Ringing Hollow

By Stefan Koopman, Senior Macro Strategist at Rabobank

The UK’s pivotal role in European finance means its economic data has a habit of punching above its weight in swaying sentiment. Tuesday’s labor market data jolted markets too, overshadowing the dovish Chinese numbers. Regular pay jumped to 7.8% year-over-year in the three months through June. Although part of the increase reflects prior months’ revisions, it did rekindle speculation of Bank of England tightening to as high as 6%, well beyond the one final hike to 5.50% we have pencilled in for September. With UK wages rising so rapidly, doubt was being cast on imminent Fed and ECB pauses as well.

However, we would caveat this. The other, timelier elements of the report suggest a cooling market, reassuring the BoE its historic pace of hikes does have an impact on demand. The goal is to return to the pre-pandemic climate with ideal labour market conditions: not too hot for employers or too cold for employees. Labour demand – which we proxy by adding vacancies to actual employment – is now down year-over-year to 33.96 million, while labour supply is up to 34.37 million. A margin between supply and demand of double this size, so around 750,000, is historically consistent with 3-4% wage growth, so things would probably have looked very different if there wasn’t a Of course, the price of this labour market rebalancing is paid by those who enter unemployment: the headline rate rose to 4.2% in the three months to June, with the single-month rate for June even at 4.7%. This is up from 3.5% in June 2022. So while pay checks are getting fatter on average, the swelling jobless ranks and rising illness mean higher wages ring hollow for some. On that note, this great tune right out of the Appalachian hollers is exploding on the internet, with 14 million views in a week, and should speak to many UK folks as well. Listen closely!

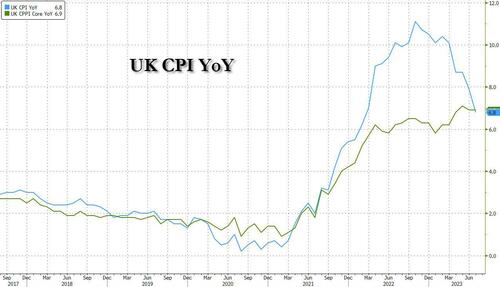

The UK inflation data that was out this morning was slightly hotter than expected. The slowing of the annual inflation rate in July 2023 to 6.8% from 7.9% was primarily due to lower regulated gas and electricity prices, which subtracted 0.64 percentage points from the rate, and notable downward impacts from food and non-alcoholic beverages, specifically milk, bread and cereals. However, core CPI steadied at 6.9% (vs. expected 6.8%), as falling costs of goods were offset by higher prices for services. Services inflation itself rose to 7.5% y/y from 7.2% y/y. This component matters most to the Bank of England, as it closely relates to domestic wages, exhibits persistent trends, and is less volatile than energy or goods prices. Our estimates of embedded inflation are around 6-7% y/y as well. All in all, there remains considerable evidence to support another interest rate hike in September, though there will be another labour market and inflation report that MPC meeting.

So even as global bond yields popped higher on the UK’s wage numbers, they have actually fallen a bit over a 24-hour view. This is despite very strong US retail sales data, which showed a better than expected 0.7% monthly increase in July. The usual caveat is that retail sales are presented in dollar values rather than volumes, but with goods prices under pressure, real retail sales likely rose around 1% month-over-month in July. Consequentially, the Atlanta Fed’s GDPNow model forecasts 5.0% instead of 4.1% GDP growth for Q3, which may be optimistic but still indicates solid growth despite significantly higher interest rates.

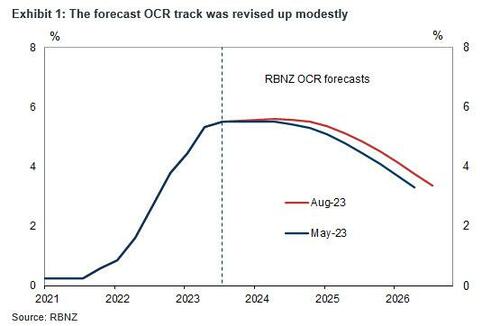

As expected, the Reserve Bank of New Zealand held interest rates steady at 5.50% this morning, after having paused its hiking cycle in May. However, the RBNZ signalled that rates would remain restrictive for a prolonged period, even showing a slightly higher path for the Official Cash Rate in its forecasts.

This indicates some possibility of a further hike to 5.75%, which arguably had the more important effect of pushing the pricing of rate cuts out to 2025. As an early leader in post-pandemic tightening, the RBNZ tends to be seen as the ‘kiwi’ in the coal mine. Though recent data points to softening economic momentum in New Zealand, there are also risks that it could take longer for inflation pressures to abate. The Bank of Canada nods in the background, having failed in pausing its hiking cycle and now seeing Canada’s inflation reaccelerating to 3.3% from 2.8% year-over-year. There was a modest slowing in the trimmed core CPI measure to 3.6%.

Tyler Durden

Wed, 08/16/2023 – 09:20

via ZeroHedge News https://ift.tt/OQGTL5Y Tyler Durden