Record Demand For Stellar 20Y Auction

After stellar 10Y and 30Y auctions last week, moments ago the Treasury sold its sole coupon auction for the week when it placed $13BN in a 20Y paper (technically the 19-Y 11-M reopening of Cusip UB2). The auction was met with no less than record demand, with metrics off the charts in virtually every category.

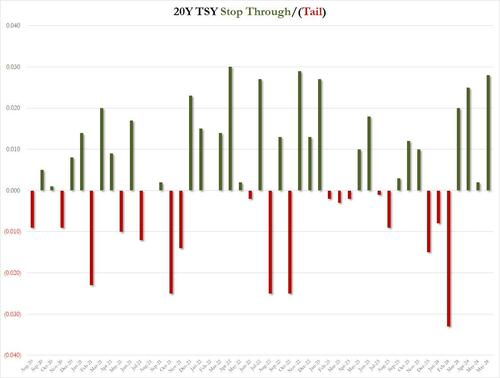

Starting at the top, the high yield of 4.452% was below last month’s 4.635% and the lowest since January’s 4.423%. This was a whopping 2.8bps stop through to the 4.452% When Issued, which was the biggest stop through since Nov 22 and the third highest on record!

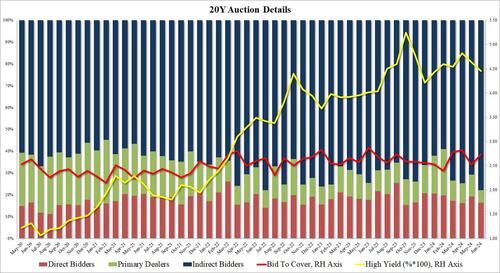

The bid to cover jumped to 2.74 from 2.51, and well above the six-auction average of 2.60 if nowhere close to the highest on record which was 2.87 exactly one year ago.

But if the BTC was so-so, the internals were stellar, with Indirects taking down 77.9%, which was the second highest on record with just the 78.0% in July 2022 higher. And with Directs awarded 16.3%, Dealers were left holding only 5.3% of the final auction, a record low for the tenor.

The market reaction was swift with 10Y yields promptly dumping to a three day low of 4.20% before reversing the gain and trading just off session lows.

Tyler Durden

Tue, 06/18/2024 – 13:22

via ZeroHedge News https://ift.tt/IEasYgv Tyler Durden