Is This Gold Breakout For Real? De-Dollarization May Be The Key Factor…

Authored by Mark Jeftovic via DollarCollapse.com,

Historically, fresh all-time-highs portend drawdowns for gold… Why this time may be different.

Gold finally did what many of us have been waiting on for a long time, and notched up a new all-time-high while closing strong into the weekend.

It’s been over three years in the making, and had some gut wrenching pullbacks in the interim.

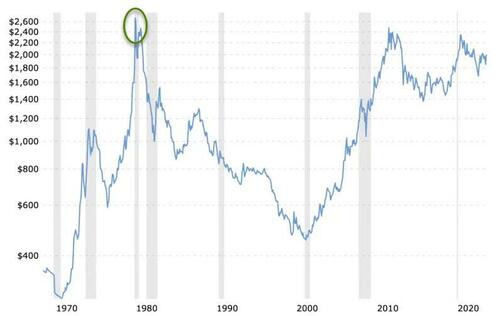

The problem with gold over the course of The Fiat Era – is that with notable exceptions, new all-time-highs were usually an intermediate top signal that portended an imminent, significant pullback, followed by lengthy sideways grinds that could drag out for years.

To be sure, since The Nixon Shock in 1971, when dollar convertibility into gold was suspended temporarily – gold has for the most part been solidly “up and to the right”, as the Bitcoiners like to say.

Via Macrotrends.net

But that’s over a multi-decade timeframe. The intermediate cyclical and counter-cyclical moves, especially the bearish ones, could last longer than a typical trader’s career. Or least his patience…

Congrats to all the goldbugs celebrating new all time highs… pic.twitter.com/KNE8ccDwwe

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) December 2, 2023

After the 1980 all-time-high, it took 28 years for gold to put in another one, in nominal terms. In inflation adjusted terms, gold still hasn’t surpassed the 1980 top:

Via Macrotrends.net – Inflation adjusted

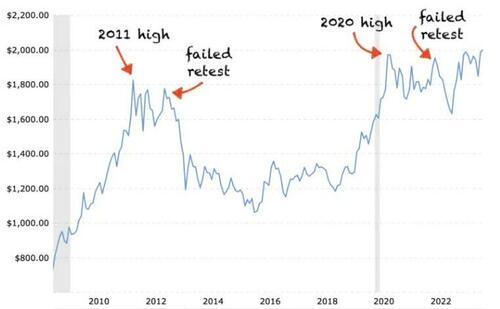

When it finally did put in another ATH as the world was heading into the Global Financial Crisis, the expectations were that it would soar. After all, it seemed as if the financial system was literally imploding, and that was supposed to be the entire point of gold.

But that isn’t what happened, gold came off hard, along with everything else – turns out that in a liquidity crisis, the “best” assets get sold off too…

After a 25% decline from the 2008 high to the GFC lows, gold reversed hard and took off, about six months sooner than the rest of the stock market did – and finally went on a bull run of successive higher highs through until the 2011 high a bit shy of that fabled $2000 mark ($1,825) – before a vicious five year decline took it down over 40%. It was brutal.

Since then, the brief high during COVID (still shy of the $2K handle) and the failed retest of that high in 2022 were both followed by double-digit pull backs.

During the fiat currency era, while the nominal price of gold has generally been steadily increasing, there have only been three periods when it was in a solid bull run of putting up successively higher highs:

1971 – 1975 and 1976 – 1980, which many regard as one bull market, then 2009 – 2011.

The 2008 and 2020 all-time-highs marked “tops” that took three years to regain and surpass.

So, the obvious question is, which is it now?

The 4-Dimensional Base Case for Gold (a.k.a “Why this time may be different”)

As you can probably tell, I’m not really a chartist or much for technical analysis. While many look at these prior cycles for gold and try to derive meaning from the patterns using Elliot Waves and Fibonacci retracements, whatever, I just look at what actually happens and try to understand the fundamental investment logic of why people allocate to gold. General people, normies – not goldbugs.

