Tverberg: Advanced Economies Are Headed For A Downfall

Authored by Gail Tverberg via Our Finite World,

It may be pleasant to think that the economies that are “on top” now will stay on top forever, but it is doubtful that this is the way the economy of the world works.

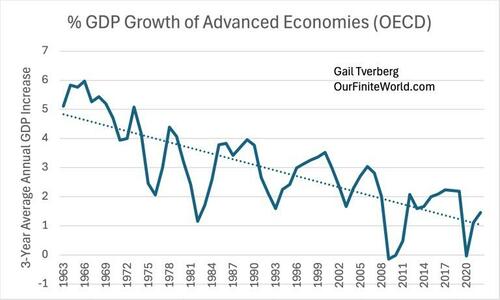

Figure 1. Three-year average GDP growth rates for Advanced Economies based on data published by the World Bank, with a linear trend line. GDP growth is net of inflation.

Figure 1 shows that, for the Advanced Economies viewed as a group (that is, members of the Organization for Economic Co-operation and Development (OECD)), GDP has been trending downward since the early 1960s; this is concerning. It makes it look as if within only a few years, the Advanced Economies might be in permanent shrinkage. In 2022, the expected annual GDP growth rate for the group seems to be only 1%.

What is even more concerning is the fact that the indications in the graph are based on a period when the debt of the Advanced Economies was growing. This growing debt acted as an economic stimulus; it helped the industries manufacturing goods and services as well as the citizens buying the goods and services. Without this stimulus, GDP growth would no doubt appear to be falling even faster than shown.

In this post, I will look at underlying factors that relate to this downward trend, including oil consumption growth and changes in interest rate policies. I will also discuss the Maximum Power Principle of biology. Based on this principle, the world economy seems to be headed for a major reorganization. In this reorganization, the Advanced Countries seem likely to lose their status as world leaders. Such a downfall could happen through a loss at war, or it could happen in other ways.

[1] The major factor in the downward trend in GDP growth seems to be the loss of growth of oil supply.

In the 1940 to 1970 period, the price of oil was very low (less than $20 per barrel at today’s prices), and oil supply growth was 7% to 8% per year, which is very rapid. The US was the dominant user of oil in this era, allowing the US to become the world’s leading country both in a military way (hegemony), and in a financial way, as the holder of the “reserve currency.”

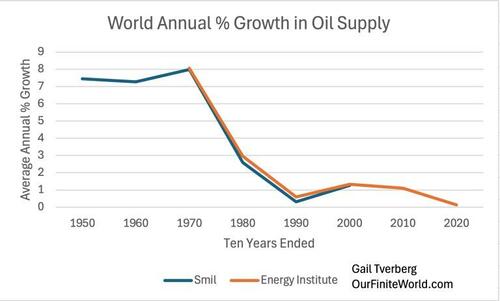

Data on year-by-year oil consumption growth is not available for the earliest years, but we can view the trend over 10-year periods (Figure 2).

Figure 2. Smil estimates are based on estimates at 10-year intervals by Vaclav Smil in Appendix A of Energy Transitions: History, Requirements and Prospects. Energy Institute estimates are based on amounts in 2023 Statistical Review of World Energy.

With the rapid growth in the world oil supply in the 1940 to 1970 timeframe, the US was able to help Europe and Japan rebuild their infrastructure after World War II. The US also did a great deal of building at home, including adding electricity transmission lines, oil and gas pipelines, and interstate highways. It also added a Medicare program to provide healthcare for the elderly. The emphasis at this time was on building for the future.

In the 1960s, the Green Revolution was started, aimed at increasing the quantity of food produced. This revolution involved greater mechanization of farming, the use of hybrid seeds that required more fertilizer, the use of genetically modified seeds, and the use of herbicides and pesticides. With these changes, farming became increasingly dependent on oil and other fossil fuels. The green revolution led to lower inflation-adjusted prices for food, as well as greater supply.

