WTI Rebounds Off Lows After Across-The-Board Inventory Draws

Oil prices are tumbling this morning despite lower CPI (juicing rate cut hopes), weak retail sales (but strong gas station spending), and a big draw reported overnight by API. It seems the main downside driver was IEA lowering its 2024 demand forecast.

-

World oil demand is forecast to grow by 1.1 million barrels per day this year, down 140,000 bpd from last month’s projection.

-

Global crude inventories surged in March by 34.6 million barrels as trade disruptions pushed oil on water to a post pandemic high, according to the IEA.

The question is – will the official data confirm API’s big crude draw and re-energize prices.

API

-

Crude -3.1mm (-1.1mm exp)

-

Cushing -601k

-

Gasoline -1.27mm (unch exp)

-

Distillates +349k (+300k exp)

DOE

-

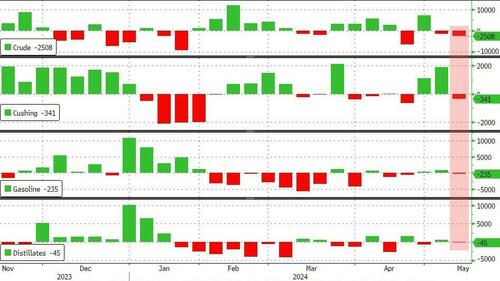

Crude -2.508mm (-1.1mm exp)

-

Cushing -341k

-

Gasoline -235k (unch exp)

-

Distillates -45k (+300k exp)

The official data shows inventory draws across the board with crude stocks down 2.5mm barrels…

Source: Bloomberg

The Biden admin continued to add to the SPR, adding 593k barrels…

Source: Bloomberg

US Crude production remains flat near record highs at 131.mm b/d…

Source: Bloomberg

WTI was trading just above $77 ahead of the official print and rallied further on the across-the-board draws…

Finally, we note that refinery utilization rates are back above 90%, the highest since January. Rates increased in all regions, with the Midwest rising for the second straight week to 90.8%, from 85.2% in the previous week, as refineries wake up from maintenance.

Tyler Durden

Wed, 05/15/2024 – 10:39

via ZeroHedge News https://ift.tt/hYHErQI Tyler Durden