Gold & The Dollar Surged This Week, Stocks & Crypto Purged As Reflation & WW3-Risk Wreck Rate-Cut Hopes

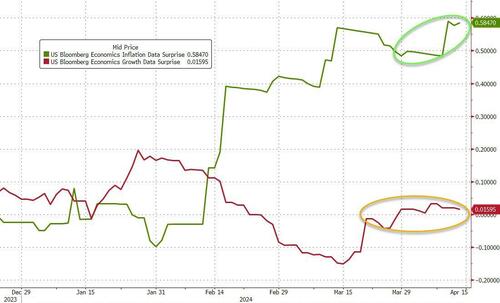

Inflation fears/promises/threats were realized this week with CPI and PPI hot (yes PPI) and UMich infl exp rising too. Inflation data has been surprising to the upside all year and growth data not so much…

Source: Bloomberg

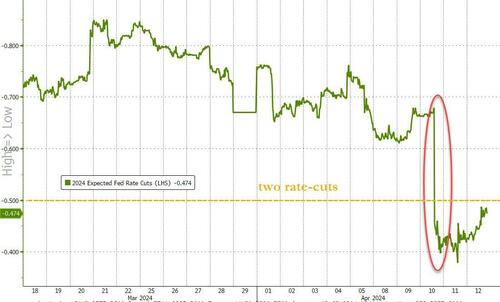

…and that rising inflation expectation wrecked the hopes and dreams of the doves this week, smashing expectations for The Fed to less than two total cuts in 2024 now priced in…

Source: Bloomberg

And even the armada of Fed Speakers launched today spoke as one…

-

*FED’S COLLINS: NOW SEE FED CUTTING LATER THAN PREVIOUSLY THOUGHT

-

*FED’S GOOLSBEE: IF PCE REINFLATES, ‘WE WILL STABILIZE THE PRICES‘

-

*FED’S SCHMID: REASON TO THINK RATES WILL STAY HIGHER FOR LONGER

-

*FED’S BOSTIC: `I AM NOT IN A HURRY’ TO CUT INTEREST RATES

-

*FED’S DALY: NO URGENCY TO CUT INTEREST RATES

Even with today’s sudden slam-down, gold was impressive this week – interestingly rallying along with the USDollar on the week. Stocks were spanked but had a wild ride and today saw Bitcoin & Black Gold monkey-hammered (for no good reason)…

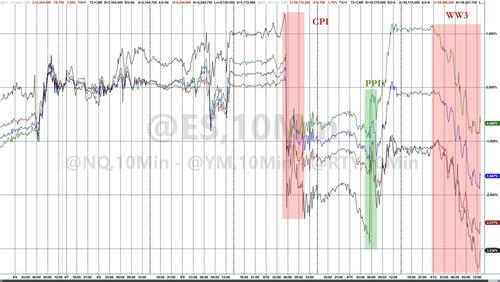

Source: Bloomberg

Stocks really did have a wild ride this week, plunging on CPI (wrecking the narrative), then rallying on a PPI print that was anything but dovish (as the algos took hold), only to get monkey-hammered today as ammo ran out and WW3 risks re0ignioted amid ‘imminent’ threats between Iran and Israel over attacks. By the end, all the US majors were back at the lows of the week, led by Small Caps and The Dow…

The S&P 500 suffered its worst weekly loss since October (second week lower in a row) and closed at one-month lows, while the median stock closed at two-month lows…

Source: Bloomberg

Energy stocks – which were the only sector green on the week as of last night’s close – were unceremoniously dumped today as all S&P sectors ended red with Financials the biggest losers (not a great day for JPM today)…

