Powell, You Have A Problem: Gold Hits All Time High As Markets Price In Rate Cuts As Soon As March

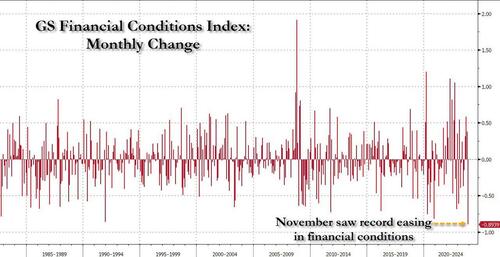

Ahead of the looming Fed blackout period – which lasts until the Dec 13 FOMC meeting – Powell had once last chance to tame euphoric markets after the best November in the past 40 years… and he blew it. Instead of pushing forcefully against the meltup in risk assets after the biggest easing in financial conditions on record during November…

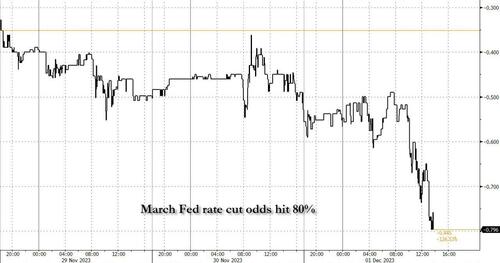

… the Fed chair appeared largely nonchallant, and in his fireside chat earlier today, what the market focused on was Powell’s comment that rates are “well into restrictive territory” which not only assured there would be no more rate hikes, but steamrolled Powell’s other, hawkish warning, that it is premature to speculate when the Fed might ease. The result was a collapse in yields, a surge in stocks, bitcoin spiking to new 2023 highs above $38,000, all driven by renewed bets that the Fed will cut rates as soon as March where the market now assigns odds of a rate cut as high as 80%, roughly double from yesterday.

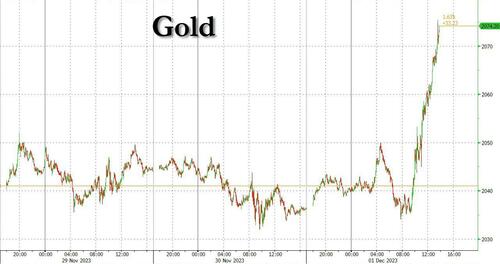

And while it is unclear if it was Powell’s intention to give markets the green light to keep rallying into year-end, a problem has emerged, the same problem that emerges every time the market views the Fed as willing to sacrifice the dollar to prop up risk assets: gold.

After surging from a ytd low of $1820 in early October, to a high of $2,040 last week, largely thanks to a relentless gold buying spree out of China as we reported previously, gold has finally realized which way the wind is blowing and as shown below, it exploded higher amid a frenzy of institutional, ETF and retail buying (and perhaps continued Chinese buying), all of which managed to finally push the yellow metal to hit new all time highs of $2,075.41, the highest on record.

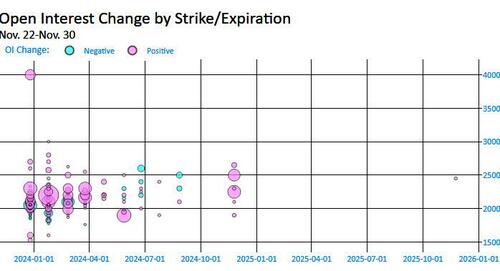

That’s just the start. As Bloomberg notes, gold calls were also in strong demand, both for futures and the biggest ETF tied to the metal, as bullion marched closer to a record high Friday. As shown in the chart below, the buildup of open interest between $2,000 and $2,500 has been relentless over the past week on growing optimism that rates are primed to decline:

That, alongside continued Chinese buying, and perhaps a reversal in ETF selling now that gold is clearly breaking out to new all time highs, means that the Fed has a new “old” problem on its hands: wholesale flight from fiat and into the safety of hard currencies, such as gold. No wonder “digital gold”, aka bitcoin, is also surging… although that one still has a ways to go to reach its previous all time high.

Then again, if the Fed is indeed set to cut rates as soon as March, and then proceed with more QE which will be inevitable to monetize the soaring US budget deficit and exploding interest payments, then we are set for new all time highs in everything – gold, bitcoin, stocks… oh and oil; because after the current bout of CTA selling is finally over, oil and commodities will be the next asset class to hit record highs at which point Powell’s mutation into Arthur Burns will be complete, confidence in the Fed will be crushed as the next – and far sharper inflation cycle kicks in – and the countdown to the end of the Dollar reserve currency system can finally begin.

Tyler Durden

Fri, 12/01/2023 – 14:07

via ZeroHedge News https://ift.tt/jUcV0M9 Tyler Durden