IRS Hammers US Taxpayers With Record Penalties In FY-23

Authored by Martin Armstrong via ArmstrongEconomics,

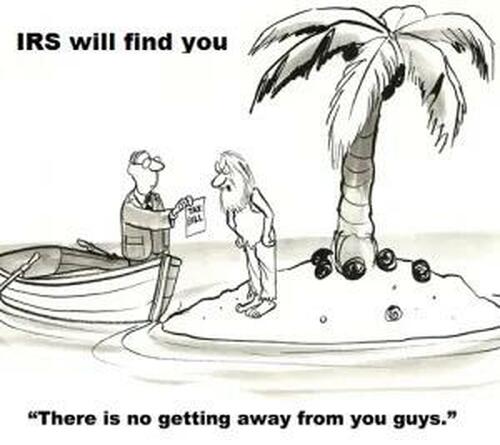

The government has become desperate for funding, seeking out money from their own citizens through taxation.

Not only have they raised taxes for every bracket, but the IRS managed to squeeze more money out of Americans through audits for fiscal year 2023 than any year on record. In fact, the IRS shook down Americans for an additional $7 billion in tax penalties alone – a 300% increase from FY22.

These funds are mere chump change as we send out far more than this to Ukraine on a regular basis. The people do not vote on how their taxes are frivolously spent, but they are responsible for the government’s spending. Biden claimed he would target the hated “rich” but reports have found that the majority of those targeted were gig economy workers and freelancers. Biden has done everything in his power to kill the gig economy. The IRS hates the gig economy because they believe those workers are stealing from Uncle Sam.

The average penalty for underestimating taxes was around $150 in 2022. This year, the average penalty was around $500.

The IRS also ramped up its campaign to fine anyone who missed the tax deadline. Late payment fees increased to $485 or 100% of the tax owed if that amount is less. Then there is the question of “How much do I owe?” The tax system in the US is so complex that there are careers dedicated toward figuring out that predicament. Every citizen and business would prefer if the government simply told them how much they needed to pay. Instead, they deliberately make the tax code vague in order to penalize everyone and anyone.

The penalty for underpayment rose in the past year from 3% to 8%. There is no grace for those who cannot afford to pay their due amount as the IRS charges interest on all payments that are not made in full. Those who intentionally disregarded their payments faced a $630 penalty or 10% of the amount owed.

Yet, the Biden Administration wants you to believe they care deeply about the working man. Biden wanted to hire far more IRS agents this year to raise these penalties. Public confidence dissolves when the state begins to hunt their own citizens for taxes. The government becomes the clear enemy. We have seen it happen countless times throughout history when citizens flee and later protest or revolt over absurdly high taxes. The fact that the Biden Administration has been using US taxpayer funds for foreign causes only adds insult to injury.

Tyler Durden

Tue, 06/25/2024 – 21:00

via ZeroHedge News https://ift.tt/iTBp50j Tyler Durden