Source: Bloomberg

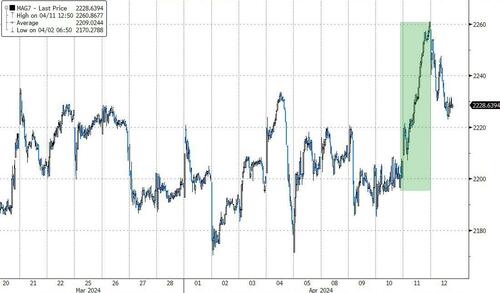

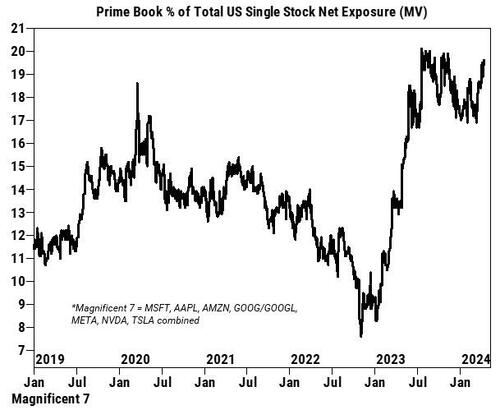

Notably, Goldman’s trading desk highlights the fact that The Magnificent 7 collectively have been net bought by hedge funds for a second straight week on the Prime book (following 6 straight weeks of net selling), suggesting a renewed focus on quality and balance sheet strength into the Q1 earnings season…

Source: Bloomberg

The group now makes up 19.6% of total US single stock Net exposure on the Prime book, up sharply from the YTD low of 16.9% in early March and approaching the record level of ~20% seen last summer…

Source: Goldman Sachs

Treasuries were bid today (yields down and stocks down) with yields down around 7-9bps across the board. On the week though, yields were higher, led by the short-end/belly of the curve. Obviously the big move was around CPI on Wednesday…

Source: Bloomberg

The dollar roared higher this week (its biggest weekly gain since Sept 2022) to its highest since Nov 2023…

Source: Bloomberg

Crypto was clubbed like a baby seal today, with Bitcoin erasing the week’s gains and then some…

Source: Bloomberg

…and once again, the selling pressure was initiated from the perp futs markets….

Ethereum was even worse with ETH/BTC plunging back below recent support (which is also January support) to its lowest since April 2021…

Source: Bloomberg

Some one was definitely not happy about the message that gold was sending this week and Benoit Gilson stomped on spot prices this afternoon after the precious metal soared to new record highs…

Source: Bloomberg

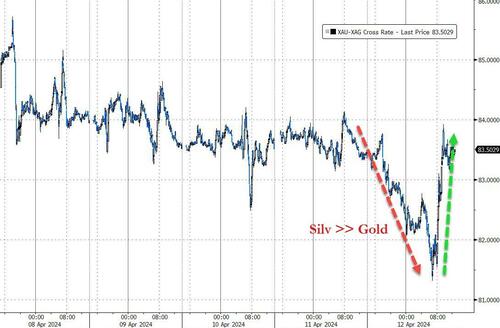

Silver outperformed Gold for the second week in a row, back to its strongest relative to gold since November…

Source: Bloomberg

…surging relative to gold early on today, before the big reversal…

Source: Bloomberg

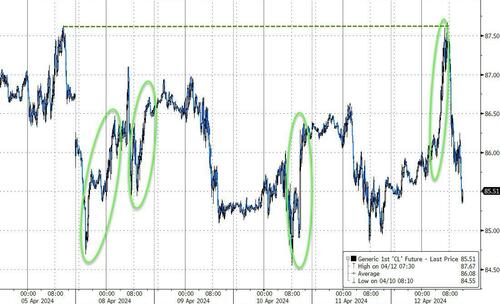

Crude prices also had a wild ride this week amid “WW3-on / WW3-off” headlines…

Source: Bloomberg

Finally, after the quarter-end surge in RRP usage, the liquidity withdrawals continue, falling to new cycle lows today, barely above $400BN…

Source: Bloomberg

Is it any wonder The Fed is rapidly looking to taper QT?

Tyler Durden

Fri, 04/12/2024 – 16:00

via ZeroHedge News https://ift.tt/InAqmjl Tyler Durden