Elections And Devaluations

Authored by Yves Smith via NakedCapitalism.com,

Yves here. It’s revealing that Serious Economist Jeffrey Frankel limits himself to third-world examples in his case studies below on post-election devaluations.

Perhaps it would be unseemly to look at, say, the US, UK, Japan, South Korea, or even Australia (admittedly the latter and Canada have their currency values substantially affected by commodity prices). Of course, Frankel might contend that any politically-related currency action in an advanced economy would not amount to a depreciation-level decline. After all, they have independent central banks.

As many, including your humble blogger, have noted, the US is running a very hot fiscal policy along side tight monetary policy. Hence America has persisted in having solid to very strong groaf figures, leading the Fed to persist in tight monetary policy. All of that has led the dollar to trade at very lofty levels.

One has to think the dollar will start to reverse near the election, say in October. But inflation has been very sticky, and it’s interest rates that are buoying the greenback, so it might stay comparatively strong even past the election. In addition, the US has, at least since the Clinton Administration, has had an explicit strong dollar policy. Weak currencies and financial centers do not co-exist happily. The Fed has historically not cared a whit about what moves in interest rates have done in terms of in and out flows to emerging economies, who are routinely whipsawed by hot money moves. One wonders if we will eventually see the Fed become more attentive to the value of the dollar.

Any readers who are currency-knowledgeable are encouraged to opine on which countries might look more attractive as King Dollar retreats from its current high.

By Jeffrey Frankel, Economist and Professor, Harvard Kennedy School. Originally published at VoxEU

An unprecedented number of voters will go to the polls globally in 2024. It has long been noted that incumbents tend to engage in expansive fiscal (and where possible monetary) policy in the run up to elections in order to buoy the economy and therefore their electoral prospects. This column extends this concept to look at exchange rates and finds that currencies frequently depreciate following an election as the incumbent’s efforts to overvalue the currency in the run up to the election are unwound and the new government comes to terms with depleted reserves and current account woes.

Lots of countries are voting, with 2024 an unprecedented year in terms of the number of people who will go to the polls. Recent elections in a number of emerging market and developing economies (EMDEs) have demonstrated anew the proposition that major currency devaluations are more likely to come immediately after an election, rather than before one. Indeed, Nigeria, Turkey, Argentina, Egypt, and Indonesia are five countries that have experienced post-election devaluations within the last year.

The Election–Devaluation Cycle

Economists will recall a 50-year-old paper by Nobel Prize winning professor Bill Nordhaus as essentially initiating research on the political business cycle (PBC). The PBC refers to governments’ general inclination towards fiscal and monetary expansion in the year leading up to an election, in hopes of the incumbent president, or at least the incumbent party, being re-elected. The idea is that growth in output and employment will accelerate before the election, boosting the government’s popularity, whereas the major costs in terms of debt troubles and inflation will come after the election.

But the seminal 1975 paper by Nordhaus also included the prediction of a foreign exchange cycle particularly relevant for EMDEs. That is the proposition that countries generally seek to prop up the value of their currencies before an election, spending down their foreign exchange reserves, if necessary, only to undergo a devaluation after the election.

Nordhaus wrote: “It is predicted that the concern with loss of reserves and balance of payments deficits will be greater in the beginning of electoral regimes, and less toward the end.…The basic difficulty in making intertemporal choices in democratic systems is that the implicit weighting function on consumption has positive weight during the electoral period and zero (or small) weights in the future.”

The devaluation may be undertaken deliberately by an incoming government, choosing to get the unpleasant step – with its unpopular exacerbation of inflation – out of the way while it can still blame it on its predecessors. Or the devaluation may take the form of an overwhelming balance-of-payments crisis soon after the election. Either way, a government has an incentive to hoard international reserves during the early part of its term in office, and to spend them more freely to defend the currency toward the end of its term.

A political leader is almost twice as likely to lose office in the six months following a major devaluation as otherwise, especially among presidential democracies (Frankel 2005). Why are devaluations so unpopular that governments fear to undertake them before elections? In the traditional textbook model, a devaluation stimulates the economy by improving the trade balance. But devaluations are always inflationary in countries which import at least a portion of the basket of goods consumed. Furthermore, devaluations in EMDEs often are contractionary for economic activity, particularly via the adverse balance sheet effects on those domestic borrowers who had incurred debts denominated in dollars.

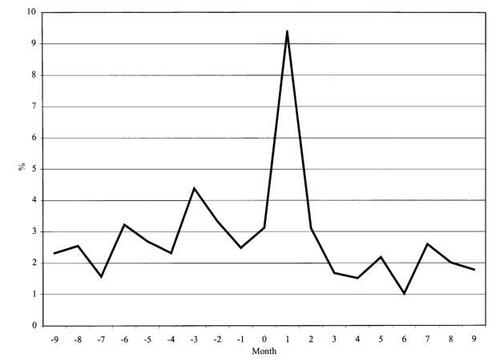

The theory of the political devaluation cycle was developed in a series of papers by Ernesto Stein and co-authors. One might think that voters would wise up to these cycles and vote against a leader who sneakily postponed a needed exchange rate adjustment. But given a lack of information about the true nature of the politicians, voters may in fact be acting rationally. Figure 1, from Stein and Streb (2005) shows that devaluations are far more common in the immediate aftermath of changes in government. (The sample covers 118 episodes of changes, excluding coups, among 26 countries in Latin America and the Caribbean between 1960 and 1994.)