The 1970s was a time of adaptation to spiking oil prices and declining growth in oil supplies. At the same time, wages were increasing, and more women were entering the workforce, making the rise in oil prices more tolerable. There were also advances in computerization, changing the nature of many kinds of work.

The 1980s marked a shift to an emphasis on how to get costs down for the consumer. There was more emphasis on competition and leverage (the euphemism for borrowing). Instead of building for the future, the emphasis was on using previously built infrastructure for as long as possible.

Also in the 1980s, the Advanced Economies started to shift toward becoming service economies. To do this, a significant share of manufacturing and mining was moved to lower-wage countries. Transferring a significant share of industry abroad had the additional benefit of holding down prices for the consumer.

[2] Oil consumption growth and GDP growth seem to be connected.

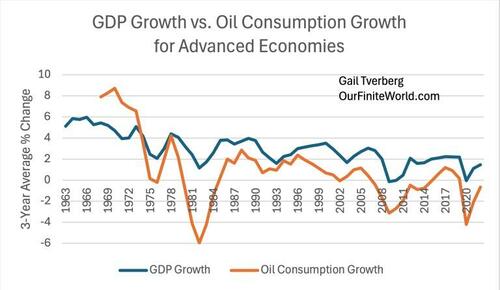

Figure 3. Chart showing both 3-year average GDP growth rate for Advanced Economies based on data published by the World Bank and 3-year average growth rates for oil consumption by Advanced Economies based on data of the 2023 Statistical Review of World Energy by the Energy Institute.

Figure 3 shows that oil consumption growth was higher than GDP growth up until 1973, when oil prices started to spike. This was the period of greatly adding to infrastructure, using the abundant oil supply, as discussed in Section [1]

After 1973-1974, GDP growth tended to stay slightly above oil consumption growth as Advanced Economies started to focus on becoming service economies. As part of this shift, Advanced Economies began moving industry to lower-wage countries. This shift became more pronounced after 1997, when the Kyoto Protocol (limiting CO2 emissions) was promulgated. The Kyoto Protocol gave participating countries (in practice, the Advanced Economies) a reason to hold down their own local consumption of fossil fuels, which is what is measured in Figure 3 and most other energy analyses.

Figure 3 shows that even after moving a significant share of industry to offshore locations, there still seems to be a significant correlation between oil consumption growth and GDP growth. Even with a service economy, oil consumption growth seems to be important!

[3] Prior to 1981, increasing interest rates were used to slow economic growth.

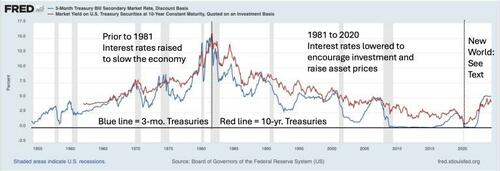

Figure 4. Secondary market interest rates with respect to 10-year US Treasury Notes and 3-month US Treasury Bills, in a chart made by the Federal Reserve of St. Louis and annotated by Gail Tverberg.

With the rapid growth in oil consumption in the 1940 to 1970 period, the economy often grew rapidly despite rising interest rates. After World War II, government loans became available to returning veterans to buy homes, helping to make the usage of oil affordable.

It was only as growth in oil consumption slowed and interest rates rose to a high level in the 1979-1981 period that high interest rates created a major recession. At such high interest rates, builders of all kinds were discouraged from building. Hardly anyone could afford a new home. Businesses couldn’t afford new factories, and governments couldn’t afford to build new schools. Few people could afford new car loans.

On Figure 3, it is not surprising that GDP dipped at the same time as oil consumption shortly after 1981. The dip in oil consumption was larger because heavy users of oil, such as construction and manufacturing, were squeezed out by the high interest rates.

[4] Falling interest rates in the period 1981 to 2020, as shown in Figure 4, stimulated the economy in many ways.

