Saved By The Seasonals: Headline Spending Surprises As ‘Real’ Retail Sales Plunge

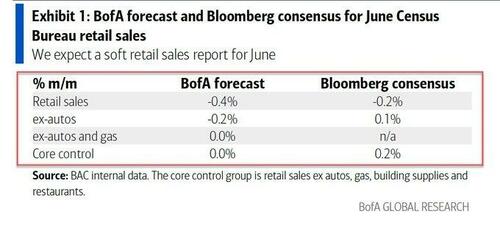

BofA’s omnipotent analysts track record on retail sales looks to be tested once again with a worse than consensus forecast (for an already downbeat expected print) in June…

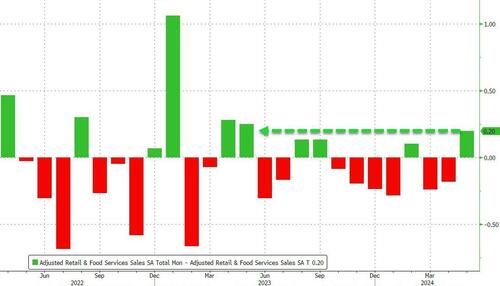

BUT… for once they were wrong with retail sales far better than expected – though notably the headline print was unchanged Mom (-0.3% exp). but May was also revised higher from +0.,1% to +0.3% MoM. The YoY retail sales growth slowed to just 2.3% – the slowest since February…

Source: Bloomberg

For context, May 2024’s upward revision was the largest since May 2023…

Source: Bloomberg

Core (Ex-Autos) retail sales soared 0.4% MoM (well above the 0.0% exp) and May was also revised higher.

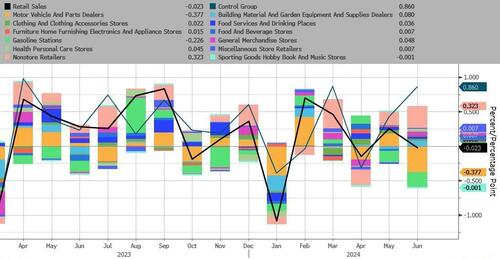

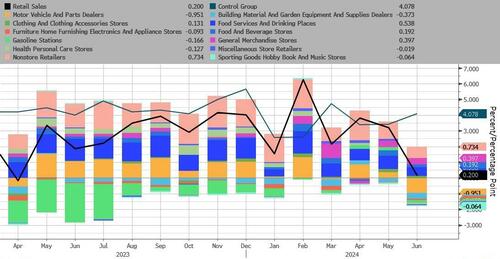

The Control Group – used in the calculation of GDP – exploded 0.9% MoM higher – smashing the +0.2% expectations()

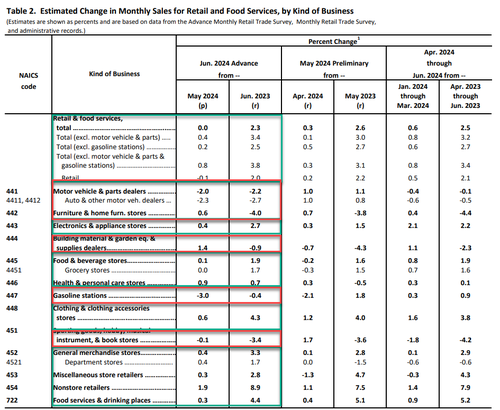

Non-store retailers (online) were the biggest driver of the gains in June while motor vehicles and parts dealers saw sales plunge…

Source: Bloomberg

On a non-seasonally adjusted basis, retail sales were +0.2% YoY with Motor Vehicle Sales the largest contributor to the downside….

Source: Bloomberg

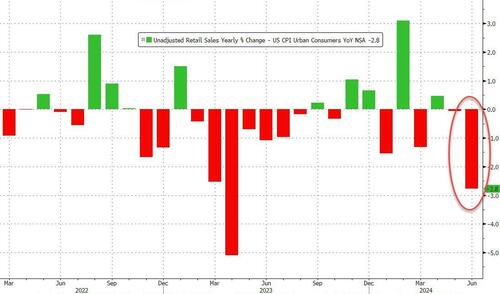

Finally on a non-seasonally-adjusted basis, real retail sales (roughly ‘adjusted’ for CPI) tumbled YoY in June…

Source: Bloomberg

As seasonals saved the day…

Source: Bloomberg

…aaah, Bidenomics!

Tyler Durden

Tue, 07/16/2024 – 08:43

via ZeroHedge News https://ift.tt/uretHmZ Tyler Durden