FOMC Leaves Rates Unch, Says (Bigger Than Expected) QT Taper To Start In June

Tl;dr: The Fed just told the market that ‘yields are too damn high‘.

* * *

Since the last FOMC meeting, on March 20th, gold has been the biggest outperformer (interesting along with dollar strength), while stocks, bonds, and crude (and crypto) have all been sold (with bonds and oil equally ugly)…

Source: Bloomberg

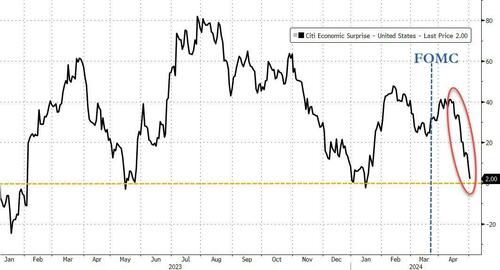

And since March 20th, US macro data has serially disappointed…

Source: Bloomberg

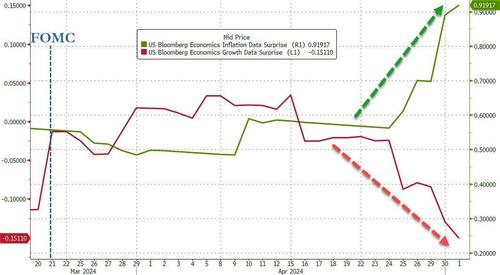

More problematically, since the last FOMC meeting, inflation data has dramatically surprised to the upside and growth data to the downside – screaming stagflation in the face of the Fed…

Source: Bloomberg

Rate-cut expectations (for 2024 and 2025) have plunged significantly since the last FOMC (that is now just one 25bps rate-cut priced in for 2024)…

Source: Bloomberg

Expectations are fully priced for a nothing-burger today on rates…

Source: Bloomberg

… with a slight hawkish bias in the language-changes in the statement (and the possibility of QT-taper signaling). But it will be Powell’s press conference that everyone will be focused on.

So what did The Fed say?

Rates unchanged…

- *FED HOLDS BENCHMARK RATE IN 5.25%-5.5% TARGET RANGE

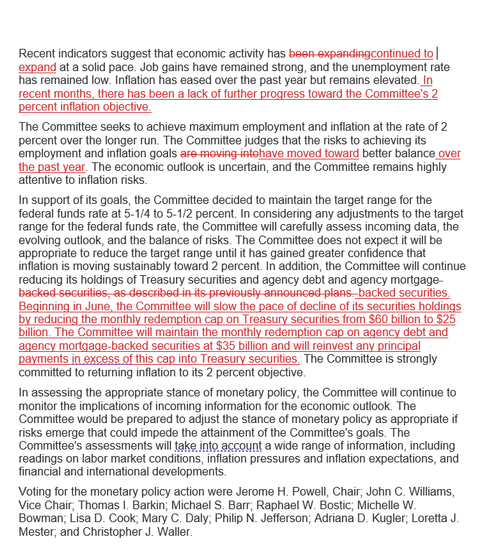

Key statement changes

Fed adds following sentence:

“In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective.”

Fed also replaces

“The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance“

with

“The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year.

And the QT Taper is here – and its bigger than expected (-$35BN/mth vs -$30BN expected):

Beginning in June, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion.

The Committee will maintain the monthly redemption cap on agency debt and agency mortgage‑backed securities at $35 billion and will reinvest any principal payments in excess of this cap into Treasury securities

This means $105BN less gross issuance needed in Q3, with The Fed implicitly saying ‘yields are too high’.

Just as we said…

The big question for today: how much will Fed taper QT by?

If Taper goes to $30BN (from $60BN/month), that means less funding needed in Q3 (most likely from Bills), and means less pressure on issuance. Yields should slide

— zerohedge (@zerohedge) May 1, 2024

Read the full redline below:

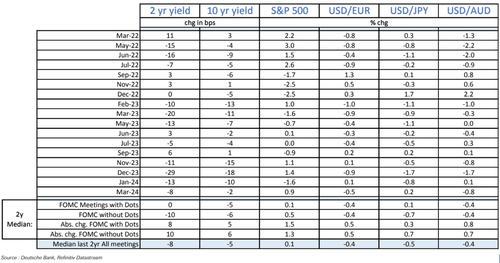

What happens next (on average)?

Tyler Durden

Wed, 05/01/2024 – 14:00

via ZeroHedge News https://ift.tt/rdXvFH2 Tyler Durden