Blackstone’s Massive CRE REIT Records Eleven Months Of Outflows

Blackstone has limited investor redemption requests from its $68 billion real estate trust for high-net wealth investors for the eleventh consecutive month while the Federal Reserve pushes interest rates to two-decade highs, which has only sparked turmoil in regional banks earlier this year and an ongoing commercial real estate crisis.

According to a letter obtained by Bloomberg, Blackstone Real Estate Income Trust (BREIT) recorded investor outflows for September at $2.1 billion, or 28% less than what was requested to withdraw in August. The good news is that withdrawal requests are the lowest since October 2022.

However, BREIT only returned $625 million, or about 34% of what was requested – as the massive real estate trust continues to gate redemptions to prevent outflows. Last month was the 11th straight month of restrictions for BREIT.

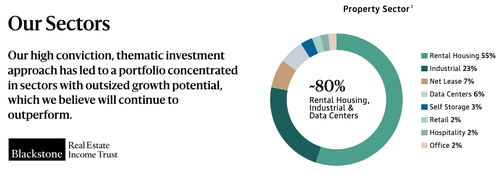

About 80% of the BREIT fund has exposure to rental housing, industrial, and data centers.

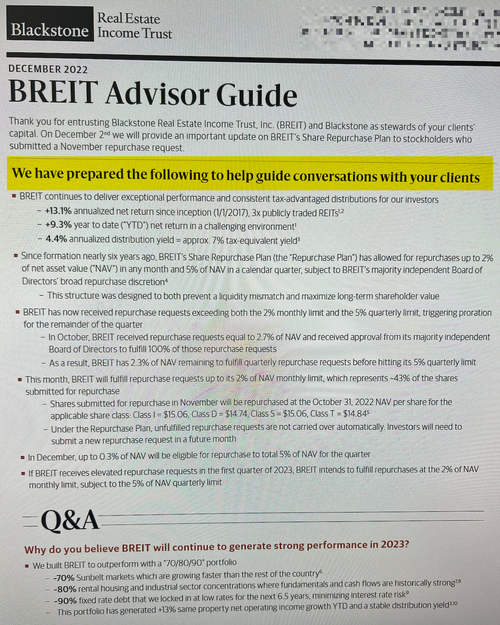

We were the first to publish an investor letter by BREIT urging money managers with wealthy clients in the fund to keep clients calm (view letter here).

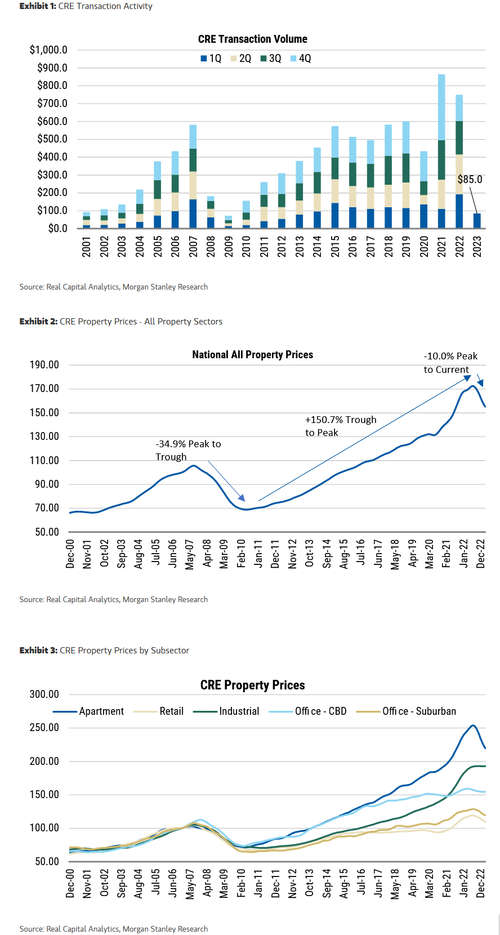

In March, we pointed out (“New “Big Short” Hits Record Low As Focus Turns To $400 Billion CRE Debt Maturity Wall“) that the regional banking crisis kick-started CRE turmoil. JPM, Morgan Stanley, and Goldman Sachs have all joined the CRE gloom parade.

A more recent note from Morgan Stanley expects CRE office prices to slide 27.4% from peak to trough in 18 to 24 months this cycle, not that far off from the -34.9% during the GFC in 34 months, which will range from a decline of 15% for apartments to a stunning plunge of 40% for office.

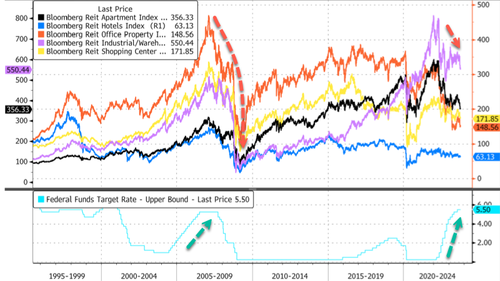

REIT indexes via Bloomberg show how high-interest rates pressure the CRE space.

Meanwhile, Barclays’s analyst Lea Overby said the office tower market “will take a long time to work out,” adding she isn’t too worried about the threat of the overall CRE market because “debt is spread across a wide enough array of investors to absorb losses.”

BREIT concluded in the letter: “A shareholder who began submitting repurchase requests when proration began has received approximately 97% of their money back and the semi-liquid structure is working as intended.”

Tyler Durden

Tue, 10/03/2023 – 06:55

via ZeroHedge News https://ift.tt/VRLOCg6 Tyler Durden