Job Openings Tumble With Hiring Stuck At 2018 Levels

After several months of relatively boring JOLTS prints, last month Janet Yellen’s favorite labor market indicator once again got exciting and not in a good way, as the number of March job openings unexpectedly plunged by 325K, pulling the total to 8.5 million, the lowest in three years. Then, moments ago the BLS reported the latest April update and it was even worse.

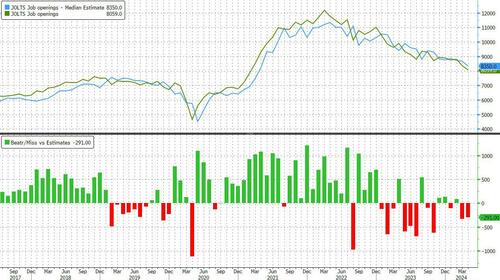

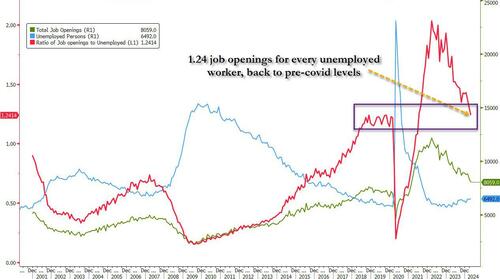

Starting at the top, according to the April JOLTS reported, job openings unexpectedly plunged by 296K, from an downward revised 8.355 million in March (which meant the March drop was upward revised to 458K) to just 8.059 million, far below the 8.350 million expected – and the lowest number since February 2021 when it last printed below 8 million.

The 291K miss to estimates of 8.350 million, was big but not as big as last month’s revised miss which was 325K (and has been revised even higher). Still, the two consecutive misses are the biggest since mid-2023.

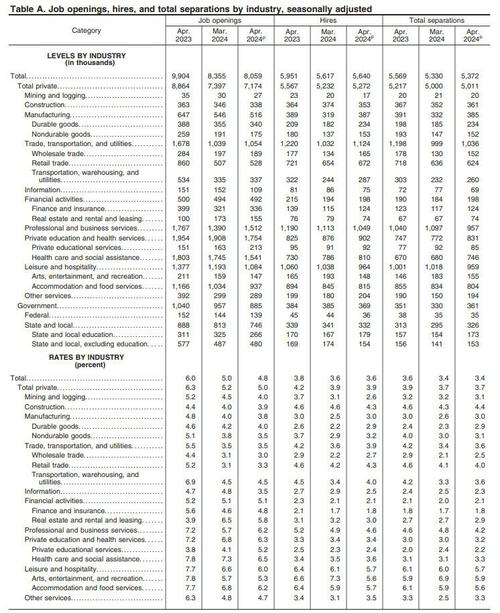

According to the DOL, in April job openings decreased in health care and social assistance (-204,000) and in state and local government education (-59,000) but increased in private educational services (+50,000).

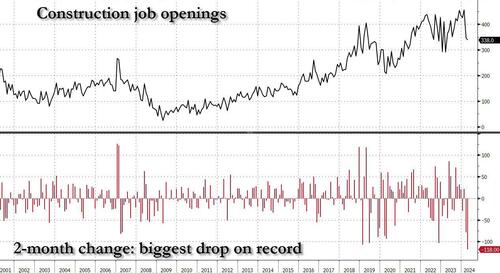

The silver lining: last month’s record collapse in construction jobs from 456K to 274K, a 182K one-month drop and the biggest on record, was upward revised dramatically higher, with the March number now at 346K, although April saw another drop to 338K if not nearly quite as dramatic. Still, the 2-month drop in construction job openings is still the biggest on record.

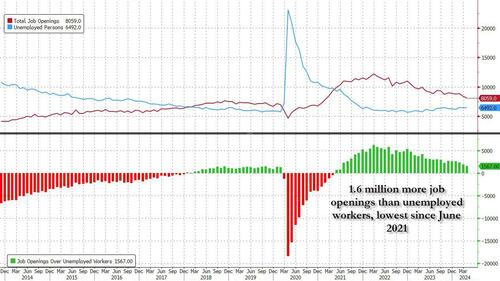

In the context of the broader jobs report, in March the number of job openings was 1.567 million more than the number of unemployed workers (which the BLS reported was 6.492 million), down significantly from last month’s 1.926 million and the lowest since June 2021.

Said otherwise, in April the number of job openings to unemployed dropped to just 1.24, a sharp slide from the March print of 1.30, the lowest level since June 2021 and now officially back to pre-covid levels.

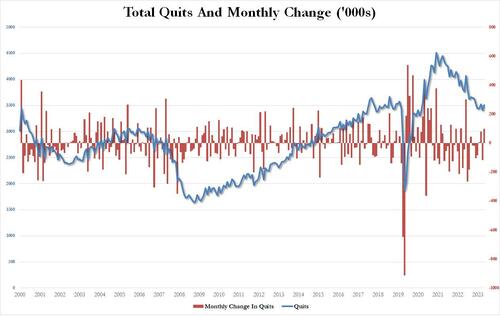

A quick look at the number of quits, an indicator closely associated with labor market strength as it shows workers are confident they can find a better wage elsewhere, shows that after last month’s unexpected plunge by 118K (revised from a collapse 198K), in April the number of quits actually rose by 98K to 3.507 million, which is back to the range observed in the pre-covid days.

Also notable is that amid the stagnant level of job openings, the number of hires has remained flat in the mid-5 million level (in April it rose modestly to 5.640 million from 5.617 million) – close to the lowest since Jan 2018 (excluding the record one-month plunge due to covid), and is now also well below pre-covid levels.

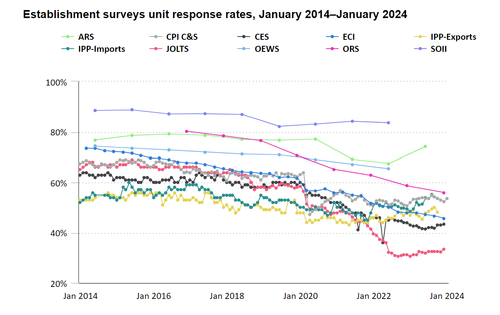

Finally, no matter what the “data” shows, let’s not forget that it is all just estimated, and it is safe to say that the real number of job openings remains still far lower since half of it – or some 70% to be specific – is guesswork. As the BLS itself admits, while the response rate to most of its various labor (and other) surveys has collapsed in recent years, nothing is as bad as the JOLTS report where the actual response rate remains near a record low 33%

In other words, more than two thirds, or 70% of the final number of job openings, is estimated!

And at a time when it is critical for Biden to still maintain the illusion that at least the labor market remains strong when everything else in Biden’s economy is crashing and burning, we’ll let readers decide if the admin’s Labor Department is plugging the estimate gap with numbers that are stronger or weaker (we already know that they always get revised lower next month).

Tyler Durden

Tue, 06/04/2024 – 10:35

via ZeroHedge News https://ift.tt/s915eCS Tyler Durden