WTI Extends Losses To 5-Month Lows After API Reports Huge Crude Build At Cushing

Oil prices fell for the fourth straight day to close at five-month lows today as US oil exports neared record highs amid record high domestic crude production flooding the market, overshadowing Saudi Arabia’s pledges that OPEC+ will deliver on its planned production cuts.

“The voluntary element of the deal left the markets questioning whether the supply reduction would actually come into effect,” said Fiona Cincotta, financial market analyst at StoneX.

Meanwhile, the demand outlook is being hurt by rising concerns about China, she said.

Non-OPEC countries are driving oil production growth, with the US, Brazil and Guyana contributing 1.4 million barrels per day, 0.43 million b/d and 0.2 million b/d, respectively. In 2024, the increase in non-OPEC production is likely to be in the range of 2 million b/d, according to ANZ Bank.

After across the board builds last week, expectations are for the first crude draw in seven weeks.

API

-

Crude +594k (-1.00mm exp)

-

Cushing +4.28mm – biggest build since April 2020

-

Gasoline +2.83mm (+700k exp)

-

Distillates +890k (+1.00mm exp)

Another week, another set of across-the-board inventory builds with Cushing stocks soaring…

Source: Bloomberg

WTI was hovering at mid-November intraday lows around $72.40 ahead of the data and extended losses after the unexpected build…

If OPEC+ cuts achieve complete compliance, global stockpiles would decline by less than 350k b/d in 1H 2024 and 700k b/d for next year, RBC Capital Markets analysts said in a Dec. 3 note.

“We are re-entering a supply driven market, one that more closely resembles the decade leading into Covid-19 rather than the demand-led market seen in the post-pandemic era. And those types are markets are often fraught with bull traps”

Prices will likely remain volatile and potentially directionless until the market sees clear data points pertaining to the voluntary output cuts, analysts including Michael Tran said.

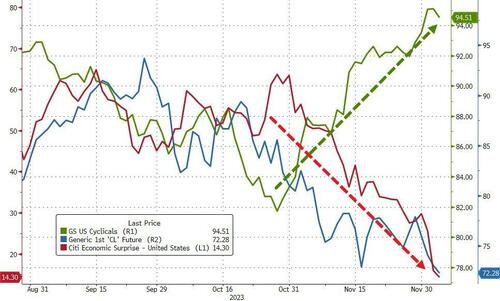

It’s also worth noting that oil prices are drastically decoupled from cyclical stocks…

So, who’s guessing right on growth?

Tyler Durden

Tue, 12/05/2023 – 16:41

via ZeroHedge News https://ift.tt/NixHFco Tyler Durden