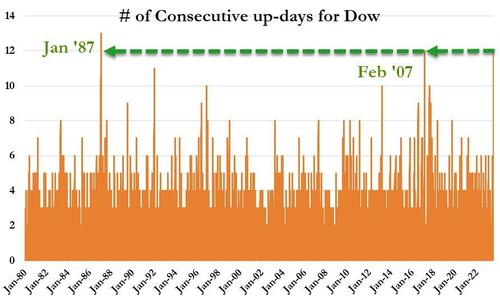

The last time The Dow had a longer winning streak than this (12 straight days) was in Jan 1987 (13 days – the all-time record win streak)…

Banks were dumped today, erasing yesterday’s exuberance…

Source: Bloomberg

Treasuries were sold today relatively evenly (up 3-4bps) with the belly slightly underperforming. Interestingly, the 30Y is trading back (on its way up to 4.00%) at the same level as it was at the last FOMC meeting…

Source: Bloomberg

But the short-end is notably above the last FOMC meeting levels…

Source: Bloomberg

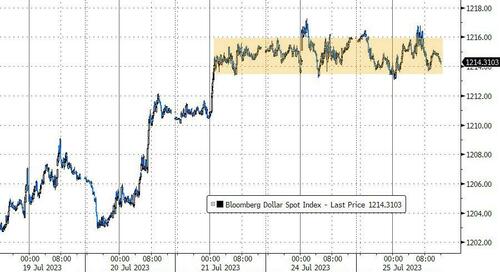

The dollar continues to tread water in a very narrow range (eerily narrow for the last three days)…

Source: Bloomberg

We do note that EURCHF tumbled today as the Swiss Franc saw demand ahead of The Fed and ECB. Swissy is the strongest vs the euro since Sept 2022 (with the biggest strengthening of CHF vs EUR since January today)…

Source: Bloomberg

Bitcoin inched higher (finding support at $29k) after yesterday’s tumble but nowhere near $30k…

Source: Bloomberg

Gold ended the day marginally higher but had a very choppy day

Oil prices extended their gains, with WTI testing up near $80 – back at the same level as it was after the OPEC-Cut news in April…

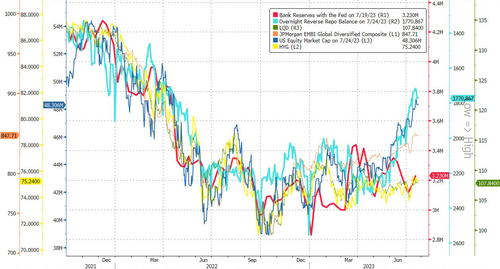

Finally, we note that there remains only one thing that matters to stocks right now…

Source: Bloomberg

So what will cause The Fed’s reverse repo facility to stop being drained? While you ponder that consider this…

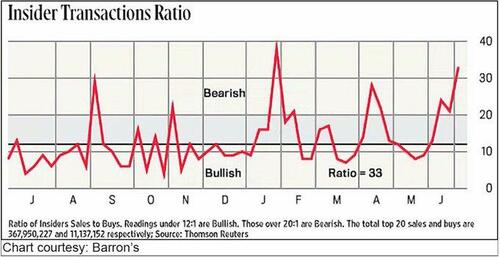

Source: Bloomberg

What do all those insiders know about this meltup that retail investors don’t?

We give the last word to Thomas Peterffy, the billionaire founder and chairman of electronic brokerage giant Interactive Brokers, who told MarketWatch this afternoon that a US soft landing is “wishful thinking” adding that “the market should be much lower.”

Tyler Durden

Tue, 07/25/2023 – 16:00

via ZeroHedge News https://ift.tt/d879NDO Tyler Durden