Cash Will Be No Refuge Under CBDCs

Authored by Mark Jeftovic via BombThrower.com,

The world is headed toward Central Bank Digital Currencies (CBDCs) and everybody knows it, even the people who don’t want them (which at the moment looks to be most people).

But the policy-makers have deigned it be so, and CBDCs provide such a compelling opportunity for surveillance and social control that they are irresistible. That the fiat currency system is in the process of imploding makes it an imperative.

My editor and researcher JonB, (give him a follow) sent me this tweet:

Australia to be ‘functionally cashless’ by 2025. Australian people have to stop this madness and start using more cash, otherwise we will be ruled by the banks and government and rationing will affect everyone. https://t.co/ygfpzMYNcf

— Giggity (@GiggityVJ) September 24, 2023

It was to draw my attention to the timeline for Australia going cashless, and while doing so doesn’t coincide with the launch of their CBDC, the RBA is dilligently headed there (as are nearly all central banks globally).

One area of focus in The Bitcoin Capitalist is that we track all the national CBDC deployments and the myriad supranational policies and aspirations that go into them (we call it “Eye on EvilCoin”, for the Mr. Robot fans out there).

With the tweet above, I became more intrigued by the call-to-action itself, because I see this a lot: the idea that the way to resist the CBDC is to keep using cash. This is not only wrong-headed, it’s self-defeating.

Cash doesn’t buy you freedom under CBDCs

The error in thinking so arises from a failure to understand that cash is simply older iteration of what digital cash, and CBDCs are going to be: denominations in a currency, backed by nothing and controlled by the very state that you’re trying to protect yourself from.

It gets worse, because this is also the same state that has already weaponized the currency against you, either slowly, via targeted inflation (a.k.a “theft”) or overtly, as we saw here in Canada during the #FreedomConvoy.

The only thing I can see happening to the paper cash economy after a given country has (successfully) gone cashless, is that the paper currency will lose most of its value and everything gets far more expensive when priced in terms of cash.

It’ll be easier to destroy cash than ban it

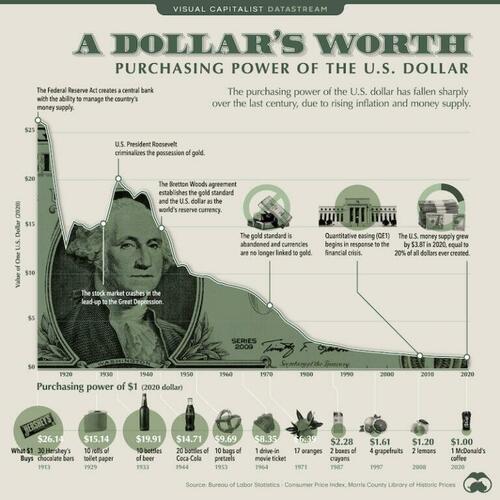

Far easier. After all, governments and central banks have been destroying cash throughout history.

Via VisualCapitalist

In all probability, they won’t even have to ban cash or impose penalties for using it.

All they’ll have to do is crank up the money printer and hyperinflate it out of existence – all the while offering holders of cash the opportunity to switch into the CBDC at seemingly advantageous (or one-sided) terms.

At that point, banning cash will seem akin to banning the buggy whip. Kind of pointless.

The Good News

While it’s practically baked-in that CBDCs will either launch as, or morph into, CCP-style social credit systems, what is unknown at the moment is if Late Stage Globalism’s financial system will actually hold together long enough for retail CBDCs to deploy.

We see a lot of tweets and Youtube videos from people predicting a snap launch of a CBDC after a sudden banking holiday in the imminent future.

I don’t see that as possible, because there isn’t a major economy in the world that is anywhere close to being ready to launch a retail CBDC.

There are numerous interbank clearing networks that are either in test beds or already up and running. FedNow’s launch over the summer is one, and many say that is a precursor to the CBDC launch.

But at the retail level: on your phone, monitoring every transaction, metering your carbon footprint – this is still a long way off.

The US, the IMF, the BIS et al are still writing white papers about it. Many of them are chilling, to be sure, but they’re still navel gazing and not actually working on it. The UK just announced their retail CBDC roadmap and the research phase alone will start this year and go on for the next three years.

In Canada there are some tests going on but even the Bank of Canada admits there isn’t a compelling use case for CBDCs and not many Canadians really want it.

Of the four retail CBDCs already up and running (The Bahamas, Jamaica, The Eastern Caribbean Dollar, and Nigeria), they have all been plagued with technical problems or public apathy. Venezuela has launched two CBDCs over the past decade, each launch coinciding with a massive currency devaluation, and they both stiffed.

But it’s Nigeria’s eNaira which is the closest to a heavy-handed government forced CBDC. Although there is no social credit component yet -authorities there were pressing hard for a full-on cash ban to get people to use it, and that’s gone quite badly. Nigerians are opting for gold and Bitcoin instead (hold that thought).

The global financial system is coming unglued so fast that governments may find themselves forced to accelerate retail CBDC projects.

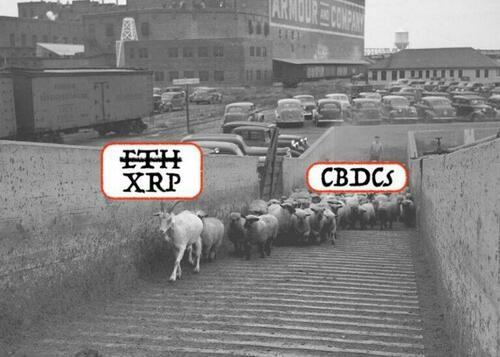

My prediction has always been that in a crisis they’ll resort to some half-baked abomination that rolls out atop a base layer that already exists: like Ethereum (which we’re already seeing in Brazil) or Ripple – who seems to want to be the base layer for CBDCs.

They’re called “Judas Goats”

Once CBDC’s hit, we will wind up in a type of Monetary Apartheid, and the important thing to understand is that clinging to cash isn’t going to save you.

Fortunately, no matter which path toward retail CBDCs governments choose, it will take long enough that you still have time to prepare.

Precious metals are a favourite amongst the liberty-minded. Wisdom and history show it prudent to have some of your wealth in gold and silver (the FDR gold ban is actually instructive there because even though many people refer to it, it wasn’t overly successful in terms of public compliance).

But real sovereignty will lie in having access to a digital hard-asset that is truly decentralized and that can be frictionlessly moved around the globe, impervious to capital controls.

I am talking of course, about Bitcoin. Start a dollar cost average today, get off zero – and you will be in an entirely different economic class from 95% of the people who get blindsided when retail CBDCs do roll out.

It’s also entirely possible that Late Stage Globalism may implode before then and make it all moot. But even then, you’re still going to need some way of preserving and safeguarding your wealth, and paper cash will be especially useless in that event. You’ll also need the ability to move it, at will, and that isn’t always easy to do with gold.

The ideal toolkit contains both Bitcoin and precious metals, among other elements which are out of scope here (second passports, property and businesses in multiple jurisdictions, etc).

The main point is this: If your goal is to mitigate against a cashless society, one of the least effective ways of doing it would be with cash.

* * *

My forthcoming ebook The CBDC Survival Guide will give you the tools and the knowledge to navigate coming era of Monetary Apartheid. Bombthrower subscribers will get free when it drops, sign up today.

The Bitcoin Capitalist provides actionable intelligence on the macro forces shaping Late Stage Globalism and a tactical toolkit for growing your wealth as it plays out. Try it today here.

Tyler Durden

Mon, 09/25/2023 – 10:45

via ZeroHedge News https://ift.tt/aPyUiQt Tyler Durden