WTI Extends Losses After API Reports Unexpected Crude Build

WTI ended April on a down-note (closing lower on the month, as opposed to Brent which saw its fourth straight monthly gain) as hopes for cease-fire talks between Israel and Hamas dampened fears of a wider conflict that could threaten crude supplies.

The recent declines come as a “relief to both central bankers and consumers alike,” Stephen Innes, managing partner at SPI Asset Management, told MarketWatch.

There’s been a notable decrease in speculation about the possibility of U.S. benchmark WTI surpassing the $100-a-barrel threshold, at least for now, he said. This shift in sentiment can be attributed, in part, to “reduced concerns about disruptions to Iranian production, following Israel’s measured response to previous drone attacks.”

Meanwhile, “attention should also be directed towards peace talks, as progress in this area could further contribute to a decrease in oil prices,” said Innes.

But, after last week’s big crude draw, analysts expect another drawdown in stocks this week.

API

-

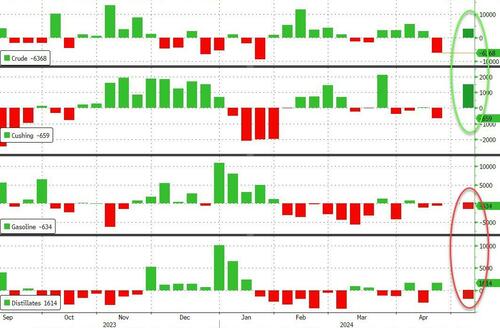

Crude +4.91mm (-1.5mm exp)

-

Cushing +1.48mm

-

Gasoline -1.48mm (-1.2mm exp)

-

Distillates -2.19mm (+400k exp)

Crude stocks unexpectedly rose almost 5mm barrels last week while distillates inventories declined notably…

Source: Bloomberg

WTI was hovering around $81.65 ahead of the API print and extended losses modestly after…

Despite the reprieve in oil prices, crude-oil markets are expected to remain volatile, said Innes, partly due to uncertainty surrounding the pace of global oil demand growth, the rise in non-OPEC+ and U.S. oil production, the potential for supply disruptions in regions like Russia and the Middle East and, critically, OPEC+’s future production strategy.

“These dynamics underscore the ongoing challenges and complexities within the oil market landscape,” Innes said.

Tyler Durden

Tue, 04/30/2024 – 16:38

via ZeroHedge News https://ift.tt/HgpDMdP Tyler Durden