It’s Official: Reflation Is Here

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

For months and even years, the mainstream news has sought to spin terrible inflation news. It’s not so bad, it’s just transitional, it’s getting better, it’s not really a problem, and all your gloom about the value of the dollar is in your head. Truly, in the past fortnight, we have been inundated with articles suggesting that the public is dumb as rocks for thinking that inflation is still a problem.

Yesterday morning: boom! The upward trend for the entire first quarter was solidly confirmed. We could be entering a second wave. It was so bad that not even the two most influential venues could deny it. The New York Times reported, “Inflation Stronger Than Expected.” The Wall Street Journal reported, “Hot Inflation Report Weakens Case for Fed’s June Rate Cut.” The accompanying editorial is even better: “The Inflation Thief Rises Again.”

Truly, I’m stunned by the highly unusual and rather brazen truthfulness of these headlines. I don’t think we’ve seen that in three years. Which makes me wonder: Maybe the problem is even worse!

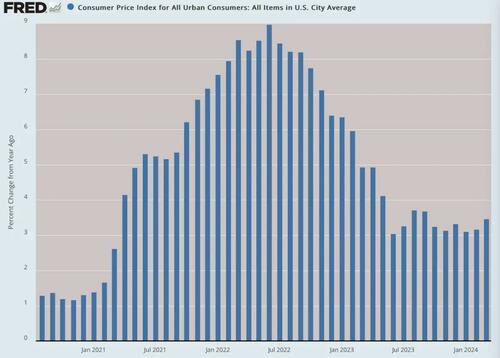

Here is a look at the inflation data as we see it now. The upward trajectory even from last summer is becoming apparent. The total loss of purchasing power in three years is easily 20 percent, but probably closer to 30 percent or more.

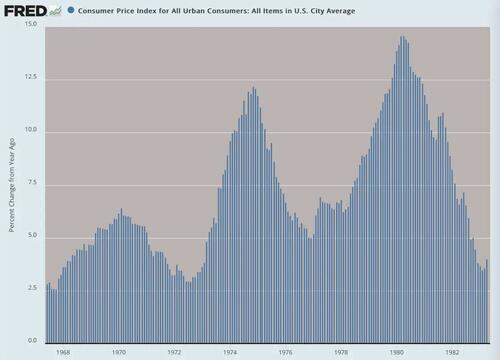

And that’s just from the official data, which is highly manipulated by messing up the pricing of housing and health insurance while excluding the cost of borrowing entirely. Adding those easily gets us back to double digits and perhaps exceeding what we experienced in 1979–1980, especially once you consider the sheer longevity of this mess.

In the 1970s, the devastation occurred in three distinct waves. Each time the trend improved, elites declared victory and the Federal Reserve moved in with rate cuts, thereby causing yet another round. Absolutely no one in charge anticipated the next wave. It came anyway.

Are we about to repeat this pattern?

It’s extremely spooky that the Fed has been angling for a rate cut for the past six months, just waiting for the chance. It’s bizarre. The whole idea of cutting rates comes from the notion of “countercyclical monetary policy.” You do it to stop a recession or dig out of one when it is happening.

Why would they talk about cutting rates now? Officially, we are doing well, in an upswing. To be sure, I don’t believe a word of it. The jobs data is a joke, and so is the output data. This is not recovery. It is possible to reconstruct the numbers in a way to show that we never left the recession of March 2020 and never recovered from lockdowns.

Regardless, based on official announcements of our rosy present, there is no case for a Fed rate cut now. The main motivation is more likely political: anything to help President Joe Biden win in November, because he is a proxy for the administrative corporate state that fears another populist revolt to take away their power. That’s why they want a rate cut.

There is no reason to doubt that the Fed is working against a Trump win. The central bank is part of the deep state, integral to the establishment in the United States and the world. It will use all its powers to game the election in a way that is institutionally protective of its interests. That means a big cut long before the election.

But in order to justify one, inflation does need at least to have the appearance of getting under control. They can claim it is happening all day, and they have done this for months and years. But it also helps when the data is there to back up such claims.

That is not happening. The consumer price index (CPI) data, even as manipulated as it is, is simply not cooperating with the very idea of rate cuts. As a result, the Fed keeps being put in the situation of suggesting that it is waiting to do so. But truly, it is getting rather late in the season for a rate cut to have any real impact on second- and third-quarter output numbers.

Wall Street recognizes this, which is why financial markets took a hard hit on the CPI data this week. It suggests that they are not going to get their fix of cheap money anytime soon. If that doesn’t happen, the stock market could come back to earth. Meanwhile, commodity prices are headed in the other direction, exactly as we might expect under inflationary conditions.

Gold and bitcoin are alive and on the move, further adding to market pessimism. Let’s face it: These assets perform well when there is no other hope out there. Even central banks are buying up gold and crypto as a safe haven.

Safe from what? That’s the great question right now. Just how bad could a financial calamity get? It’s time to start asking that question. At this point, there is no chance of crushing inflation. Monetary velocity is on an upswing, and there is still $5 trillion and more in unwarranted money printing sloshing around the U.S. economy and the world. That is still working its way through global and domestic prices.

Meanwhile, we face a stunning fiscal crisis, with interest on the debt on the verge of dwarfing every other budgetary item. The commercial real estate crisis in cities is getting worse in these waves of defaults that have begun and are certain to hit city after city in the coming year or two.

Regardless of what happens between now and November, this crisis will accelerate in 2025 to become absolutely beastly, exactly at the point where the ruling class will no longer be able to bamboozle the public with rising 401(k) and other investment funds.

If a genuine financial and stock-market crisis comes in 2025 amidst a new wave of inflation, look out. What people call the “populist revolt” of our times will be nothing like what will emerge. The possibilities are truly terrifying.

There’s no need just yet to become apocalyptic, but this much we can say for sure: Today’s inflation numbers reveal that our troubles are far from over. The standard of living is on the decline and worsening, hitting the middle class as never before, with home ownership out of the question for most people.

Why didn’t the experts anticipate all this fallout from the lockdown disaster? To put it bluntly, they are not experts. They are ham-handed, greedy, and stupid, and play their policy games without serious concern for the well-being of the public. A major difference today versus the 1970s is that people today know exactly who to blame. This is precisely why Washington has become a city of fear and loathing.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Tyler Durden

Sat, 04/13/2024 – 09:20

via ZeroHedge News https://ift.tt/b3eqvIC Tyler Durden