The 1981 to 2020 period marked a time of generally falling interest rates, with short term interest rates typically being below long-term interest rates. Reducing interest rates tends to stimulate the economy in a variety of ways:

(a) As we all know, lower interest rates make monthly payments on new home mortgages lower. This means that more citizens can afford to purchase homes, leading to greater demand for new homes and their furnishings. Prices of homes tend to rise, partly because people with a given income can afford larger, fancier homes, and partly because more people in total can afford homes.

(b) Even on existing home mortgages, new lower rates can have an impact. In the US, mortgages are frequently set for a long term, such as 20 years, but they can often be refinanced at a lower rate if interest rates fall lower. In many other countries and in the US for business property, mortgage rates are set for a shorter term, such as 5 years. As the loans renew, the new lower rates become available. Borrowers are happy; there is suddenly a smaller monthly payment for the same property.

(c) With lower interest rates, there is demand for more homes to be built. This stimulates the construction industry and helps the prices of all kinds of built structures rise.

(d) A similar situation to (a), (b) and (c) exists for all kinds of items normally purchased using loans. New cars, new boats, and new second homes are affected, as are many kinds of business loans. Even loans taken out by governmental organizations become less expensive. It suddenly becomes easier to buy goods, so more goods are sold. Market prices can be higher because at the new lower interest rates, more people can afford them.

(e) There can be some benefit with respect to long-term bond holdings, if interest rates fall. Bonds generally promise to pay a stated interest rate over the life of the bond, say 20 years. If the market interest rate falls, the selling price of a high coupon-rate long-term bond increases because such bonds are worth more than a similar new bond with a lower coupon interest rate.

Financial institutions such as banks, insurance companies, pension plans, and endowment funds generally have long-term bonds as part of their portfolios. The higher value of bonds may or may not be reflected in financial statements, depending on the accounting rules applied. Sometimes, “amortized cost” is used as the carrying value until the bond is sold, hiding the gain in value. Conversely, if bonds are “marked to market,” then the higher value becomes immediately reported in financial statements.

(f) With mark-to-market accounting, insurance companies, banks and many other kinds of financial organizations can reflect the benefit immediately. As a result, for example, insurance companies may be able to sell policies more cheaply in a falling interest rate environment. (Of course, as interest rates start rising, the opposite is true. I believe that is part of the problem with the spike in insurance rates that the world has been witnessing in the past two years. But this is seldom mentioned because it is less well understood.)

(g) With falling interest rates, practically all kinds of asset prices rise. For example, the prices of shares of stock tend to rise, as does the price of farmland. Prices of office buildings tend to rise. People feel richer. They can sell some of their investments and profit from the sale. Tax rates on long-term capital gains are low in the US, further helping investors.

(h) If generally falling interest rates can be maintained for many years (1981 to 2020), gambling in the stock market starts looking like a great idea. Investment using borrowed funds looks like it makes sense. Buying derivatives seems to make sense. Adding more and more leverage makes sense. People rich enough to gamble in the stock market or the housing market begin to gain huge advantages over the many poor people whose wages remain too low to buy more than the basics.

These advantages tend to drive a wider and wider wedge between the rich and the poor. As diminishing returns become more of a problem, wage and wealth disparities become increasingly major issues. These disparities arise partly because of competition with low-wage countries for less-skilled jobs, and partly because of the need to pay higher wages to highly educated workers. They also arise because owners of shares of stock and of homes have tended to receive the benefit of significant capital gains as interest rates have fallen, for the reasons described above.

[5] Since 2020, interest rates have begun to rise in the Advanced Economies. It is difficult to see how a shift to higher interest rates can turn out well.

News write-ups about the rise in interest rates often say something like the following:

The Fed hiked interest rates a total of 11 times between March 2022 and January 2024, making borrowing more expensive for banks, businesses, and people in an attempt to curb rampant inflation.

However, Figure 4 shows that long-term interest rates (the blue line) started to rise much earlier than this–about the time the US started to borrow a huge amount of money to support the programs it initiated to keep the economy functioning at the time of the Covid restrictions in 2020.

