“A November To Remember”: The Best And Worst Performing Assets In November And YTD

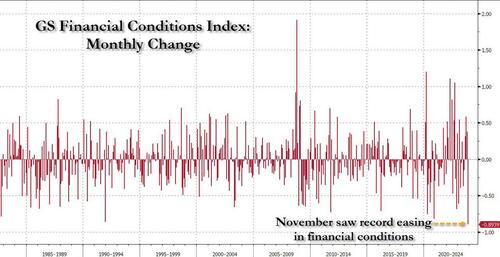

With December starting off strong, largely thanks to what the market is interpreting as dovish comments from Fed Chair Powell at his fireside chat, it is November that was truly a memorable month; in fact thanks to the biggest easing in financial conditions in history…

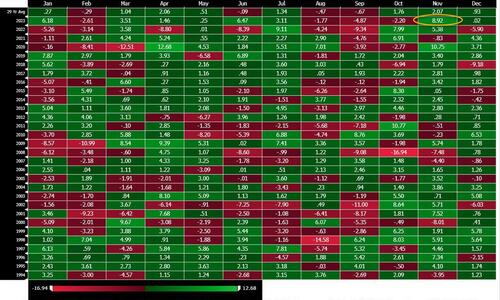

… November was the 2nd strongest November for the S&P since the 1980s (with 2020 the only stronger exception).

Courtesy of Deutsche Bank, here is an extended performance review of various assets in November, which, as DB’s Jim Reid and Henry Allen write, “saw a major rally after several weak months for markets as hopes for a soft landing and a dovish central bank pivot gathered pace.” In fact, it was…

- The best month for the S&P500 since July 2022, which reversed three months of losses and recorded its best month of 2023 so far.

- The best month for a global 60:40 portfolio of equities and bonds since the positive vaccine news in November 2020.

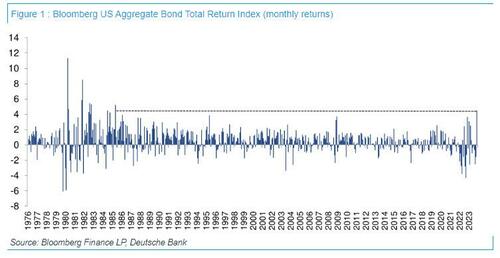

- The best month for the Bloomberg US Bond Ag Index (+4.53%) since May 1985. This includes all IG-rated fixed debt, including Treasuries and spread products.

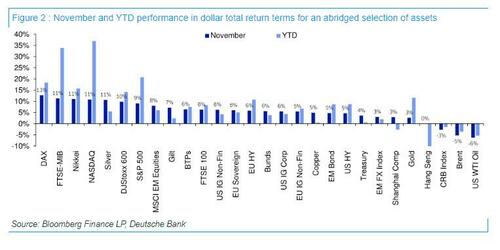

- Brent Oil (-5.2%) bucked the global risk-on trend in November, but Gold (+2.6%) hit a 6-month high.

Overall, it was an incredibly strong month across the board, with 33 out of 38 of the non-currency assets in DB’s sample in the green. Below we share more details across various assets:

The high-level macro overview

The biggest global story in November was the renewed speculation of a dovish pivot by the Fed, as investors grew increasingly confident that central banks were at the end of their hiking cycle. The rally can be traced back to the last FOMC meeting on November 1, where it was repeated that financial conditions had tightened ‘significantly’. The rally then got further support after a downside surprise in the US CPI report for October, with headline roughly unchanged at +0.04% and core rising by just +0.23%. Fedspeak added further encouragement and was cemented by an upward revision of US GDP for Q3 that showed annualised growth of +5.2%. This meant that over the course of November, markets raised their expectations of Fed rate cuts to fully price in a cut by the May meeting, having seen that as just an 8% chance at the start of the month.

The good news narrative meant that the Bloomberg US aggregate bond index achieved its best month since May 1985, with a +4.53% gain. For instance, the 10yr yield fell from 4.93% to 4.33%, breaking a streak of six months of consecutive losses for 10yr Treasuries. That was also the biggest monthly decline for the 10yr yield since July 2021. The story was similar at the ECB as well, with a cut now fully priced by April, and the good news continued right to the end of the month after Eurozone inflation for November cooled more than expected to 2.4%. This in turn supported European fixed income as bunds rose +2.6%. And that optimism was evident globally, as Bloomberg’s global bond aggregate index achieved its best month since the height of the GFC in December 2008, up +5.04%.

