Trump Reveals Key Pillars Of “Trumponomics”: Low Taxes, Sky High Tariffs, Powell Not Fired, Treasury Secretary Dimon And Much More

Before the failed assassination attempt, before the catastrophic (for Biden) first presidential debate, Donald Trump gave Bloomberg an extensive interview in which he laid out the core tenets of Trumponomics 2.0 that will define his next presidency. Here are the key highlights:

According to the interview, if Trump wins, he will…

-

enforce huge bilateral sanctions even though he claims “I don’t love sanctions,” he says. He keeps circling back to William McKinley, who he says raised enough revenue through tariffs during his turn-of-the-20th-century presidency to avoid instituting a federal income tax yet never got the appropriate credit.

-

allow Jerome Powell to serve out his term as chair of the Federal Reserve, which runs through May 2026

-

will lower the corporate tax rate to as low as 15%

-

no longer plans to ban TikTok.

-

considers Jamie Dimon to serve as secretary of the Department of the Treasury

-

ambivalent (if not outright hostile) to the idea of protecting Taiwan from Chinese aggression and to US efforts to punish Putin for invading Ukraine.

While the broad strokes of Trumponomics might not be different from what they were during his first term, what’s new is the speed and efficiency with which he intends to enact them. He believes he understands the levers of power much more deeply now, including the importance of selecting the right people for the right jobs. “We had great people, but I had some people that I would not have chosen for a second time,” he says. “Now, I know everybody. Now, I am truly experienced.”

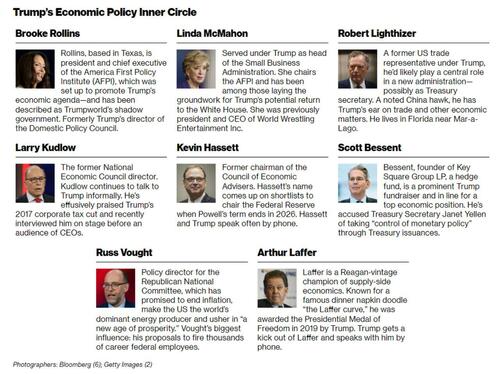

Maybe he is, or maybe he just is surrounded by better people. Here is the inner circle of Trump economic policy advisors:

In a world where everything else has been tried – and has pushed US debt to stratospheric levels that virtually assure the US will lose the dollar reserve status in coming years, Trump is betting that his unorthodox agenda of tax cuts, more oil, less regulation, higher tariffs and fewer foreign financial commitments will appeal to enough swing state voters to hand him the election. And it’s working: debate and assassination attempt boosts aside, recent polling has showed that Black and Hispanic men are shifting to the Republican Party as they tire of historically high prices for food, housing and gas. As many as 20% of Black men now back Trump while Biden is struggling to sell key voters on his catastrophic economic record (not to mention the panic over his age). While Trump is almost assured a win in November according to online prediction markets, many Democratic leaders are increasingly concerned he’ll also deliver Republicans control of the House and Senate along with the White House: a sweeping red tsunami. In such an outcome, Trump would have unprecedented leverage to shape the US economy, the climate for global businesses and trade with allies for decades to come.

But there is one hurdle: while the business leaders Trump would be working with prize stability and certainty, they didn’t get much of either in Trump’s first presidency. This time around, his campaign is more professionally run, but he hasn’t produced a detailed economic policy agenda to reassure them. The vacuum has generated confusion among those who are planning for a second Trump term.

So Trump took advantage of the interview to set the record straight on some key items:

The Fed

In late April, a few of Trump’s informal policy advisers leaked to the Wall Street Journal an explosive draft proposal to severely curb the independence of the Federal Reserve. It was inferred that Trump had endorsed the idea, which didn’t seem like a stretch given his prior attacks on Powell. In fact, the Trump campaign insisted he’d endorsed neither the proposal nor the leak, and his top campaign brass were furious about it. But the episode was a consequence of Trump’s still-unformed policy, which has left wonks from such think tanks as the Heritage Foundation battling to fill in the details and jockey for influence. Other conservative policy entrepreneurs have been pushing proposals to devalue the dollar or institute a flat tax. At Mar-a-Lago, Trump makes it clear he’s fed up with the unauthorized freelancing. “There’s a lot of false information,” he complains. He’s eager to set the record straight on several topics.

First, there’s Powell. While in February, Trump told Fox News that he wouldn’t reappoint the Fed chair; now he states unequivocally that he’ll let Powell finish his term, which would last well into a second Trump administration. “I would let him serve it out,” Trump says, “especially if I thought he was doing the right thing.”

Even so, Trump has thoughts on interest-rate policy, at least in the near term. The Fed, he warns, should abstain from cutting rates before the November election and giving the economy, and Biden, a boost. That would be a problem for a market that has already priced in not one but two rate cuts in the second half (the first of which in September). “It’s something that they know they shouldn’t be doing,” he said.

