China’s Battered Banks Are Poised For More Pain

By John Cheng, Bloomberg Markets Live reporter and strategist

China’s battered banking stocks will likely decline further as they are summoned by local authorities to support the country’s struggling property developers, analysts say.

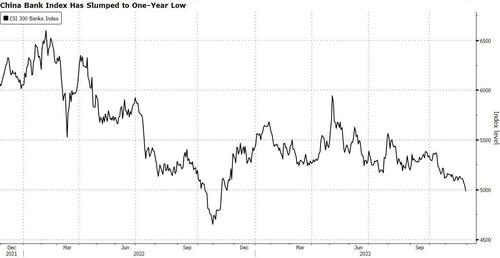

Latest policy moves to boost lending to developers — including via the use of unsecured loans — have only strengthened the conviction that lenders’ shares may weaken further. Even record-low valuations have not been enough to lure investors, with the CSI 300 Banks Index slumping to a one-year low amid worries over shrinking margins.

“Unfortunately, we think banks may have to do more national service this time to stabilize the growth expectations,” said Xiadong Bao, a fund manager at Edmond de Rothschild Asset Management in Paris. “We think those headwinds may persist given the challenging macro condition and weak consumer sentiment. It is difficult to have a positive view before the credit cycle comes back.”

China’s banks face a conundrum of balancing support for the property sector and the economy with the need to manage their already depressed earnings. The sector’s net interest margins slumped to a record low of 1.73% as of September, below the 1.8% threshold seen as necessary to maintain reasonable profitability.

In a readout last week, China’s parliament asked lenders to step up funding for developers to reduce the risk of additional defaults and ensure completion of housing projects, adding that the financial sector’s profits have room to fall as a share of the economy. Lenders are also being directed to refinance loans to local governments at lower rates.

Still, banks could circumvent guidance to provide unsecured loans to developers “due to credit risk concerns,” JPMorgan Chase & Co. analysts including Katherine Lei wrote in a note.

While banks may stay selective on new property loans, “headwinds from rising system leverage, prolonged property stress, and a shifting policy environment are weighing on banks’ growth and profitability,” Fitch Ratings Inc. analysts including Lan Wang wrote in a note, adding that the impact on larger state banks will be more modest.

Tyler Durden

Thu, 11/30/2023 – 17:40

via ZeroHedge News https://ift.tt/DNSBxGs Tyler Durden