Hedge Funds Dump Chinese Stocks At The Fastest Pace In Almost A Year

Back on January 24, we told premium subs to our private news feed that Chinese stocks had plunged too far, too fast, and that the time to buy China (via FXE) had arrived. In retrospect, we timed that call perfectly as it was the bottom-tick for Chinese equities. Several months later, well after our readers had already put the trade on, the always delayed Wall Street lemming brigade turned very bullish on China, however with far more risk and far less upside.

Then, one month ago when we concluded that Chinese stocks had moved too far, too fast, on May 6 we told subs that the time to close the FIX trade had come as we, too, unwound out long China position at a 25% profit in just over three months.

It appears that call too was almost perfect, because after extending fractionally beyond our sell level, Chinese stocks have since slumped and it now appears that the sell brigade has also arrived (one month after our reco; incidentally readers who wish to become premium subscribers can do so here).

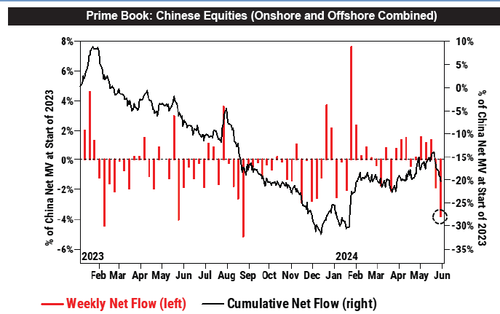

As Goldman’s John Flood writes in his daily Chart of the Day, what stood out to him from the latest Goldman weekly Prime Brokerage data is that “Hedge funds unloaded Chinese stocks across all channels last week and at the fastest pace since last summer” and after net buying Chinese equities in 7 of the previous 8 weeks (modest in magnitude), HFs reversed course and have picked up the pace of selling again.

In other words, they are doing precisely what we said to do… with the requisite 1 month delay.

As shown in the Goldman PB chart below, Chinese equities collectively were net sold for a second consecutive week on the Prime book – last week’s notional net selling was the largest since Aug ‘23.

Some more details:

- Managers net sold Chinese stocks across all channels last week, led in notional terms by ADRs and to a lesser extent H-shares, suggesting a more cautious stance amid signs of an uneven recovery path in economic activity.

- From a positioning standpoint, exposures in Chinese equities remain low, with Gross/Net allocations (as % of the overall Prime book) currently sitting in the 6th/8th percentiles on a 5-year lookback.

Hilariously, the reversal takes place just after Goldman published a note last week in which the bank, which was bearish on China well into 2024, said it had turned “constructive on Chinese stocks” (full note available to pro subs) and see more upside ahead. And since Goldman’s sellside research is just a punching bag for Goldman’s in house traders to abuse and fade, that’s when China puked.

That said, we see even more downside to China with Flood noting that “the pullback hasn’t changed our core views/thesis on China equity, if anything, it provides a better entry point for investors to capitalize China’s rising portfolio value (i.e. diversification benefits), downside policy put underwritten by the government, and upside optionality on capital market reforms.”

Translation: wait until Goldman turns bearish before rebuying into Chinese names as virtually all the good news – including the latest housing bailout (for ants) – has already been priced in.

Tyler Durden

Mon, 06/03/2024 – 14:10

via ZeroHedge News https://ift.tt/ibW4dxN Tyler Durden