If the normies think that either the currency, or the financial system itself, could go down the crapper, they’ll buy gold.

If they think the crisis is over and everything will be fine, they’ll sell it.

The 1980 gold bull ended because Paul Volcker “saved the USD” by hiking interest rates to 20%.

The 2011 bull run ended because QE and ZIRP “saved the financial system”.

Since the advent of the Fiat Era, the bull thesis for gold has been driven by “3-D’s”:

Debasement, Deficits, Debt…

This is nothing new, we don’t need to rehash it here. They’ve all been out of control, and accelerating, for decades. Far beyond what anybody paying attention could have thought was possible.

So far, the Three D’s haven’t been able to do it, but lately, another “D”… The Fourth “D” has been added to the mix:

…and De-Dollarization

Talking about the end of USD hegemony used make you look nutty. It was a weirdo talking point exclusive to preppers and doomers.

Then a few things happened, all within a very short time frame:

-

COVID hit – and suddenly the doomers and preppers didn’t look so weird anymore. Even though the pandemic turned out to be less deadly than the experts thought, the policy response of lockdowns and stimulus still blew the first three D’s out to even more absurd proportions.

-

The weaponization of the financial system toward foreign adversaries – Afghanistan, Russia, Iran, changed the calculus of holding USD foreign reserves (notwithstanding whether these governments had it coming or not).

-

Exorbitant Privilege becoming more conspicuous and overt: It was long known that the US enjoyed a peculiar advantage in the global financial system – able to conjure value ex-nihilo and use it to import resources and boost domestic living standards – but combined with the other catalysts, it suddenly appeared to be more asymmetric than previously.

Now, “de-dollarization” isn’t some unthinkable scenario, it’s a thing. The BRICs are already planning an alternative system and we’re seeing more transactions that were previously settled exclusively in USD, being settled in alternative currencies – including gold.

Something else that is different this time is that Central Banks are buying up gold in record quantities, China’s PBOC reportedly scarfed up ____ tonnes this year , over 12% of annual production. This is believed to be in anticipation of even more oil purchases from GCC countries in Chinese Yuan, not USD.

As I finish this article out on Monday morning, gold is off a bit from the Asian opening last night, where it spiked over $50/oz out of the gate, only to give it all back. Peter Schiff is freaking out, because Bitcoin is outperforming gold, even as the former put up that new all-time-high.

Wake me up when gold cracks the inflation adjusted high from 1980.

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) December 4, 2023

But these short term gyrations from one trading session to the next are meaningless. I find it almost cringey that a figure like Schiff would be fixating on it.

Bitcoin and gold are being impelled by the same motivation to protect purchasing power and defend against the coming era of capital controls – they each bring different types of optionality to the portfolio (which is why I find the “gold vs Bitcoin” argument beyond tedious).

However, when it comes to gold, especially – 5,000 years as a monetary metal as we like to remind people – we have to look at the longer waves. Gold’s moves play out over months and years, what between trading sessions is noise.

In my mind the key level to watch whether this gold move is real, is when it surpasses the 1980 high in inflation adjusted terms: which is around $2,590/oz

Once gold cracks $2,600/oz in USD terms, we’ll know for sure we’re into one mother of a long-wave super-cycle for the yellow metal.

(Which also means, btw, that the time to allocate a portion of your portfolio to gold is before it breaks out to successive all time highs, not after. You can put some of your retirement savings into a gold ira, pick up some physical, and we’re finishing up report on the best options for vaulted gold – join the mailing list to get that when it drops).

* * *

Sign up to the DollarCollapse mailing list and receive the simplest, most actionable guide to contrarian investing Nobody Knows Anything, free. Follow us on Twitter here, or like us on Facebook here.

Tyler Durden

Mon, 12/04/2023 – 17:40

via ZeroHedge News https://ift.tt/tWzsawy Tyler Durden