The Pain Trade: Citron’s Andrew Left Says He’s Shorting GameStop…Again

Stop us if you’ve heard this one before…

In an interview with Bloomberg on Monday, short seller Andrew Left of Citron Research said he has once again shorted GameStop, after famously being short the name during its original astronomical run higher in 2021.

“I have covered my short from May, and then I re-shorted it today,” he said on Bloomberg. “I don’t have any ill will towards the company. It’s not even a company, it’s a trading vehicle.”

On X later in the day, Left wrote: “What made Keith Gill aka Kitty interesting initially was his authenticity. He shared a detailed investment thesis and put his money where his mouth was, which combined with a high short interest and a restless country and boom.. investing history. This time it feels different.”

“Now, with $GME, he posts with a large account and a significant near-term option position, appearing more like manipulation without a solid thesis,” he added.

“Considering the stock is now 2,000% higher than his initial video almost 4 years ago,” Left said. “We believe someone is backing Gill—there’s no way he made this size trade alone. His reported finances don’t support t his trade. Investors will see through this roaring Icarus.”

“For the record, I don’t think anything Kitty did was illegal. However, I believe he and his associates overstate their importance in the market and overlook that the market dynamics and structure of $GME have changed since January 2021,” Left wrote on X Tuesday morning.

“Back then, he bought the stock at $2 when it had 100% short interest, and there was still hope to turn the business around. Now, three and a half years later, he’s buying the stock at $80 (split adjusted) with low short interest and a failed business model. When Buffett bought Chubb, it went up 3% the next week. Is Kitty better than Buffett?”

He concluded: “If investors want to buy $GME, they should be allowed. The risks are well known, and these are free capital markets. Assuming Kitty does not have MNPI, he has the right to make a large bet and tell everyone. He cannot predict the reaction.”

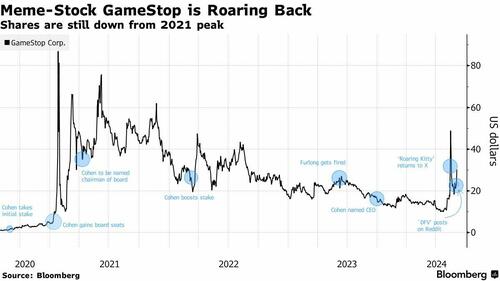

GameStop soared at the opening bell on Monday before paring gains by the end of the cash session. It initially boosted its market value by $6 billion and prompted trading halts due to volatility. The stock is still well below its peak price of $86.88 in January 2021.

The resurgence of meme stocks has captivated the stock market again, fueled by the return of prominent figure “Roaring Kitty”, who gained notoriety in 2021 for rallying retail traders on Reddit.

“He might as well be a hedge fund manager,” Left said of Kitty, named Keith Gill.

Meanwhile Left had said back in early 2021 that his firm would cease publishing short selling research, marking the end of a twenty-year tradition. Since then, Left has not been as vocal on social media about markets as he once was.

Tyler Durden

Tue, 06/04/2024 – 13:40

via ZeroHedge News https://ift.tt/BNu2hSH Tyler Durden