Figure 1 Average devaluation pattern before and after elections

Source: Stein and Streb (2004).

Some Devaluations Over the Past Year

Many EMDEs have been under balance-of-payments pressure during the last two years. One factor is that the US Federal Reserve raised interest rates sharply in 2022-23 and is now leaving them higher for longer than markets had been expecting. Consequently, international investors find US treasury bills more attractive than EMDE loans and securities.

A good example of the political devaluation cycle is Nigeria. Africa’s most populous country held a contentious presidential election on 25 February 2023. The incumbent, who was term-limited, had long used foreign exchange intervention, capital controls, and multiple exchange rates to avoid devaluing the currency, the naira. The new Nigerian president, Bola Tinabu, was inaugurated on 29 May 2023. Two weeks later, on 14 June, the government devalued the naira by 49% (from 465 naira/$, to 760 naira/$, computed logarithmically). It soon turned out that this was not enough to restore equilibrium in the balance of payments. At the end of January 2024, the government abandoned its effort to prop up the official value of the naira, devaluing another 45% (from 900 naira/$ to 1,418 naira/$, logarithmically).

A second example is Turkey’s election in May 2023. President Recep Tayyip Erdoğan had long pursued economic growth by obliging the central bank to keep interest rates low – a populist monetary policy that was widely ridiculed because of the president’s insistence that it would reduce soaring inflation – while simultaneously intervening to support the value of the lira. The government guaranteed Turkish bank deposits against depreciation, an expensive and unsustainable way to prolong the currency overvaluation. After the elections, the lira was immediately devalued, as the theory predicts. The currency continued to depreciate during the remainder of the year.

Next, on 19 November 2023, Argentina elected a surprise candidate as president, Javier Milei. Often described as a far-right libertarian, he comes from none of the established political parties. He campaigned on a platform of diminishing sharply the role of the government in the economy and abolishing the ability of the central bank to print money. Milei was sworn in on December 10. Two days later, on 12 December he cut the official value of the peso by more than half (a 78% devaluation, computed logarithmically, from 367 pesos/$ to 800 pesos/$). At the same time, he took a chain saw to government spending such as energy subsidies rapidly achieved a budget surplus, and initiated sweeping reforms. Argentine inflation remains very high, but the central bank stopped losing foreign exchange reserves after the devaluation, again as predicted by the theory.

A fourth example is Egypt, where President Abdel Fattah al-Sisi just started a third term, on 2 April 2024. The economy has been in crisis for some time. Nevertheless, the government had ensured its overwhelming re-election on 10-12 December 2023 by postponing unpleasant economic measures, not to mention by preventing serious opponents from running. The widely expected devaluation of the Egyptian pound, came on 6 March 2024 depreciating 45% (from 31 egyptian pounds/$ to 49 pounds/$, logarithmically). It was part of an enhanced-access IMF programme, which also included the usual unpopular monetary and fiscal discipline.

Finally, in Indonesia the widely liked but term-limited President Jokowi is soon to be succeeded by the Defense Minister Prabowo Subianto, who is less widely liked but was backed by the incumbent in the 14 February election. The rupiah has been depreciating ever since the 20 March announcement of the outcome of the contentious presidential vote. It fell almost to an all-time record low against the dollar on 16 April.

What next?

Of course, the association between elections and the exchange rate is not inevitable. India is undergoing elections now and Mexico will in June. But neither seems especially in need of major currency adjustment.

Venezuela is scheduled to hold a presidential election in July. As with some other countries, the election is expected to be a sham because no major opposition candidates are allowed to run. The economy is in a shambles due to long-time mismanagement featuring hyperinflation in the recent past and a chronically overvalued bolivar. But the same government that essentially outlaws political opposition also essentially outlaws buying foreign exchange. So, equilibrium may not be restored to the foreign exchange market for some time.

To stave off devaluation, these countries do more than just spend their foreign exchange reserves. They often use capital controls or multiple exchange rates, as opposed to allowing free financial markets. That doesn’t invalidate the phenomenon of post-election devaluations; it just works to insulate the governments a bit longer from the need to adjust to the reality of macroeconomic fundamentals. Unfortunately, many of these countries also fail to allow free and fair elections, which works to also insulate the government from the need to respond to the voters’ verdict.

Tyler Durden

Tue, 05/14/2024 – 22:40

via ZeroHedge News https://ift.tt/iRTJ4Mg Tyler Durden