The Great Debt Fiasco: How Washington’s ‘Reckless And Opportunistic’ Pandemic Splurge Jeopardized America’s Future

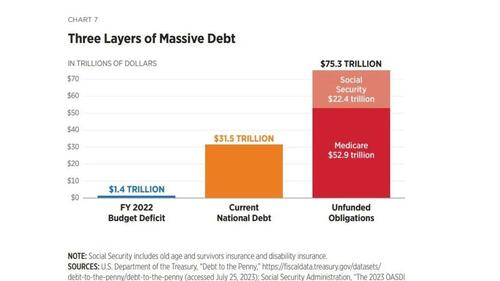

As the US blows past $33 trillion in national debt for the first time – and adds roughly $1 billion in new debt every hour, a comprehensive new report from the Heritage Foundation reveals that the US government has tacked on $7.5 trillion in new debt over past two years alone, drawing a stark image of America’s economic prospects.

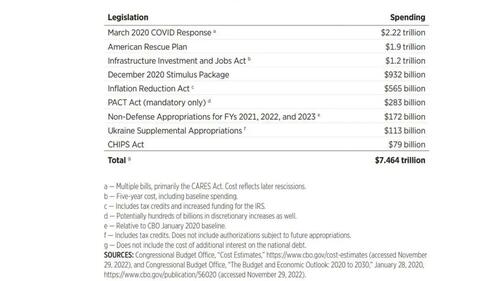

The report sheds light on a series of colossal spending packages rolled out between March 2020 and December 2022, amounting to an astronomical $7.464 trillion in debt, or a staggering $57,400 per household.

The Heritage Foundation splits the ordeal into three components: the nature of federal spending, the Federal Reserve’s role in this fiasco, and the impending ramifications of this debt accumulation. The conclusions drawn are far from comforting. Much of the pandemic-era expenditure was not only unwarranted but actively detrimental, leaving the country grappling with an inflation surge, labor shortages, and broken supply chains, Fox News reports.

“The COVID-19 pandemic unleashed unprecedented federal fiscal and monetary actions that wasted trillions of dollars,” said the Heritage experts.

Indeed, most of this drunken spending was done in the name of a virus that kills less than 1% of those it infects (mostly the elderly and the obese), and employed extreme lockdown measures which were no more effective than countries that refused to do the same.

The authors say that the US Congress failed to couple any justifiable pandemic spending with measure to reduce future deficits.

“A looming fiscal crisis has shifted from a long-term concern to a current event. Congress must return to responsible governance for America to avoid further economic calamity,” the report concludes.

“When there’s a supply shock, when the economy tumbles off a cliff, all the government can do is make the recovery longer and slower by trying to give you a sugar pill on the front end,” said Co-author Richard Stern, Director of the Grover M. Hermann Center for the Federal Budget at The Heritage Foundation. “That’s what happened here. We are now suffering worse four years later because the government did things in the moment to make it look a little better.”

Breaking it down, $2.22 trillion was spent by the Trump administration’s March 2020 COVID response and a December 2020 stimulus package. The rest was spent by the Biden administration via the American Rescue Plan, the Infrastructure Investment and Jobs Act, and other various packages.

According to Heritage President Kevin Roberts, the report’s findings “explain how we got here and provide recommendations for extinguishing the fire so that we can change course and reduce the severe economic pain facing everyday Americans across the country.”

“Inflation doesn’t just happen; it is a direct result of overbearing, clumsy, dysfunctional government policies,” said Roberts. “While everyday Americans suffer under the hidden tax of Biden’s crippling inflation – at the gas pump and checkout counters, in utility bills, rents, and car payments – Congress and the President have an unending appetite for more spending, regulation, and subsidies.”

Yikes

— Elon Musk (@elonmusk) September 21, 2023

The report also notes that the so-called Inflation Reduction Act is “a complete misnomer” that has only done the exact opposite.

“This reckless and politically opportunistic spending spree has left the U.S. with a weakened economy, an inflation crisis, and a looming debt crisis. The volume and nature of the spending spree helped to create skyrocketing inflation and interest rates and created a labor shortage, reducing real household incomes and leaving store shelves bare and supply chains broken.”

What does this mean for the future?

According to the authors, “The amount of damage caused by the federal spending spree is immense, and the size and scope of the long-term fiscal problem can be overwhelming,” reads the report’s final paragraph. “Policymakers must address this reality in a sober fashion, neither pretending that easy fixes exist nor ignoring the problem altogether. This will require controlling spending, returning to meaningful budgeting, and fixing problems at the Federal Reserve.“

“There is a genuine opportunity for leadership if elected officials have the courage and foresight to do the right thing, both for America’s near-term battle against inflation and its long term economic prospects.”

Tyler Durden

Fri, 09/22/2023 – 20:00

via ZeroHedge News https://ift.tt/1vfdD5r Tyler Durden