Inflation

Trump has been ruthlessly critical of Biden’s stewardship of the economy. But he sees, in the anger generated by high prices and interest rates, an opportunity to woo voters who typically don’t support Republicans, such as Black and Hispanic men. Trump says he’ll bring down prices by opening up the US to more oil and gas drilling. “We have more liquid gold than anybody,” he says, even though the tariffs he plans on implementing will certainly lead to higher prices for imported goods. A report from the Peterson Institute estimates that Trump’s tariff regime would impose an additional annual cost of $1,700 for the average middle-income family. And Oxford Economics estimates that Trump’s combination of tariffs, immigration restrictions and extended tax cuts could also increase inflation and slow economic growth. The through line of these policies, says Bernard Yaros, lead US economist at Oxford Economics, is “an increase in inflation expectations.”

Immigration

He believes harsh restrictions are key to boosting domestic wages and employment. He characterizes immigration restrictions as “the biggest [factor] of all” in how he’d reshape the economy, with particular benefits for the minorities he’s eager to win over. “The Black people are going to be decimated by the millions of people that are coming into the country,” he says. “They’re already feeling it. Their wages have gone way down. Their jobs are being taken by the migrants coming in illegally into the country.” Trump’s language turns apocalyptic. “The Black population in this country is going to die because of what’s happened, what’s going to happen to their jobs—their jobs, their housing, everything,” he continues. “I want to stop that.”

Budget deficit

Trump’s desire to renew his landmark 2017 Tax Cuts and Jobs Act and to further reduce corporate taxes means that the budget deficit, having ballooned to war levels, will not shrink any time soon if ever. Coupled with the upward pressure on interest rates that economists expect from his protectionist policies, Trump’s plans could exacerbate the country’s growing debt burden. In the end, however, Trump’s other positions could be enough to sway business leaders to his side. Harold Hamm, a Trump donor and the executive chairman of oil giant Continental Resources Inc., writes in an email: “There seems to be outright hostility to free markets in the Biden Administration. As a result, capital is parked on the sidelines. Why? Because of regulatory uncertainty and in some cases downright regulatory hostility toward certain sectors.” Hamm cites the pause Biden put on liquefied natural gas projects in January as one example. “When Trump is re-elected,” he predicts, “that capital that was parked on the sidelines will be unleashed once again.”

Treasury Secretary Dimon

It is no secret that most Fortune 1000 CEOs have never been fans of Trump, but slowly the tide is turning. Overnight, the world’s richest man, Elon Musk, announced he would donate $45 million a month to a Trump PAC. Expect many others to follow. But the biggest praise for Trump in recent months has come from a card-carrying Democrat and the CEO of the largest US bank: “Be honest,” Jamie Dimon said at the World Economic Forum in Davos in January. “He was kind of right about NATO, kind of right about immigration. He grew the economy quite well. Tax reform worked. He was right about some of China. … He wasn’t wrong about some of these critical issues, and that’s why they’re voting for him.” According to Bloomberg, Trump relishes the compliment. He’s changed his view of the man he attacked on Truth Social last year as “Highly overrated Globalist Jamie Dimon” and now says he could envision Dimon, who’s thought to be contemplating a political career, as his secretary of the Treasury. “He is somebody that I would consider,” Trump says.

Tariffs and Foreign Policy

As president, Trump shattered the long-standing Republican orthodoxy of favoring free trade. He says he’ll go further if reelected. To Bloomberg, he offered an impassioned defense of US tariffs — he’s been studying McKinley, dubbing him “the Tariff King” — to make it clear he intends to ratchet up levies not just on China but on the European Union, too. “McKinley made this country rich,” Trump says. “He was the most underrated president.” In Trump’s reading of history, McKinley’s successors squandered his legacy on costly government programs such as the New Deal (“the whole thing with the parks and the dams”) and unjustly poisoned an important tool for economic statecraft. “I can’t believe how many people are negative on tariffs that are actually smart,” Trump says. “Man, is it good for negotiation. I’ve had guys, I’ve had countries that were potentially extremely hostile coming to me and saying, ‘Sir, please stop with the tariff stuff.’”

Another confirmation that Trump was right: despite rampant criticism, Biden maintained Trump’s tariffs on China, even increasing ones on steel, aluminum, semiconductors, electric vehicles, batteries and other goods. “This is going to add price inflation across the board, all in the name of ‘tough guy’ election-year politics,” Yaël Ossowski, deputy director of the Consumer Choice Center, a nonpartisan advocacy group, said in May. And sure enough, in Trumpworld, Biden’s actions are seen as validation that Trump was right, and his Democratic critics were wrong, about the threat China poses to the US economy and security. Trump is eager to prescribe more of the same medicine, including to European allies. In addition to targeting China for new tariffs of anywhere from 60% to 100%, he says he’d impose a 10% across-the-board tariff on imports from other countries, citing a familiar litany of complaints about foreign countries not buying enough US goods.