This funding went back into the economy to provide income to would-be workers who were forced to stay home and to small businesses that needed additional funds to cover their overhead. Pauses in student loan repayments had a similar effect. At the same time, fewer goods and services were created because non-essential activities were restricted.

This combination of more wealth in the hands of citizens at the same time as a limited quantity of goods and services were being produced was precisely the right combination of actions needed to generate inflation. So, it was no wonder that there was an inflation problem.

Indirectly, high US borrowing has been, and continues to be, part of the inflation problem. Total goods and services produced in the world economy are not currently rising very quickly because diesel and jet fuel are in short supply, something I wrote about here and here. The US and other Advanced Economies keep issuing more debt in the hope that using this debt will help them purchase a larger share of the goods and services produced by the world economy.

It is not clear to me that this problem can be fixed since the US and the other Advanced Economies need to keep borrowing to support their economies and to fight for causes such as the Ukraine War. Note the downward trend in Figure 1!

One of the big problems with high asset prices and higher-than-zero interest rates is that farmers find that the cost of their land becomes too high to make it worthwhile to grow crops. This is especially the case for new farmers, who may need to buy their land using the higher-cost debt.

People often believe that farm prices will rise indefinitely, but Reuters reports that high borrowing costs and low food prices are cutting demand for farm equipment from John Deere, the world’s largest manufacturer of agricultural machinery. Without a flow of new farm equipment to replace that which is breaking or worn out, food production can be expected to fall.

Another issue is that apartment owners find a need to raise the rent on their units if the interest rate they are forced to pay rises or if the cost of property insurance rises. If they raise the rent of their units, this leaves renters with less income for other goods and services. Indirectly, today’s wage and wealth disparity problems tend to become greater than they were before the rise in interest rates.

In theory, if long-term (not just short-term) interest rates rise and remain higher, the many benefits of falling interest rates in Section [4] will be erased, and even reversed. The economy will be far worse off than it is now because of falling asset prices and defaulting debt. Financial institutions, such as banks and insurance companies, will be especially damaged because the true value of their long-term bonds will tend to fall. This can sometimes be hidden by accounting approaches, but ultimately unrealized capital losses will cause a problem as they did for Silicon Valley Bank.

The heavy use of debt and leveraging in the Advanced Economies makes these economies especially vulnerable to major financial problems if interest rates rise, or even if they stay at the current level. The bubble of debt and other promises (such as pensions promises) holding up the Advanced Economies seems vulnerable to collapse.

[6] The problem facing the people of the Advanced Economies is like the problem the biological world often faces.

The biological world is constantly faced with the problem of too many animals (for example, wolves and deer) wanting to occupy a given space with specific resources, such as water, sunlight, and smaller plants and animals to eat. In some sense, the world economy is an ecosystem, too, one that we humans have made. The Advanced Economies are already in a conflict with the less advanced economies, trying to decide which parts of the world will “win” in the battle over the resources needed for future economic growth.

The Maximum Power Principle (MPP) tries to explain who can be expected to be the winners and losers in an ecosystem when there are not enough resources to go around. I think of the MPP as an extension of the “survival of the fittest” or “survival of the best adapted.” The difference is that MPP looks at the functioning of the overall system, which, in this case, is the world economy.

The parts of the system (such as the individual people, the levels of borrowing, the government organizations, and the narratives governments choose to tell to explain the current situation) will be selected based on how well they permit the overall world economy (not just the Advanced Economies) to function. The goal seems to be to create as many goods and services as possible by dissipating all available energy in as useful a way as possible. In this way, the world GDP, which is a measure of the output of the useful work performed by the world economy, can stay as high as possible, for each time period.

