Alphabet Soars After-Hours Following Top- & Bottom-Line Beat

The big question into Alphabet’s earnings was what progress they had made on monetizing the AI promise without cannibalizing the company’s main moneymaker – search advertising; and just how much capex they blew on NVDA chips to feed the LLM-processing beast.

Daniel O’Regan, a managing director of equity trading at Mizuho Securities, wrote that “this is one of the most important earnings seasons in recent memory. The tape has rallied so hard and so fast, it’s almost like a game of musical chairs. People are wondering if/when will the music stop especially in single stocks.”

So how did Alphabet do?

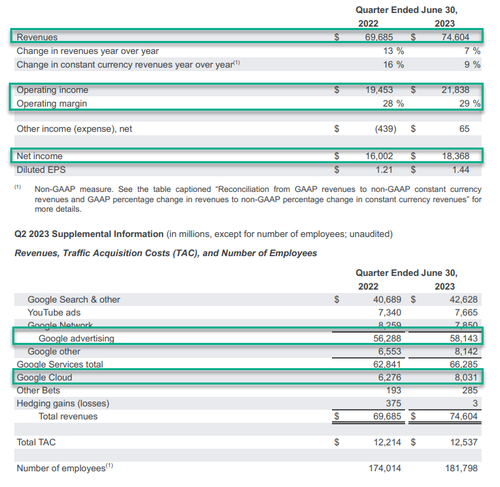

The headline is strong top- and bottom-line beats:

-

*ALPHABET 2Q REV. $74.60B, EST. $72.77B

-

*ALPHABET 2Q EPS $1.44, EST. $1.32

Sundar Pichai, CEO of Alphabet and Google, said:

“There’s exciting momentum across our products and the company, which drove strong results this quarter. Our continued leadership in AI and our excellence in engineering and innovation are driving the next evolution of Search, and improving all our services. With fifteen products that each serve half a billion people, and six that serve over two billion each, we have so many opportunities to deliver on our mission.”

Under the hood, it was just as impressive with every unit beating expectations and no signs of search advertising being impacted by AI…

-

Google advertising revenue $58.14 billion, estimate $57.45 billion

-

YouTube ads revenue $7.67 billion, estimate $7.41 billion

-

Google other revenue $8.14 billion, estimate $7.17 billion

-

Google Services revenue $66.29 billion, estimate $64.67 billion

-

Google Cloud revenue $8.03 billion, estimate $7.83 billion

-

Other Bets revenue $285 million, estimate $231.7 million

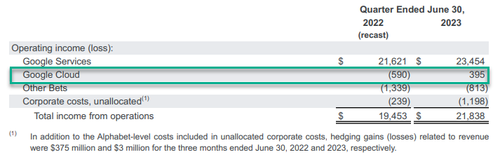

Google Cloud has delivered another profitable quarter. After turning a profit for the first time last quarter, investors were eager to see if the unit could repeat that performance this time.

One additional point is that Alphabet and Google CFO Ruth Porat will assume the newly created role of President and Chief Investment Officer of Alphabet and Google, effective September 1, 2023.

Ruth will continue to serve as CFO, including leading the company’s 2024 and long-range capital planning processes, while the company searches for and selects her

successor.In her new role, Ruth will continue to report to Sundar Pichai, Alphabet and Google CEO. Ruth assumed the role of CFO in May 2015 and is the company’s longest-serving CFO. In her new role, Ruth will be responsible for Alphabet’s investments in its Other Bets portfolio, working closely with Sundar, and the company’s investments in countries and communities around the world. Alphabet’s investments span numerous sectors and are engines of economic growth globally. She will also focus on engagement with policymakers and regulators regarding employment, economic opportunity, competitiveness, and infrastructure expansion.

GOOGL shares are up over 7% in the after-hours,above $130 – its highest since April 2022…

Finally, one possible debbie-downer in the GOOGL earnings was a disappointment in capex:

- Capital expenditure $6.89 billion, estimate $8.01 billion

How will the market react to that at a time when expectations were for buying-panics in AI-related chips?

Tyler Durden

Tue, 07/25/2023 – 16:15

via ZeroHedge News https://ift.tt/VbrLkZ9 Tyler Durden