“The ‘European Union’ sounds so lovely,” Trump says. “We love Scotland and Germany. We love all these places. But once you get past that, they treat us violently.” He mentions reluctance in Europe to import US automobiles and agricultural products as key drivers of the more than $200 billion trade deficit, a statistic he considers a critical measure of economic fairness.

Taiwan

Asked about America’s commitment to defending Taiwan from China which views the Asian democracy as a breakaway province, Trump makes it clear that despite recent bipartisan support for Taiwan, he’s at best lukewarm about standing up to Chinese aggression. Part of his skepticism is grounded in economic resentment. “Taiwan took our chip business from us,” he says. “I mean, how stupid are we? They took all of our chip business. They’re immensely wealthy.” What he wants is for Taiwan to pay the US for protection. “I don’t think we’re any different from an insurance policy. Why? Why are we doing this?” he asks. Another factor driving his skepticism is what he regards as the practical difficulty of defending a small island on the other side of the globe. “Taiwan is 9,500 miles away,” he says. “It’s 68 miles away from China.” Abandoning the commitment to Taiwan would represent a dramatic shift in US foreign policy, as significant as halting support for Ukraine. But Trump sounds ready to radically alter the terms of these relationships.

Saudi Arabia

His views about Saudi Arabia are far more amicable. He says he’s spoken to Crown Prince Mohammed bin Salman Al Saud within the past six months, though he declines to elaborate on the nature and frequency of their talks. Asked if he worries that increasing US oil and gas production would upset the Saudis, who wish to maintain their primacy in energy, Trump replies that he doesn’t think so, pointing once more to a personal relationship. “He likes me, I like him,” he says of the crown prince. “They’re always going to need protection … they’re not naturally protected.” He adds: “I’ll always protect them.” Trump blames Biden and former President Barack Obama for eroding US relations with Saudi Arabia, saying they pushed the country toward a key adversary. “They’re not with us anymore,” he says. “They’re with China. But they don’t want to be with China. They want to be with us.”

Ukraine

Western allies are taking extensive measures to prepare for his possible return to the White House. These include increasing defense spending, transferring control of military aid for Ukraine to NATO, racing to improve relationships with Trump’s advisers and affiliated think tanks, and reaching out to Republican governors and thought leaders to divine his intentions. At a NATO summit in Washington, Ukrainian President Volodymyr Zelenskiy urged allies to act quickly to help his country repel Russia’s invasion instead of waiting for the election results in November to decide what to do. Dan Caldwell, a policy adviser at the right-leaning think tank Defense Priorities, says that “it’s actually in Europe’s interest to ‘America-proof’ their defense and to start operating on the assumption that the United States has other, more urgent national security priorities, and domestic ones as well.”

TikTok

The one exception to Trump’s claim to not want to harm US tech companies, and to privilege domestic ones over foreign ones, is TikTok. Discussing his recent embrace of the Chinese-owned social media platform, where he’s already quite popular, Trump mentions that banning it in the US would benefit a company and a CEO he has no desire to reward. “Now [that] I’m thinking about it, I’m for TikTok, because you need competition,” he says. “If you don’t have TikTok, you have Facebook and Instagram—and that’s, you know, that’s Zuckerberg.” It’s an outcome he won’t abide. He’s still stung by Facebook’s decision to bar him indefinitely in the wake of the Jan. 6 attacks. “All of a sudden,” Trump grouses, “I went from No. 1 to having nobody.”

Crypto

His reversal on cryptocurrency has been marked by similar dynamics: not long ago he criticized Bitcoin as a “scam” and a “disaster waiting to happen.” Now he says it and other cryptocurrencies should be “made in the USA.” He frames this about-face as a practical necessity. “If we don’t do it, China is going to figure it out, and China’s going to have it—or somebody else,” he says.

Crypto becoming a top 2024 election issue as expected. On one hand you have Pocahontas and her “Anti-Crypto army”, and now you have DeSantis going all-in crypto, anti-CBDC and anti-Warren. https://t.co/cmrGcPQIcY https://t.co/vK5MqiOhNj

— zerohedge (@zerohedge) May 2, 2023

Not coincidentally, the crypto industry – spurned by the Democratic Party, brimming with cash and eager for friends in Washington – has now found its way to Trump. “Thanks largely to the actions of the Securities and Exchange Commission, the Biden administration has stumbled into becoming anti-crypto,” says Justin Slaughter, policy director at the crypto-focused investment firm Paradigm. “Given that about 20% of Democrats own crypto, per polling, and its ownership skews young and non-White, this was politically unwise.” Trump has moved to fill the void, declaring in a May speech that he would “stop Joe Biden’s crusade to crush crypto.” The following month he reaped the benefits, raising money from Bitcoin miners at a Mar-a-Lago fundraiser. Trump’s campaign then announced it would “build a crypto army,” and it now accepts crypto contributions.

More in the full Bloomberg interview here.

Tyler Durden

Tue, 07/16/2024 – 22:40

via ZeroHedge News https://ift.tt/U76Obyu Tyler Durden