Writings by scientists on this subject tend to be difficult to understand, but they may add some insight. One definition of MPP says that systems which maximize their flow of energy survive in competition. Mark Brown, professor emeritus at the University of Florida, says that under the Maximum Power Principle, “System components are selectively reinforced based on their contribution to the larger systems within which they are embedded,” and, “When resources are in short supply, they need to be used efficiently.” John Delong from the University of New Mexico says, “Winning species were successfully predicted a priori from their status as the species with the highest power when alone.”

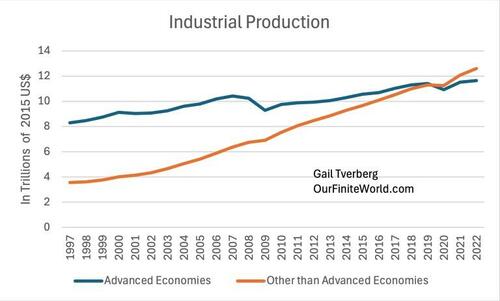

I suggest that if these principles are applied to the competition between the Advanced Economies and the less advanced economies of the world, the Advanced Economies will lose. For example, the Advanced Economies have been falling behind the less advanced economies in industrial output.

Figure 5. Industrial output of Advanced Economies, compared to that of Other than Advanced Economies based on data of the World Bank.

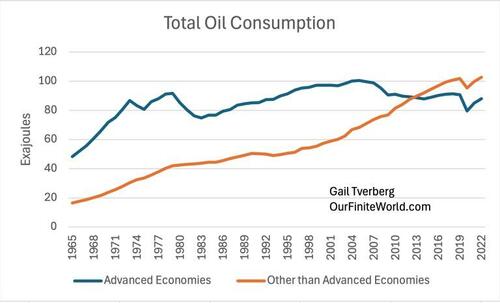

In addition, the Advanced Economies of the world have fallen behind in the bidding for oil supplies:

Figure 6. World oil consumption, based on data of the 2023 Statistical Review of World Energy, produced by the Energy Institute.

Furthermore, the NATO allies seem unable to pull ahead of Russia in the Ukraine conflict. In theory, this should have been an easy war to win, but with limited manufacturing capability, it has been hard for the allies to provide enough weapons of the right kinds to win.

To me, this all points to the conclusion that in a conflict over scarce resources, the Advanced Economies are likely to lose. The conflict could come in the form of war, or it could simply be a financial conflict. Figure 1 shows that the Advanced Economies are already falling behind in the competition for economic growth, even with all the debt they are adding.

[7] There is a lot of confusion about what is ahead.

We don’t know what is ahead. The economy is a self-organizing system that seems to figure out its own way of resolving the problem of not enough resources to go around because of diminishing returns. The world economy seems to be headed toward reorganization.

I believe that the Covid-19 era represented one rather strange self-organized response to the “not enough oil to go around” problem. Figure 6 shows a clear dip in the amount of oil consumed in 2020, particularly by the Advanced Economies. Some of this reduced oil consumption continues, even now, because more people started working from home, saving on oil. Another helpful change was a huge ramp-up in the use of online meetings.

It is possible that new adaptations to limited oil supply may appear in as strange a way as the Covid-19 era did.

Another possibility is that the Advanced Economies, particularly the US, will encounter severe financial problems as the rest of the world moves away from the US dollar. Or the problem could be falling asset prices because of higher interest rates, causing many financial institutions to fail. Or the problem could be too much money being printed, but practically nothing to buy, causing severe inflation of commodity prices.

War may be a possibility because it is an age-old way of dealing with resource problems. For one thing, it becomes easy to raise debt to pay for a war. This debt can be used to hire soldiers and buy munitions. With the higher debt, the GDP of the economy can be expected to suddenly look better because of the stimulus given to it. The major “catch” is that picking a fight with a major competitor or two could prove to be disastrous.

Let us hope that our leaders make wise choices and keep us away from severe problems for as long as possible.

Tyler Durden

Mon, 07/15/2024 – 19:40

via ZeroHedge News https://ift.tt/FxcS0kw Tyler Durden