While fixed income advanced, we also saw a boost in risk appetite as the S&P 500 broke three months of consecutive losses to rise +9.1% in total return terms. The NASDAQ outperformed relative to the S&P 500, up +10.8%, as much of the rally remained concentrated in the tech sector. Meanwhile, the VIX index dropped – 5.22pts to 12.92pts, the largest monthly drop for the volatility measure since last November. Towards the end of the month it even closed at a post- pandemic low.

European equities were also strong across the board, as the STOXX 600 finished the month up +6.7%. This demand for risky assets and the rally in US Treasuries likewise supported corporate debt in November, and US IG spreads tightened – 25bps to 104bps.

The commodities space was more divergent in November, with energy prices seeing a decent decline, whereas others like precious metals saw a strong advance. For instance, oil prices fell in November with Brent crude down -5.2%, although there was a recovery towards the end of the month. That came after several outlets including Bloomberg reported the OPEC+ group would be announcing production cuts at the end of the month. Cuts were eventually confirmed yesterday, but the market remained concerned compliance may be weak, sending oil lower. By contrast, gold prices hit a 6-month high in November, ending the month up +2.6% at $2,036/oz.

Which assets saw the biggest gains in November?

- Global Sovereign Bonds: Hopes for a soft landing drove the rally in sovereign bonds, as US Treasuries rose +3.6% in November, their best performance since August 2019. EU Sovereign bonds gained +3.0%, with specific advances for bunds (+2.6%), BTPs (+3.3%), as well as gilts (+3.1%).

- Equities: The risk-on tone meant that the S&P 500 gained +9.1% in its best month since July 2022, and the STOXX 600 rose +6.7% in its best month since last November 2022. The Hang Seng was an outlier, which traded flat at -0.2%, marking its fourth consecutive monthly decline.

- Credit: Demand for risky assets and the global bond rally saw US IG non-fin credit rise +6.2%, and European IG non-fin gained +2.4%. European HY and US HY rose +2.8% and +4.6% respectively.

Which assets saw the biggest losses in November?

- Oil: As fears of regional escalation of the Israel-Hamas conflict abated, Brent and WTI crude fell -5.2% and -6.2% respectively. Record high US crude oil production also added to the downward price pressure

Summarizing the above, here is an abridged selection of global assets from the DB universe.

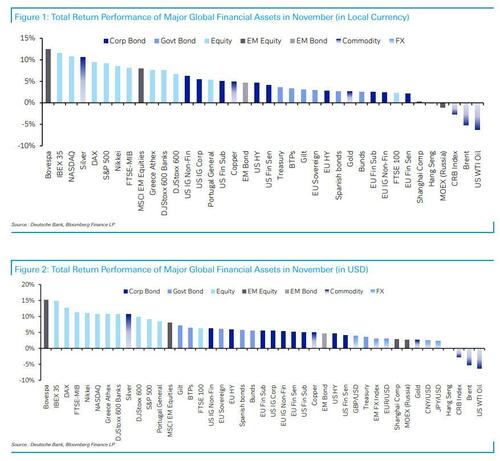

Next, a detailed chart of the best and worst performing assets in November (in local currency and USD)…

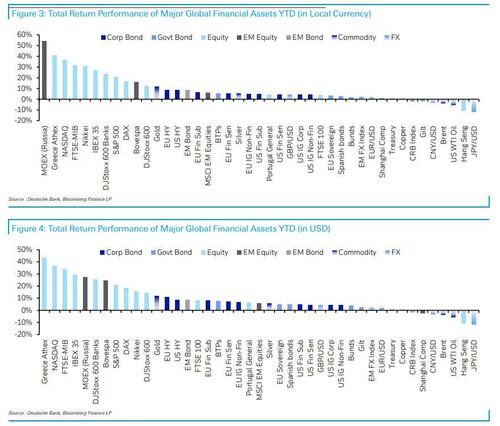

And finally, the same for the YTD period.

More in the full note available to pro subs in the usual place.

Tyler Durden

Fri, 12/01/2023 – 12:38

via ZeroHedge News https://ift.tt/aorznM4 Tyler Durden