Mike Wilson: The Consumer Is Falling Off A Cliff

They have become the broken records of gloom: since late 2022, Morgan Stanley’s Mike Wilson and JPM’s Marko Kolanovic have peddled a bearish narrative that has been as relentless as it has been wrong, and even when the S&P rose more than 1000 points from its Oct 2022 lows (roughly around the time the formerly permabullish Kolanovic turned into a bear), they have refused to change their tune even as their more nimble (and flip-floppy) Wall Street peers such as BofA’s Savita Subramanian and Goldman’s David Kostin turned from mega bears to ultra bulls months ago.

Now, as we noted back in February, the rally most likely won’t end until Mike and Marko finally capitulate, and so far that has certainly been the case….

Rally won’t end until Wilson and Marko turn bullish

— zerohedge (@zerohedge) February 7, 2023

… although it increasingly appears that instead of capitulating, the stubborn duo plans on staying bearish as long as it takes to catch the next bear market, even if it means the S&P hitting a new all time high first, and then when stocks finally do drop they will jump out of the bushes and scream “told you so”, assuming they are still employed by then of course (and one can be certain they have some powerful and unhappy clients who were kept out of the market meltup of 2023, and who are doing everything in their power to make M&M join the weekly initial claims rolls).

Still, with every week that passes and that the market does not plunge, the litany of argument proposed by the duo of doom may eventually hit the market, and today’s note by Wilson is the closest one to the target yet.

Picking up where we left off last week with “Sentiment Is Turning Very Negative On The US Consumer“, Wilson’s latest Weekly Warm-Up Note (available to pro subs in the usual place) targets what is fast becoming the weakest link in the US economy, the US consumer and, in the context of the market, consumer stocks.

Pointing out that “since 2Q earnings season” but what he really means is since the Fed’s final, July, rate hike (something Michael Hartnett has long been hammering the table on as the straw that breaks the market’s back)…

… Wilson writes that stocks have “taken on a different personality”:

Starting with a “sell the news” reaction to earnings results, weakening price action has permeated to early cycle sectors and even to some of this year’s biggest winners more recently.

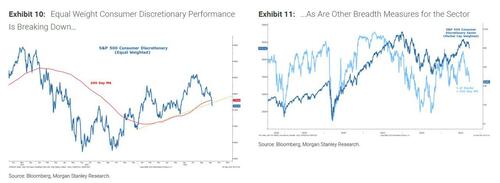

Then, echoing what we said last week, the Morgan Stanley strategist writes that the breakdown in performance breadth within Consumer Discretionary “is particularly notable” and supports the view of Morgan Stanley’s economists that “consumer spending is unlikely to keep up with the surprisingly strong pace witnessed in the first 3 quarters of the year.”

Let’s dig in a little more into the report.

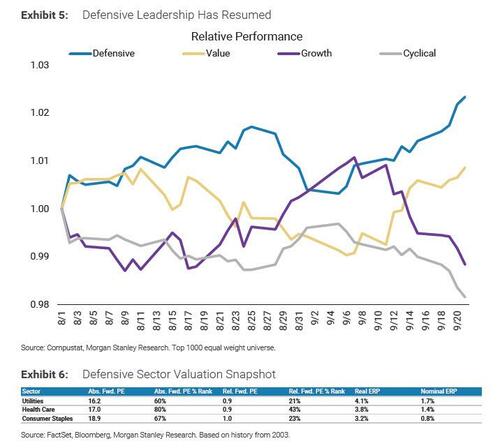

Wilson starts off by rehashing one of his preferred themes: that market internals have been supportive of the notion that we’re in a late cycle backdrop with high quality balance sheet factors outperforming, and while defensives have also resumed their outperformance, cyclicals have underperformed. “Value has been aided by strong performance from the Energy sector, while growth has underperformed recently given the interest rate move. Given our relative preference for defensives, we provide the valuation summary in Exhibit 6 across defensive sectors. In terms of absolute multiples, Utilities trades the cheapest (~16x), while Staples trades the richest (~19x).”

At the same time, Wilson writes that “Utilities and Staples look the cheapest (bottom 25% of historical relative valuation levels), while Health Care relative valuation is a bit more elevated. That said, all 3 defensive sectors presented trade in the bottom 50% of historical relative valuation levels, implying that multiples remain undemanding for the cohort.”

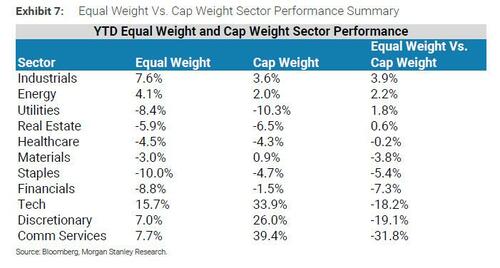

The uber-bear then points out that breadth under the surface of the market (as measured by equal vs. cap weight performance) looks the strongest in Industrials and Energy, which are “late-cycle” cyclical areas in which he claims that he “continues to be constructive on a relative basis.”

This, of course, is Wilson’s way of sneaking a longish position in his overwhelmingly bearish view on stocks, by going long “just a few sectors”, then if everything rips, he can claim he was right, even if he has been telling clients to short the S&P ever since 3900. Good luck with that particular form of “flexibility”. Here is the rest of Wilson’s observation on market breadth:

… equal weight vs. cap weight performance for the market overall and for the majority of sectors continues to look weak and has decelerated in recent weeks. Further, just ~30% of stocks have outperformed the S&P 500 YTD and only about half of the stocks in the index are up on the year ( Exhibit 9 ). As we have discussed recently, this type of backdrop has very much put the focus back on stock picking.

And while any half-hearted pivot by Wilson to turn semi-bullish will crash and burn, where the MS strategist may have a valid point is his criticism of consumer stocks: he writes that as with the technical/breadth set-up for consumer stocks looking particularly challenged around current levels…

… what is the anchor thesis behind Wilson’s condemnation of the consumer sector is that the “price action is picking up on slowing consumer spend, student loan payments resuming, rising delinquencies in certain household cohorts, higher gas prices and weakening data in the housing sector.”

Wilson then turns to the bank’s economists, saying they “judiciously avoided making the recession call earlier this year when it was a consensus view” and who now see “a weakening consumer spending backdrop from here—they forecast negative real PCE growth in 4Q and a muted recovery thereafter.”

Furthermore, while travel and leisure has been a bright spot for consumption, that dynamic is now also changing to some extent. Here are some more details on that:

Summer travel season was robust this year with approximately 2.5 million people passing through TSA checkpoints daily– higher than volumes seen pre-pandemic during summer 2019. Excess savings and pent-up demand helped fuel this travel boom but both of those tailwinds may now be dwindling according to our economists’ views.

A significant proportion of US consumers have drawn down their Covid era excess savings and our US Economics team estimates that lower-income households have fully exhausted their excess savings, while middle- and higher-income households are less willing to spend their excess savings on discretionary consumption. We are underweight the consumer discretionary sector as the consumer becomes increasingly stretched and discretionary travel is one area where consumers could show an appetite to conserve spending. We are seeing travel companies exposed to the lower-income consumer indicating signs of demand weakness.

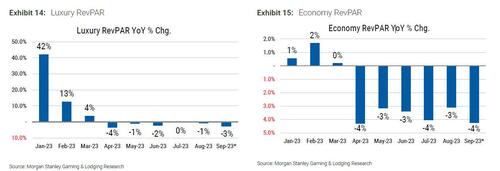

The Gaming & Lodging industry has been cooling especially in the economy segment of the market. Overall revenue per available room (RevPAR) for US hotels has been tracking at a lower trajectory for 3Q vs 2Q and hotel occupancy is down vs 2019. Economy RevPAR has been consistently down 3-4% yoy since April. While on the high-end, luxury RevPAR was down 4% in April, then flat-to-down 2% through summer and down 3% MTD for September ( Exhibit 14 and Exhibit 15 ). Economy and luxury hotel demand is largely driven by leisure, consumer travel rather than business travel. There has also been weakness in the regional casino space over the past 6 months.

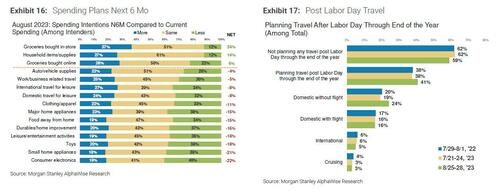

Our most recent AlphaWise Consumer Survey shows that consumers want to keep traveling and 58% of respondents are planning to travel over the next 6 months. However, net spending plans for international travel declined from 0% last month to -8% this month, indicating consumers are planning fewer pricey overseas trips ( Exhibit 16 ). Domestic travel plans without a flight moved higher. This indicates that consumers want to keep traveling but are increasingly looking at taking cheaper trips and are choosing destinations they can drive or take a train to vs. having to fly.

In conclusion, Wilson remains as bearish as always (with some notable carve outs, like being long energy and industrials) and his hope is that this time it is the consumer that finally proves to be the camels that break’s this market rally’s back. His conclusion is that “investors should avoid rotating into early cycle winners like consumer cyclicals, housing-related / interest-rate sensitive sectors, and small caps” and instead they should “barbell” of large-cap defensive growth with “late-cycle” cyclical winners like Energy and Industrials. So yes, Wilson is evolving, and far from shorting the market, his take-home reco is a targeted long. Whether that is tantamount to full-blown capitulation is unclear, but if stocks do crash in the coming days, the answer is a resounding yes.

Much more in the full note from Mike Wilson available to pro subs.

Tyler Durden

Tue, 09/26/2023 – 05:45

via ZeroHedge News https://ift.tt/laQ5LFq Tyler Durden